When on the subject of investing, the first question that needs to be answered is what asset class is being referred to? Typically we tend to hear of people investing in either stocks or real estate. However, deciding to invest in either asset class depends on a number of factors. Rather then write about those factors (age, risk tolerance, net worth, and goals), I’ll be jumping into the drawbacks and benefits of the investing in stocks and real estate. I should note what I touch on is simplified, however it provides a starting point for making an investment decision between the two asset classes.

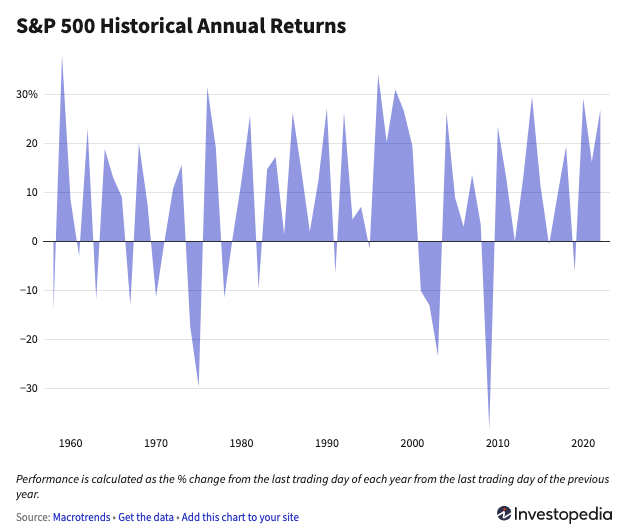

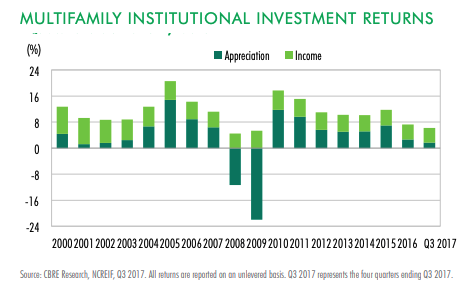

With that being said, the average annualized return of the S&P 500 through Dec. 21, 2021 is 10.67%. However, adjusted for inflation, the historical average annual return is only around 7%. On the other hand, according to CBRE, multifamily real estate has yielded a 9.8% average annual return in the 25 years preceding 2017. With that in mind, let’s jump deeper into the benefits and drawbacks of both asset classes.

Benefits and Drawbacks of Stocks

Investing in stocks, like any asset class, has its drawbacks and benefits. The main drawbacks of investing in this asset class are high taxes, volatility, high knowledge barriers, and minimal control of investment.

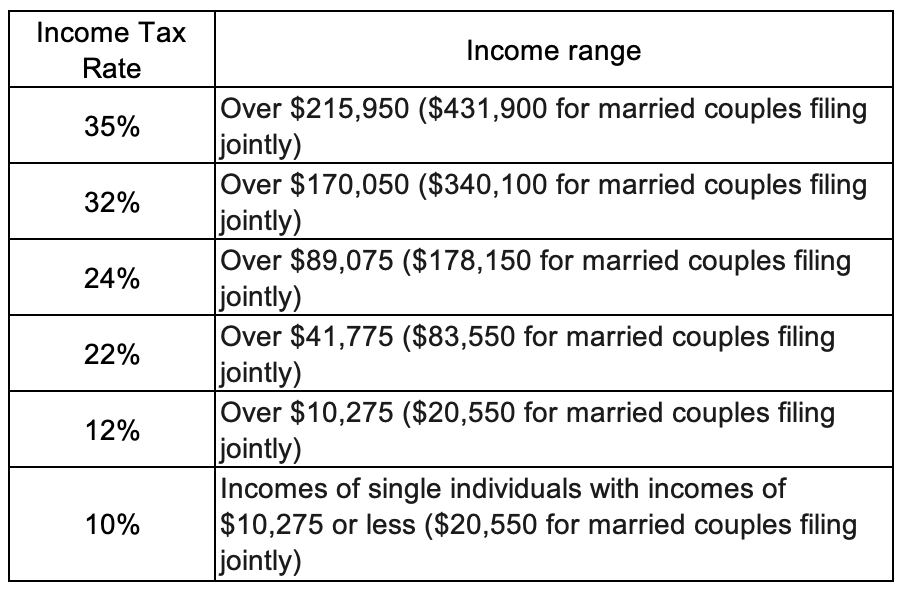

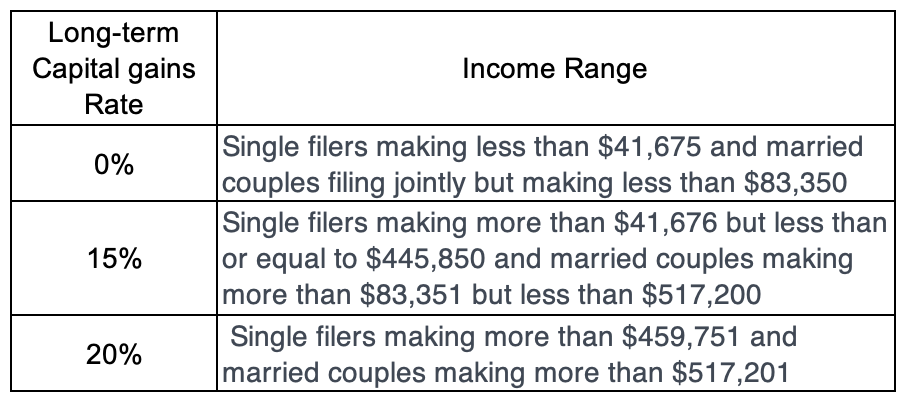

There are two types of capital gains taxes: short-term and long-term. Short-term capital gains rates apply to assets purchased and held for less than one year before sold, while assets held for more than one year are subject to long-term capital gains tax. Short-term capital gains are taxed at the same rate as federal income taxes, which can be up to 35% (see table below). Long-term capital gains tax also depends on the income an individual or married couple filing jointly brings in (see table below), however it’s typically lower than short term capital gains tax. The government incentivizes individuals who hold over one year (long-term) in the form of lower taxes. For example, an individual who makes an income of $10,275 or less and sells a stock in a period under a year will get taxed 10%, while if they hold long-term (assuming they continue to be in that tax bracket) they get taxed 0%. Having said that, when investing in stocks there is no quick way to lower your tax burden. The government incentivizes individuals who own business and with stocks those tax incentives don’t exist. I trust the distinction in terms of taxes between the two asset classes will be more clear after reading the real estate section of this post.

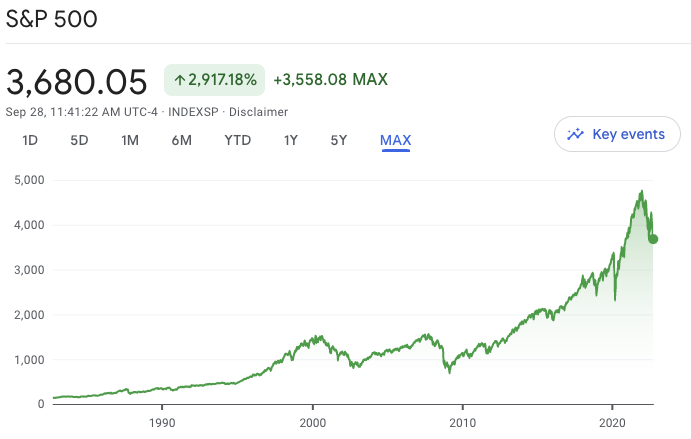

Another drawback of stocks is volatility. As shown by the stock markets year-to-date (YTD) returns, one’s net worth can change dramatically. This year (2022) the S&P 500, Nasdaq, and Dow Jones Industrial indexes have fallen YTD by double digits. Those returns are certainly undesirable and many people have gotten hurt even more as many stocks once thought to be sturdy (characterized by lower volatility) have fallen far worse than the indexes. For example, some of the FAANG stocks such as Facebook, Netflix, and Amazon have fallen YTD by over 30%.

In terms of what it takes to invest in the markets, the knowledge barrier is significantly high. I remember when I first started to learn about stocks I felt as if I was drowning in knowledge. It’s difficult to know where to start and while an individual can study great investors such as Warren Buffet, returns are never a sure thing and past performance doesn’t guarantee future performance. Thus, it takes many hours of studying and a deep interest in the markets to feel comfortable investing. While exchange traded funds (ETFs) and other investments that hold a bundle of stocks make it easier to invest in a specific strategy, even those investments require a certain level of understanding. In addition to a high knowledge barrier, what can really put off investors is a lack of control. When someone invests in a stock or fund they cannot control the underlying companies. If I invest in Facebook stock I have no control of the management decisions. Same applies to if I invest in an ETF, I have no control of the underlying companies and on top of that I cannot dictate what the fund manager chooses to invest in.

On the other hand, investing in stocks has several benefits. Those benefits include the potential to make extraordinary gains in a shortened time frame, ability to niche into what interests you, liquidity, and low capital requirements. While I listed volatility as a drawback of stocks, it can be of benefit and provide investors with amazing opportunities. For example, the markets are significantly lower now than they were in the beginning of the year and as I pointed out many stocks have been beaten down. Luckily, stocks will eventually come back up and as Warren Buffet would say “never bet against America.” Knowing this, I can use volatility to my advantage and invest in companies at discounted prices. It takes a quick glance at a chart of the S&P 500 to realize that every drop has presented buying opportunities. Thus, taking advantage of corrections in the market can yield outsized gains in which many other asset classes rarely provide in the same time frame due a variety of factors (liquidity, capital requirements, etc.). The 2020 Covid crash is just one of those crash examples that yielded extremely high returns in a short period.

Another benefit to stocks is that the asset class allow investors to niche into sectors that they find interesting or happen to know a lot about. For example, I may be well versed regarding technology and while I may not have the capital or aptitude to start a technology company, I can still reap the benefits of a tech company by investing in their stock. No other asset class allows you to invest in such a wide variety of industries so readily. Finally, stocks offer investors the ability to get in and out of investments as they please (liquidity) and it doesn’t take a significant amount of money to start investing. On the other hand, if I invest in a rental house, not only does it take a significant amount of time to buy and sell that house, but it requires far more capital than buying a share in a company.

Benefits and drawbacks of real estate

Now that I’ve listed the pros and cons of investing in stocks, let’s dive into real estate. The drawbacks of investing in real estate include high capital requirements, high knowledge barriers, lack of liquidity, and time.

When I refer to real estate here I’m primarily referring to multifamily (5+ units). However, much of what I talk about in this section can be applied to other real estate asset classes. With that in mind, real estate requires high capital requirements which many investors, especially young investors, simply don’t have. If I want to invest in a $500,000 multifamily property and the bank is willing to lend 80% of that, I still need to come up with $100,000+ after accounting for closing costs. This is not to mention the time it takes to find a property, contact the necessary people to close on it, and manage the property while handling all the other responsibilities someone still has to stay on top of. More so, I can’t simply buy and sell a property with a few clicks. The process of buying, managing, and selling a property can’t be compared to the ease of buying and selling a stock. However, before someone can even consider buying a property, they have to understand and study real estate first. Simply contacting a broker to buy a property someone feels is a good investment is a recipe for disaster. While investing in real estate can seem daunting, the benefits of this asset class are indisputable.

Real estate provides investors with a way to hedge against inflation, invest for cash flow and/or back end appreciation, reduce tax burdens, take advantage of leverage, and have control. On top of that, and this is almost needless to say, everyone needs a place to live. Thus, there will always be demand for real estate.

Perhaps explaining the process of buying a multifamily property will help to understand the benefits of this asset class best. I’ve highlighted all the benefits of real estate to make it easy to spot. Let’s say I’m looking to buy a 20 unit in the outskirts of Chicago. I have $200,000 and after talking to a number of loan brokers and presenting them some example properties I think would be good investments, they tell me they can loan me 80% of the capital needed to close. I know that I want cash flow in order to cover my living expenses so I look for deals that can provide that. After finding a deal, I analyze the property and reasonably assume I could bump rents because inflation ran high and the comparable units in the area support the rent increase. In addition, the market also supports my business plan which calls for me to renovate the units and achieve even higher rent. After identifying and analyzing the property, I talk to a cost segregation company who does the research to verify that it’s worth it to hire them to create a cost segregation report. What that report allows me to do is depreciate my building at a faster rate then the 27.5 years the government says I can. In addition, in the future I can show a loss or at least far less income coming from the property which can offset taxes. I then get in touch with the loan broker again and confirm the capital can be lent to purchase the property. Finally, I identify a property management company to manage the property so that I don’t have to worry about leaky toilets, identifying tenants, etc. After 5 years I will refinance the property and pull 50% of my equity out and then can use that toward the purchase of another property. 5 years after that I will refinance again and pull the remaining 50% of my equity out and now am simply collecting cash flow without any money in the deal.

The example above shows the power of investing in a multifamily property. At the end of the day, control is what makes this asset class so dominant. I can choose my investment goals (cash flow and/or back end appreciation), the location, property management company, if I want to renovate or not, etc. What I did not touch on was the ability for someone to invest in a multifamily syndication passively. You can find a syndication willing to accept lower amounts of capital, but typically syndications are looking for a minimum investment of $10,000. If you would like to consider investing with us at JP Acquisitions, reach out to someone on our team, fill out our contact form, or sign up to our investor portal so we can get in touch with you.

Conclusion

Choosing to invest in stocks or real estate can be difficult. Personally, I believe that saving money to invest in a trusted syndication group that can provide a steady 6-8%+ cash return yearly is the best way to get a head start on building wealth. The money invested will provide cash flow in which someone can use to cover living expenses. As their wealth grows, they can invest more which leads to even more cash flow. Rinse and repeat that process for a long time and it’s hard to imagine someone regretting their decision. I should mention that I have nothing against investing in stocks and that’s how I first got started investing. After 3 years of studying and investing in the stock market, I realized the stability and cash flow of real estate were the two selling points that made the asset class superior to stocks. After having dealt with the volatility of the Covid crash and the aftermath we’re experiencing now, I decided the risk simply wasn’t worth the return. That’s not to say stocks can’t help someone build wealth, but rather you could find a better risk/reward in real estate. I want to leave you with one more quote from Warren Buffet before I end this post:

“Rule No 1: Never lose money. Rule No 2: Never forget rule No.1.”

I hope you’ve enjoyed reading this post as much as I’ve enjoyed writing it. If you would like to learn more about what we do at JP Acquisitions don’t hesitate to reach out to someone on our team, fill out our contact form, or sign up to our investor portal.

Best of luck!

Connect with us!

About the Author

Tedi Nati is the Managing Partner of JP Acquisitions. In his role he is responsible for broker outreach, establishing deal flow, underwriting, marketing, and assisting in the closing process. In addition to his role at JP Acquisitions, he is an Assistant Equity Underwriter at Cinnaire, a non-profit Community Development Financial Institution (CFDI). In his role at Cinnaire, he is responsible for assisting the underwriting team in evaluating and structuring real estate equity investments and assessing the risks and mitigants associated with such. Tedi earned his Bachelor of Science in Finance from DePaul University, where he graduated Summa Cum Laude. In his free time he enjoys reading, writing for his blog (tedinvests.com), looking for multifamily deals, working out, and researching stocks.

Make sure to always do your own research before making any final decisions on buying any call or put options on a stock. I am not a CPA, attorney, insurance, or financial adviser and the information in this blog post shall not be construed as tax, legal, insurance, construction, engineering, health and safety, electrical or financial advice. If stocks or companies are mentioned, I sometimes have an ownership interest in them – DO NOT make buying or selling decisions based on my posts alone. If you need such advice, please contact a qualified CPA, attorney, insurance agent, contractor/electrician/engineer/etc. or financial adviser.

buy cheap phenergan – buy phenergan generic cheap lincocin 500 mg

Your comment is awaiting moderation.