Since the start of the year investors have been hearing talks about a recession on the horizon. The talks are warranted as many events have impacted the economy recently. Most notably, the Fed has increased the federal funds rate, supply chain issues have yet to fully be resolved, and the Russia-Ukraine war is still occurring. However, while most people tense up when they hear the word ‘recession’, I see opportunities. In this post I’m not making the claim that we are heading into a recession like some people may believe. Instead, I want to explain what will happen leading up to and once we are in a recession if it were to occur and how a recession impacts real estate and stocks. I want to note that I will be writing about both sides of the same coin, how a recession is bullish for the two asset classes and vice versa. Before jumping into the meat of this post, let’s define some terms and go over notable economic events that have transpired recently.

Firstly, what is a recession? The term can be defined as a significant prolonged downturn in economic activity. The popular rule of thumb that defines a recession, which has been heavily debated, is two consecutive quarters of decline in gross domestic product (GDP). I’ve now introduced another term: gross domestic product. GDP is defined as the total monetary or market value of all the finished goods and services produced within a country’s borders during a specific period of time. The term functions as a sort of scorecard of a given country’s economic health. Another term that I need to address is the federal funds rate. The federal funds rate refers to the rate which commercial banks borrow and lend their excess reserves to each other overnight. The Federal Open Market Committee (FOMC) is the policy making body of the Federal Reserve system and they meet eight times per year to set the target federal funds rate. The rate directly impacts consumer loans and credit cards and as a result promotes or hinders economic growth. If the Fed increases or decreases the federal funds rate, the interest rate for loans is directly impacted and will influence people to take on more or less debt. Investors keep an eye on the federal funds rate because it impacts asset classes (stocks, real estate, crypto, etc.). Now that we have an understanding of what gross domestic product, recession, and the federal funds rate mean, we can speak on the impact of the Fed’s most recent rate hike as well as the US labor market.

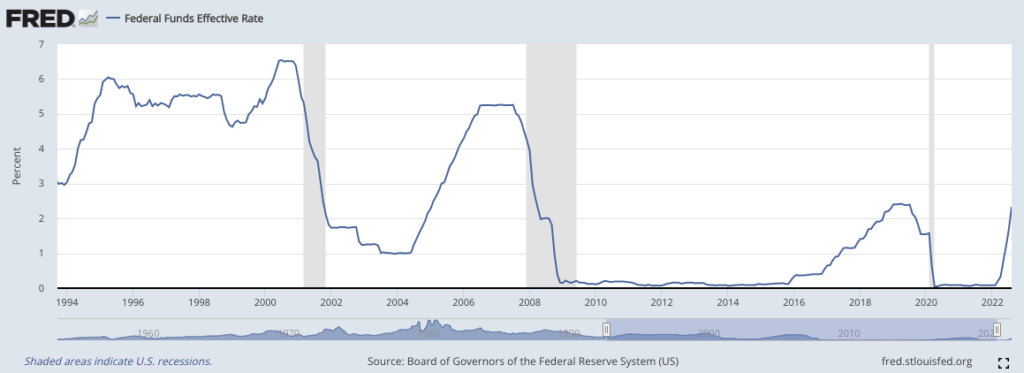

The Federal Reserve on 9/21/22 announced that it would raise the federal funds rate by three-quarters of a percentage point. This move marks the fifth increase in the last six months to combat the most recent inflation reading at the end of August of 8.26%. Keep in mind that the Fed indicated that more interest hikes would be coming, but of course that is dependent on how hot inflation is running and how strong the labor market is amongst other factors. The series of hikes by the Fed has brought the federal funds rate to a range of 3% to 3.25%, the highest it’s been since 2008 and up from a rate of nearly zero at the start of the year. For context, you’d have to go back to 1981 to find a six-month period when interest rates rose more. The numbers back then were far more extreme. From the end of July 1980 through January 1981 the federal funds rate bounced from 9% up to 19% according to the Federal Reserve Bank of St. Louis. Greg McBride, chief financial analyst at Bankrate, told CNBC, “Credit card rates are the highest since 1996, mortgage rates are the highest since 2008 and auto loans are the highest since 2012.” Nevertheless, the goal of the Federal Reserve is to keep our economy healthy and they pursue the economic goals of maximum employment and price stability (known as the dual mandate). The Fed uses a variety of policy tools to try to keep the economy healthy or in other words, they conduct monetary policy. It is known that the Fed targets two percent inflation as a way of keeping prices stable and in a speech on Aug. 27, 2020 by Jerome Powell (the Chair of the Federal Reserve) he stated, “we will steadfastly seek to achieve a 2 percent inflation rate over time.” The other part of the Fed’s dual mandate is maximum employment which can be thought of as the highest level of employment that the economy can sustain over time. Measuring employment is difficult because the level of maximum employment varies with business conditions, demographics, labor market conditions, and other factors. While the Fed does not have a numerical target for the level of employment unlike price stability, the Fed analyzes economic conditions using a wide range of data to design policies that achieve maximum employment. You may have known about the dual mandate but I reiterate it here for those reading this who didn’t already know and to highlight the Fed’s responsibility to the American people. Certainly the Fed isn’t looking to cause a recession, but rather what is known as a “soft landing.” A soft landing is a cyclical slowdown in economic growth that avoids a recession. This is one of the goals of the Fed currently as they continue raising interest rates. If we look back at history, the Fed has accomplished a soft landing only once in 1994-1995 under the then-Chair Alan Greenspan. Thus, the chances that we accomplish a soft landing now are slim by historic standards. However, you’re not here to learn about if the Fed can avoid a recession so I won’t get into that.

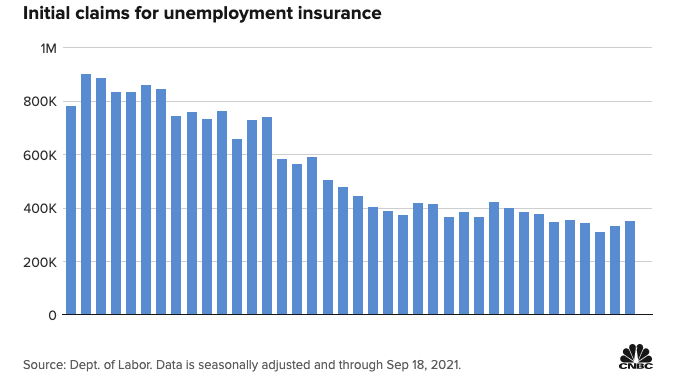

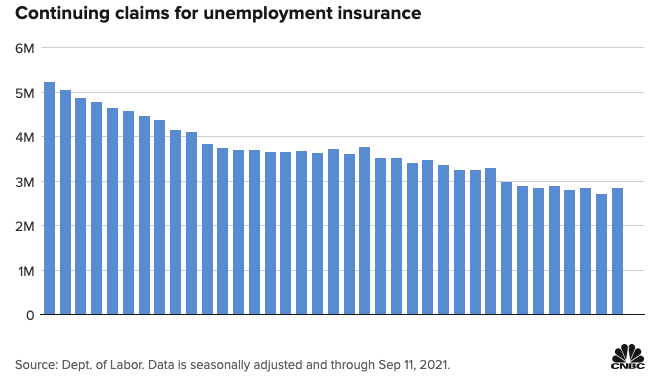

Moving on to talking about the US labor market, first-time jobless claims totaled 351,000 the week ending 9/24, an increase from 16,000 a week before and well ahead of the 320,000 Dow Jones estimate. Continuing claims on the other hand increased by 181,000 to 2.84 million. Before I continue I want to define the two categories of jobless claims—initial and continuing. Initial jobless claims consists of people filing for unemployment benefits for the first time. Continuing jobless claims consists of unemployed people who have already been receiving unemployment benefits. The reason why jobless claims are important is because it acts as an indicator for the strength of the economy and is one of the indicators the Fed uses to measure their goal of maximum employment. The more people with jobs, the more that people are likely to spend which results in a boost in economic activity. This reading of Americans filing for new claims for unemployment benefits increased modestly which indicates the labor market remains tight despite the Federal Reserve’s attempt to cool demand with aggressive rate increases.

Having addressed the Fed’s rate hike of 75 basis points (bps) and the recent jobless claims numbers, I will move on to the reason why you’re reading this post: how a recession can be bullish for real estate (multifamily specifically) and stocks.

NOTE* – A basis point is one hundredth of one percent (.01) and is primarily used to express differences in interest rates. Also, I specifically stated “multifamily real estate” because that is the asset class we invest in at JP Acquisitions.

What a Recession Spells for Multifamily Real Estate

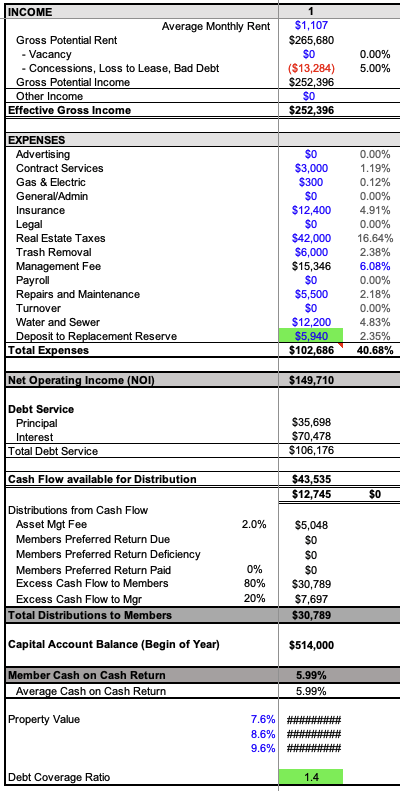

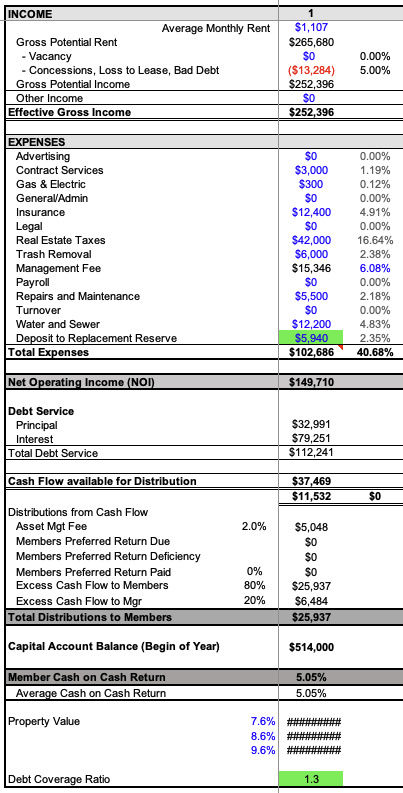

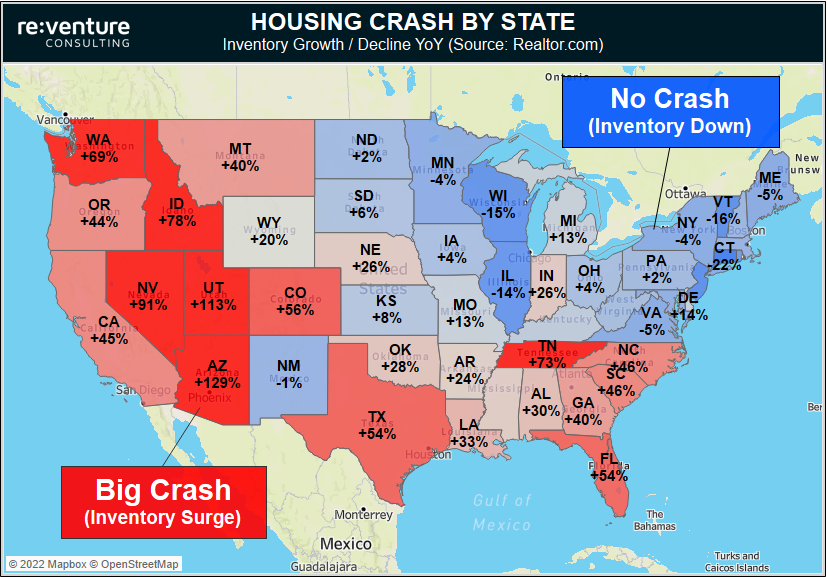

If we refer to the chart highlighting the Federal Funds effective rate since 1994, you will notice a number of things. Most importantly, leading up to a recession such as the ones in 2001, 2008, and 2020 (even if it wasn’t a traditional recession) we can see that interests rates rose significantly in the preceding period. If history is to repeat itself, then the period we are living in is no different and the Fed will increase rates and more likely than not lead us into a recession. For the time being, with interest rates where they are at, for certain one thing will happen and that is that in general real estate prices will go down. Changes in interest rates directly impacts real estate (RE) prices as a whole because if the cost of debt goes up, all else being equal, then returns will go down and vice versa. Companies that raise capital in order to purchase multifamily real estate (syndicators), in addition to other investors, are looking to achieve a certain return and they will avoid paying a higher price for a property as interest rates go up. For example, let’s say we purchase 8 units for $800,000, finance it with money from the bank, and the gross income from rents is $250,000. If our expenses are 40% of gross income (40% of $250,000 = $100,000) then we will have $150,000 left over. If we owe the bank $100,000 then we would take home $50,000. However, if we purchase those same 8 units at $800,000 and what we owe to the bank is $120,000 because the bank charged us a higher interest rate, then we would only take home $30,000. Thus, if the bank charges a higher interest rate, for the deal to be equally attractive to the $50,000 we would’ve made at the lower rate, the price of the property would need to go down. There are not many reasons as to why someone would want to purchase a property at a high price and pay the bank more for the debt in order to achieve a lower return. Sellers know this and account for it when they put their property up for sale. Below I have provided screenshots of an actual deal and what would happen if the interest rate jumped from 4.45% to 5% to better illustrate my point. Notice how the member cash on cash return (profit/amount invested) drops from 5.99% to 5.05%. The good news is that if we buy a property now at a higher interest rate then the zero we saw at the beginning of the year, we could always refinance it later when interest rates go down so as to get back some of our capital and have lower debt payments (See cash-out refinance below). What we can take away from what I’ve just said is that no matter the interest rate, we can still achieve our desired return. This is true because if interest rates are high then the price of a property will go down to offset the higher debt payments and if interest rates are low then we pay the bank less, but pay a higher price for a property.

If a recession is to occur and we assume that interest rates will go back down as a result, then buying a multifamily property is quite attractive. We will pay a lower price for a property but have to swallow a high interest rate for the time being. In the future, we will refinance that property, pull some cash out, and have a lower rate. This is known as a cash-out refinance. This term refers to replacing your current mortgage with a bigger mortgage allowing you to take advantage of the equity that was built up and walk away with the difference between the two mortgages. This is the beauty of the high interest rate environment we find ourselves in today, refinancing is always an option. Now that you understand some of the options a multifamily investor has to achieve their desired return and what occurs leading up to a recession and once in one, you’re better equipped to make investment decisions going forward. While the picture I’ve painted thus far is rather rosy, from the perspective of someone trying to sell a property, things can be gloomy. If you try to sell a property right now with rates being high, the price you will be able to command will be lower. In certain markets you may still be able to command a premium, but that does not apply to everyone. Nevertheless, if you’re not in a hurry to sell your property, you can always wait till rates go back down before selling.

What a Recession Spells for Stocks

At this point in this post you’ve likely noticed that the Fed has tremendous power over asset classes due to their ability to shift interest rates. Stocks are extremely sensitive to rates and this has proven to be true as the stock market Indexes have taken a turn for the worst as a result of the Fed’s recent moves. For context, the S&P 500, Dow Jones Industrial Average, and NASDAQ are down 25.25%, 21.48%, and 33.20% year to date (YTD) respectively. For those of us who are invested in the markets we’ve likely seen our brokerage accounts fall dramatically and the pain we feel when looking at our accounts can be aggravating. With that being said, being invested in stocks prior to a recession and when in one is no fun because we have no control over the value of companies. I don’t mean to make it seem that real estate is a better asset class than stocks when heading into a recession, but the facts seem to suggest so. Stocks simply do not do well when on the verge of a recession. When the FOMC changes interest rates, it impacts both the economy and the markets because borrowing becomes either more or less expensive. Any impact on the stock market to a change in interest rates can be felt immediately while for the rest of the economy it may take close to a year to see any widespread impact. This is true because the markets are forward looking. Higher rates tend to adversely affect earnings for companies and stock prices. Higher rates also mean future discounted valuations are lower as the discount rate used for future cash flows is higher. To shield from risk, investors may consider opting for alternative assets which means money flows out of stocks. As money flows out of stocks, prices go lower. While some of this may be going over your head, the fact to know is that higher rates spells doom for stocks. Unlike real estate, investors do not have a direct say in how a company will operate. In real estate, investors always have the option to wait until interest rates change before selling a property. In addition, rents rarely go down so the income someone receives from their property doesn’t change. With stocks, investors certainly have the option to hold onto their investments but the pain of discounted prices is felt immediately. On the flip side, as interest rates go down stocks tend to outperform real estate as the discount rate investors use to value companies goes down. For example, when the Fed lowered rates during Covid to nearly zero, stock valuations went up dramatically and people were more than happy to throw their money into the markets. If a recession is to occur, as the market seems to be factoring in, stocks will continue to perform poorly. keep in mind that if a stock goes down by whatever amount, the gain in stock price that an investor needs to see to get the same return needs to be far greater than the drop. For example, if I own XYZ stock and it goes down 50%, I would need to see a 100% gain in order to get back to where my investment once was. All in all, stocks in general are a riskier asset class than real estate in periods of rising rates such as the one we find ourselves in today.

Conclusion

Increases in the federal funds rate affect real estate and stocks negatively. The Fed has pushed rates to a point where companies and consumers feel the strain in terms of their ability to take on debt and predict the future. In the Fed’s defense, the increase in rates is justifiable since inflation is running hot at above 8%. If the Fed continues to raise rates as they have indicated, the economy will slow down even further. For the time being, the labor market has held up relatively well which indicates the economy is still strong, but the further we look out it seems inevitable that employment numbers will take a turn for the worse. According to the Bureau of Economic Analysis, consumer spending has gone up three out of the last four months and heading into the holiday season I don’t see this trend changing. Once consumers slow down their spending after the holiday season, as history has shown, companies will see their income drop and in turn the economy will slow down. According to a recent poll by the Financial Times and the University of Chicago’s Booth School of Business, 70% of the 49 economists polled said they thought we’d declare a recession in 2023. All this is to say that stocks are likely to continue to perform poorly as long as the economic outlook is grim and real estate prices in general will drop as the Fed continues to raise rates. As this post has shown, real estate is one of the best assets to own heading into and during a recession due to the consistent cash flow and financing options. Stocks on the other hand can be extremely volatile and do not provide the same protection to economic downturns as real estate does, but can be very profitable when rates go lower.

I hope you’ve enjoyed reading this post as much as I’ve enjoyed writing it. If you would like to learn more about what we do at JP Acquisitions don’t hesitate to reach out to someone on our team, fill out our contact form, or sign up to our investor portal.

Best of luck!

Connect with us!

About the Author

Tedi Nati is the Managing Partner of JP Acquisitions. In his role he is responsible for broker outreach, establishing deal flow, underwriting, marketing, and assisting in the closing process. In addition to his role at JP Acquisitions, he is an Assistant Equity Underwriter at Cinnaire, a non-profit Community Development Financial Institution (CFDI). In his role at Cinnaire, he is responsible for assisting the underwriting team in evaluating and structuring real estate equity investments and assessing the risks and mitigants associated with such. Tedi earned his Bachelor of Science in Finance from DePaul University, where he graduated Summa Cum Laude. In his free time he enjoys reading, writing for his blog (tedinvests.com), looking for multifamily deals, working out, and researching stocks.

Make sure to always do your own research before making any final decisions on buying/investing real estate, stocks, or other securities. I am not a CPA, attorney, insurance, or financial adviser and the information in this blog post shall not be construed as tax, legal, insurance, construction, engineering, health and safety, electrical or financial advice. If stocks or companies are mentioned, I sometimes have an ownership interest in them – DO NOT make buying or selling decisions based on my posts alone. If you need such advice, please contact a qualified CPA, attorney, insurance agent, contractor/electrician/engineer/etc. or financial adviser.

ivermectin 3mg over counter – ivermectin 2mg online order carbamazepine 400mg online

Your comment is awaiting moderation.