People often decide that they want to invest in real estate but don’t know where to start learning about the subject. Usually, when people think of real estate they think of investing in single-family houses. What those individuals may not realize is that multifamily properties are one of the safest investments in the world of real estate. For context, the other options that one can choose to invest in are hotels, mobile home parks, office properties, retail spaces, self-storage, and land. In this post, I want to dive into the world of multifamily real estate to give you a foundation to work with so you can better understand the asset class and its pros and cons.

With this being said, what is multifamily real estate? A multifamily property is any residential property containing more than one housing unit. That can range from a duplex (2-unit property) to an apartment complex. Most investors choose to get started by investing in two to four-unit properties and that is a great way to get started. Those smaller unit properties are easily manageable and don’t require as much time and money to get started as larger properties. Larger multifamily properties, those with five or more units, start to fall into the commercial real estate category. Properties with 5+ units normally qualify for a different type of financing, which is usually more expensive than smaller properties (less than 5 units). Multifamily properties can continue to grow in size to include hundreds or even thousands of units. Sometimes multifamily properties will cater to specific demographics such as students or seniors, but that is not always the case. The majority of multifamily properties are not specific to demographics. With that being said, let’s jump into the pros of multifamily real estate.

NOTE* – From here on out I will abbreviate multifamily to “MF” and real estate to “RE” for simplicity’s sake.

The Pros

Passive Income: Perhaps the most alluring part of multifamily real estate is the ability to generate passive income. Passive income can be defined as a strategy that allows investors to generate revenue without continuous active involvement. The way that an MF property allows one to generate passive income is by hiring a third-party property management company. The property manager that you hire can take care of the day-to-day operations of the building and you can rest assured someone is looking out for your tenants. As long as your investment property is occupied to the point where you can pay off expenses (including the property manager) and any debt on the property, you will continue to make money. Hiring a property manager is attractive to those individuals who have minimal experience running the operations of a building as well as those who are experienced and simply want to generate passive income.

Cash Flow: One of the reasons people invest in MF properties is for the cash flow that is generated each month. Cash flow in relation to RE can be defined as the money that is generated by a property and the associated expenses that come with running the property. Rents are predictable and in strong markets units can be re-leased quickly due to demand, which in turn ensures steady cash flow year after year. As a side note, some of the strongest markets this past year have been Tampa (FL), Austin (TX), & Charlotte (NC) amongst others.

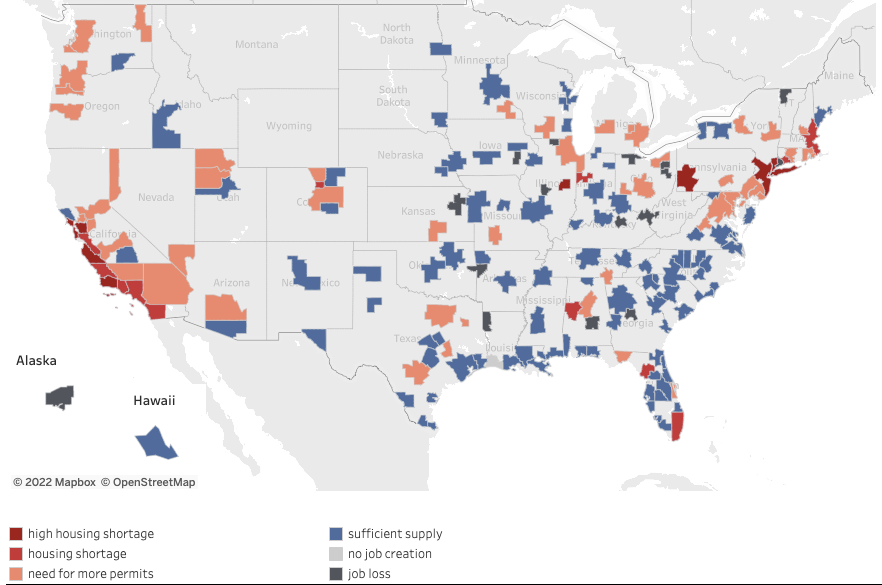

Lowered Risk: MF real estate in general is considered a relatively safe asset compared to other RE asset classes. Jaynish (Founder & President of JP Acquisitions) actually came back from a RE convention recently and found that the speakers barely mentioned MF, but rather spoke on office spaces and industrial properties. When he asked the speakers why they didn’t mention the asset class, they said that they knew multifamily will continue to do just fine while since the pandemic office spaces and industrial assets are continuing to try to find their pre-pandemic footing. The response those speakers gave on MF as an asset class was justifiable because people will always need a place to live. Even during economic downturns people still need a roof over their heads and a place they can call “home.” In addition, during economic downturns or recessions, many people find themselves forced to sell their homes because they can no longer afford them or it makes more sense to rent. On a different note, if you look into the supply of housing, what you will quickly realize is that there is a large shortage of housing which was further magnified by the pandemic. According to a report from the research group Up for Growth, prior to the pandemic in 2019, the U.S had a shortage of 3.8 million homes. That number encompasses both places to rent and places to own and has since grown further. Thus, demand for housing will continue to stay high for at least the foreseeable future which means in general the chances of your investment property being filled are higher.

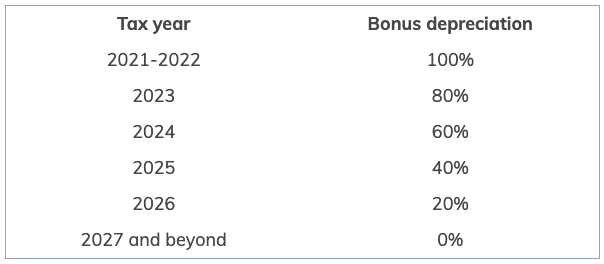

Tax benefits: Investing in multifamily real estate provides investors with attractive tax benefits. MF properties can be depreciated over a 27.5-year period which lowers one’s tax liability. Depreciation can be defined as the decrease in the value of a property over time. Depreciation expense is meant to compensate a rental property owner for the normal wear and tear of a building over time. The land is exempt from depreciation because land never wears out or is used up so to speak. To calculate depreciation, the value of a building is divided by 27.5 years. The resulting depreciation expense is deducted from pre-tax net income generated by a property. In addition, in 2017 due to the Tax Cuts and Jobs Act, the government allowed real estate investors to take advantage of something known as bonus depreciation. What that concept allows real estate investors to do is expense 100% of a qualifying property when they acquire an existing building. An investor can do this by hiring a third-party company to do a cost-segregation study in order to identify building components that are eligible for bonus depreciation. Thus, while some components of a building still need to be depreciated over 27.5 years, the cost segregation study allows other components to be depreciated over 5, 7, and 15 years. This in turn further decreases one’s tax liability and in some cases even allows for tax-free income. At JP Acquisitions, we intend to hire a third party company to conduct a cost segregation for our current property in addition to future properties as long as it makes sense to do so. Keep in mind that the government has stated that 100% bonus depreciation will be eligible for buildings placed in service or purchased in 2022, and that percentage will go down by 20% per year until it eventually hits 0%.

Multiple Ways to Invest: Another reason people are drawn to MF real estate is because of the multitude of ways in which to invest in the asset class. You can choose to purchase a building individually or partner with others. You can invest via a syndication which allows you to reap the benefits of the asset class while taking on a more passive role in the partnership. Someone also has the ability to invest in a multifamily fund that has a broad reach to invest in properties all over the country which in turn diversifies the location of your holdings. The benefit of diversification is that it lowers your risk. Another option is to invest via a real estate investment trust (REIT) which has the benefit of liquidity since REIT shares can be purchased and sold like a stock. These are just a few of the ways to invest in MF real estate. Investors love the optionality of ways to invest in this asset class.

Diversity of Opportunity: While I refer to multifamily RE in broad terms here, there are different product types that an investor has the option to put their hard-earned dollars into. For instance, you can choose to invest in small neighborhood duplexes or triplexes. You have the option to invest in newly built or renovated properties or opt-in for a higher-risk project with a value-add component. I need to note that what I mean by “value-add component” is purchasing a building with the intent of renovating it. You can also get more niche into MF real estate and invest in student housing or 55+ retirement communities targeted toward seniors. These are just a few of the product types that an investor may find intriguing, but nevertheless, the MF sector provides tremendous optionality given the product types.

The Cons

Management: While property management can be outsourced, that doesn’t mean that multifamily properties are easy to manage. Investing in multifamily properties means handling many individual leases, tenants who have various maintenance requests, tenants who prefer to communicate in different ways, paying a multitude of bills, etc. Compare this to leasing office space to a single tenant. In this case, you’d only have to deal with a single tenant. More so, with commercial leases the routine repair and maintenance obligations fall on the shoulders of the tenant. With that being said, managing a multifamily property is easier than that of a portfolio of single-family homes. There are efficiencies that come with managing a single multifamily asset, that includes the ability to hire an on-site or live-in property manager depending on the size of the property. Property managers manage tenant requests, market your property, find tenants, collect monthly rent, and more. The reason why so many MF investors hire property managers is because they maximize your time by dealing with the day-to-day operations of a property which in turn is what makes MF real estate a passive investment. I should note that property managers charge a percentage of your property’s monthly rent in exchange for their services (typically 5-10% depending on property size). Also, an investor still needs to manage their property manager to make sure they are on top of everything.

Large Upfront Cost: One of the cons of MF real estate is that there are large upfront costs. For example, if I want to purchase a $1M property and the bank is willing to lend me 75% of the value of the property ($750,000), I still need to come up with $250,000 in addition to costs associated with buying the property (closing costs). Keep in mind that most banks will want to see an investor put down at least 20% as a down payment. These large upfront costs are what make real estate different from other asset classes such as stocks which can be purchased for far less. Coming up with the cash is no easy task for the average investor which is why my team and I at JP Acquisitions syndicate deals. What syndication refers to is raising capital for purchasing real estate or building a new property. We syndicate deals to provide investors an avenue to invest in real estate without having to deal with the trouble of putting a deal together and lowering the large upfront costs. I should note that single-family homes or non-multifamily properties (less than 5 units) are often less expensive for those looking to buy rental properties, however, those deals have their own management challenges to consider.

Competition: Multifamily real estate tends to draw interest from more experienced investors. This creates intense competition for MF properties which makes it difficult for novice investors to enter the market. The best deals are often off-market and brokers typically market those deals to more experienced investment groups or individuals because they know they can close faster and with minimal hand-holding. Also, experienced investors typically have the cash and resources to outbid smaller investors. First-time investors are often best served by partnering with experienced investors as they begin to learn what it takes to invest in MF real estate. However, finding an experienced partner is a challenge in itself which is why professionals who are occupied with their jobs tend to invest with syndicators.

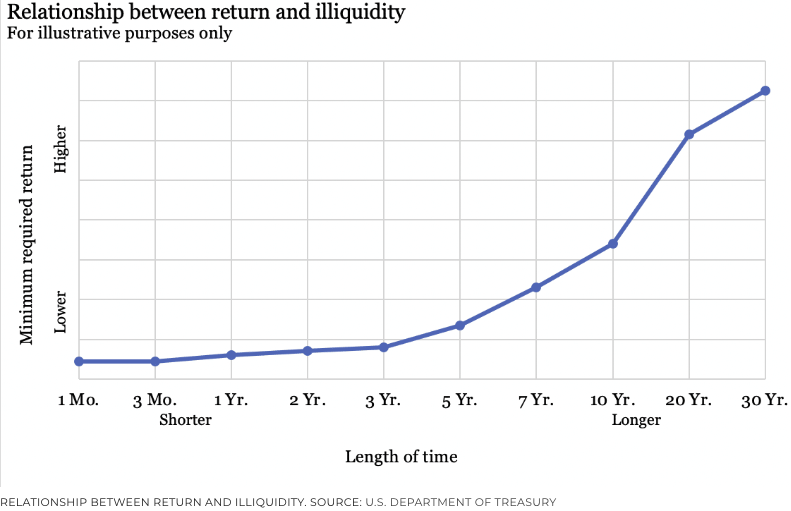

Liquidity: When investing in real estate in general, your money is usually tied up for a considerable period of time. This is different from other investments such as stocks and bonds which can be bought and sold with ease on an exchange. What makes real estate illiquid is that it’s predominantly private in nature, it takes a considerable amount of time and effort to complete transactions, and transactions require a significant amount of capital. However, illiquidity isn’t all bad. Since real estate is transacted on private markets, real estate is insulated from price volatility unlike stocks which fluctuate daily. In addition, in exchange for having your money locked up for a long period of time, investors require higher rates of return. The compensation that investors demand in exchange for having their capital locked up is known as the liquidity premium. The chart below from the U.S. Department of Treasury does a great job of illustrating the relationship between return and illiquidity. As a final note, hard assets such as real estate hedge through inflation as opposed to liquid assets (stocks, bonds, cash) due to their utility to the world which is what contributes to their sustained value.

Extra Factors to Consider: High knowledge barrier, availability of properties, and regulations.

Conclusion

Anyone interested in investing in multifamily real estate needs to weigh the pros and cons before getting their feet wet. This asset class is one that investors typically begin to invest in gradually with smaller properties (2-4 units) before scaling up to larger properties. Some people consider the strategy of buying a property and living in one of the units to get a feel for what property management entails before scaling up.

It’s important to remember that getting started is what matters. There is no wrong way to go about investing in MF real estate and there is no shame in buying a smaller property at first. Over time as your portfolio grows, you can sell the smaller units and take the proceeds to scale. A good idea if you are looking to sell your smaller properties and grow is to do what is known as a “1031 exchange.” While I’ll reserve a future post to talk about 1031 exchanges, the important thing to know is that it is an option. Another option is to employ a buy-and-hold strategy with the smaller properties to slowly pay off the mortgage and leverage the built-up equity to invest in larger properties.

Both of the approaches I outlined are how some of the wealthiest individuals in America have built their wealth. Billionaire Andrew Carnegie famously said that 90% of millionaires obtained their wealth by investing in real estate. All this is to say that MF real estate presents investors with a great opportunity to build generational wealth.

Connect with us!

About the Author

Tedi Nati is the Managing Partner of JP Acquisitions. In his role he is responsible for broker outreach, establishing deal flow, underwriting, marketing, and assisting in the closing process. In addition to his role at JP Acquisitions, he is an Assistant Equity Underwriter at Cinnaire, a non-profit Community Development Financial Institution (CFDI). In his role at Cinnaire, he is responsible for assisting the underwriting team in evaluating and structuring real estate equity investments and assessing the risks and mitigants associated with such. Tedi earned his Bachelor of Science in Finance from DePaul University, where he graduated Summa Cum Laude. In his free time he enjoys reading, writing for his blog (tedinvests.com), looking for multifamily deals, working out, and researching stocks.

Sources:

- https://www.arborcrowd.com/real-estate-investing-learning-center/multifamily-outperforms-in-recessions/#:~:text=During%20the%20Great%20Recession%20of,according%20to%20the%20CBRE%20report.

- https://www.nar.realtor/research-and-stat

- https://www.marketplace.org/2022/07/15/the-u-s-housing-shortage-has-doubled-in-less-than-a-decade-report-finds/

Make sure to always do your own research before making any final decisions on buying/investing real estate, stocks, or other securities. I am not a CPA, attorney, insurance, or financial adviser and the information in this blog post shall not be construed as tax, legal, insurance, construction, engineering, health and safety, electrical or financial advice. If stocks or companies are mentioned, I sometimes have an ownership interest in them – DO NOT make buying or selling decisions based on my posts alone. If you need such advice, please contact a qualified CPA, attorney, insurance agent, contractor/electrician/engineer/etc. or financial adviser.

buy generic promethazine 25mg – buy lincomycin 500mg online purchase lincomycin for sale

Your comment is awaiting moderation.