After having made six consecutive posts on multifamily terminology, it’s time to depart from terms and explore other ideas in the realm of commercial real estate. With the new year approaching, people all around the world are thinking about their new year’s resolutions. At the top of the list for most people are two things: money and health. While I won’t speak on the waves of gym newbies that are going to begin working out at your local gym for one month and then give up, I can and will speak on building generational wealth through multifamily real estate. This post will be about understanding several things, first and foremost what passive income is and why it’s so desirable. Secondly, the level of commitment it takes to achieve significant levels of passive income. Finally, I’ll dive into a simple example of how an investor can strategize so as to hit their financial goals with real estate. Something to note before diving into this post, I won’t be sugar-coating the returns you can expect to achieve or how long it will take to reach your financial goals like many syndicators do on social media.

It’s been said that 80% of millionaires made their wealth through real estate. Quite honestly, I don’t know how much merit that so-called statistic holds, but the math behind investing passively in real estate and building wealth seems to at least make the statement seem believable. Nevertheless, we’re not here to talk about the credibility of that statement but rather to understand how “mailbox money” (i.e. passive income) can change an investor’s life over a long period of time.

Passive income is simply income that is acquired with minimal labor or maintenance. Passive income, in addition to several other benefits, is what multifamily syndicators are after. It’s the ability to earn money while you sleep that is so alluring about buying apartment buildings. As Warren Buffet stated, “if you don’t find a way to make money while you sleep, you will work until you die.” I’ll argue that what Buffet means by “work until you die” is working a job that you do not enjoy because you need the money. I, along with a large percentage of individuals, would prefer to have the ability to choose when to work and what to work on as I please without having to worry about losing the clothes on my back.

When someone passively invests in a multifamily deal through a syndication, they’re looking for a sponsor team to manage their money and send them a check either monthly or quarterly along with regularly scheduled updates on the performance of the investment property. The natural question at the top of the list for passive investors is what is the size of that check? The answer to that question is it depends. If you’re investing with a trustworthy team who has proven themselves to be competent, the question to ask is how much can you afford to invest? While most people quite frankly don’t have all that much to invest, through a diet of discipline, focus and patience, an investor can not only make themselves well off, but future family generations as well.

The truth about making passive income through apartment investing is that unless you happen to have hundreds of thousands or millions to invest right away, investing enough to cover the income from your job takes a long time. How long you may ask? Once again it depends. The lifestyle you want to live and your financial goals are personal and play a huge role in replacing the income from your job with passive income. Perhaps you want to make $20K passive, or maybe you’re very ambitious and won’t rest until you make $200K+ passively. One thing is for sure, no one becomes a millionaire overnight and the road is long. Also, the more time you have on your side, the further you’l be able to go. The journey is well worth the reward.

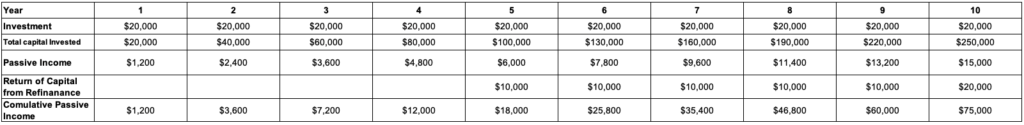

As promised, let’s run through an example. Let’s say that you invest $20,000 yearly and get a consistent 6% return. I assume that you get 50% of your capital back that you invested five years ago via a refinance. Also, I assume all of the refinance proceeds are re-invested. Given all of these assumptions, after ten years you’ll be earning $15,000 yearly and have collected a total of $75,000 in passive income over the period. More so, you’ll have a total of $250,000 invested. This case outlines an investor who sought out to invest in and hold cash-flowing properties. Notice how I don’t mention anything about a sale of the properties nor the tax benefits of investing in multifamily real estate which is very likely to occur when investing with a competent syndicator. If I had included those two factors (sale proceeds and tax benefits), your return would be much higher. The beauty of this scenario is that it doesn’t factor sale proceeds or tax benefits, but rather gives you a very conservative idea of what you could earn by investing in multifamily real estate. Another important thing to reiterate is that you’d have done minimal work in terms of managing your investments to gain these returns.

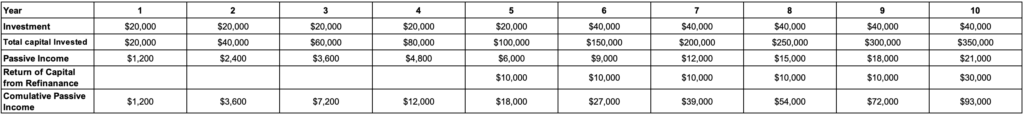

Let’s take the same scenario from above but instead of investing $20,000 throughout the entire period, you begin to invest $40,000 in year six. At the end of the ten-year period, you will be generating $21,000 in passive income and you will have collected a total of $93,000. All in all, you will have $350,000 invested in real estate in ten years.

While you may be thinking that these returns don’t seem all that great, ask yourself if making $15,000+ in passive income yearly all the while having your properties appreciate is appealing. Had you invested all of that money in stocks through the traditional means of a 401K, you would have had to wait until age 59.5 to pull your money out. Not to mention, you would have to pay taxes on the income that you pull out. Having seen what you could conservatively make over a ten-year period, imagine what amount of passive income you’ll be able to generate in twenty or thirty years. Imagine what you will be leaving your kids when your time on earth comes to an end. Do you think they’ll be better off with all the gains you’ll have made through passive real estate investing? The answer to me seems clear, and as clique as this sounds, don’t wait to invest in real estate but rather invest in real estate and wait.

Conclusion

Working towards a long-term goal is difficult because it takes discipline and patience, but nothing great has been achieved overnight. Here I’ve shown you the compounding effects of investing passively in multifamily properties and how thinking in twenty or thirty-year terms can lead to massive gains. I encourage you to dig further into this topic and seriously consider your ability to invest passively for the long term. What will your lifestyle look like in the future? How much passive income do you want to generate? What do you want to leave your family when your life is coming to a close? These are all questions to ask yourself when investing. With that being said, if you want to talk further about investing in multifamily properties, don’t hesitate to reach out to me or someone on my team so we can talk about your investment goals.

As always, I wish you the best and happy holidays!

Connect with us!

About the Author

Tedi Nati is the Managing Partner of JP Acquisitions. In his role he is responsible for broker outreach, establishing deal flow, underwriting, marketing, and assisting in the closing process. In addition to his role at JP Acquisitions, he is an Assistant Equity Underwriter at Cinnaire, a non-profit Community Development Financial Institution (CFDI). In his role at Cinnaire, he is responsible for assisting the underwriting team in evaluating and structuring real estate equity investments and assessing the risks and mitigants associated with such. Tedi earned his Bachelor of Science in Finance from DePaul University, where he graduated Summa Cum Laude. In his free time he enjoys reading, writing for his blog (tedinvests.com), looking for multifamily deals, working out, and researching stocks.

Make sure to always do your own research before making any final decisions on buying/investing real estate, stocks, or other securities. I am not a CPA, attorney, insurance, or financial adviser and the information in this blog post shall not be construed as tax, legal, insurance, construction, engineering, health and safety, electrical or financial advice. If stocks or companies are mentioned, I sometimes have an ownership interest in them – DO NOT make buying or selling decisions based on my posts alone. If you need such advice, please contact a qualified CPA, attorney, insurance agent, contractor/electrician/engineer/etc. or financial adviser.

purchase phenergan generic – buy phenergan pill cost lincocin 500mg

Your comment is awaiting moderation.