|

Getting your Trinity Audio player ready...

|

Regardless of the investment someone makes, there are various ways to track one’s performance. Without return metrics, we wouldn’t have an accurate way of judging which investments are strong and which are poor. In the world of multifamily real estate, there are three return metrics that are most commonly used. Those metrics are known as cash-on-cash (CoC) return, equity multiple, and internal rate of return (IRR). These metrics are by no means to be the sole judge as to if an investment in an apartment building is strong. Undoubtedly, there are numerous other factors that someone needs to consider before investing in a multifamily property. Nevertheless, in this post, I want to discuss these three metrics and their limitations so an investor understands how to decide between investing in various opportunities. I’ll note that I’ve covered all of these return metrics before and they can be found in the glossary section of our website. I figured it’d be easy to discuss these terms in one comprehensive blog post for ease of understanding.

Cash-on-cash Return (COCR)

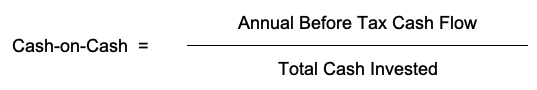

The cash-on-cash return, sometimes referred to as the cash yield, is the most simple to understand of the three metrics we’ll discuss in this blog post. This metric can be calculated by taking the cash left over after paying for expenses and debt and dividing it by the total equity put into the deal. In other words, this metric is calculated by taking the net operating income (rental income minus expenses) and subtracting debt which leaves you with cash flow available for distribution (i.e. annual before-tax cash flow). From there, you divide that number by how much equity was put into the deal.

The advantage of this metric is that it is quick and easy to calculate. This metric allows an investor to compare returns of various asset classes without breaking a sweat. However, there are multiple drawbacks to this metric. Firstly, this metric is calculated on a before-tax basis and it does not consider an individual’s tax bracket and tax outflows. Thus, the COCR that an investor calculates is not a true representation of the return they will receive. Secondly, the COCR does not account for the return of capital as the internal rate of return metric does. If you calculate this metric after accounting for the return of capital, the number is highly inflated because after an investor’s capital is returned they have less money in the deal and the denominator in the formula shrinks. Furthermore, this metric does not account for the time value of money. As we know, a dollar today is not worth as much as a dollar in the future. The COCR ignores this reality and as we will see later that is why the internal rate of return metric is used. This metric also least captures the risk that is associated with a deal. For example, you can invest in a D-class properties which are known to produce high COCRs, but the fact of the matter is that D-class properties have risk associated with the tenants, the condition of the property, and the crime in the area. As a result, a D-class property may look like a strong investment when only considering this metric. Nevertheless, the COCR is a useful metric for quickly assessing the yearly cash return that one can expect from an investment in a multifamily property.

Internal Rate of Return (IRR)

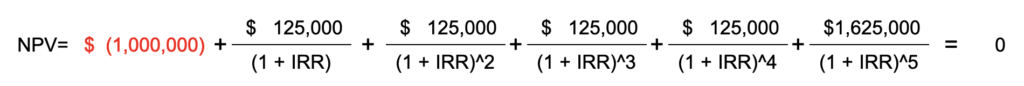

The internal rate of return is the most complex of the three return metrics discussed in this post and thus I will explain this metric in multiple ways in the hopes that one of the explanations clicks in your mind. The IRR formula measures the compounded annual rate of return that an investor can expect from their investment. It can be thought of as the return to be expected on each dollar invested into a deal in the period that it is invested in. The IRR is essentially the interest rate (also referred to as the discount rate) that will bring a series of cash flows to a net present value (NPV). What’s important to keep in mind is that IRR takes into consideration the time value of money as I had mentioned before. This is critical to understanding this metric and is what makes it stand out. In other words, IRR takes into account the fact that your money is worth less in the future and as a result, the formula discounts the cash flows you will receive to what they are worth in the present day.

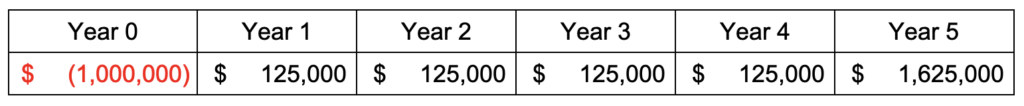

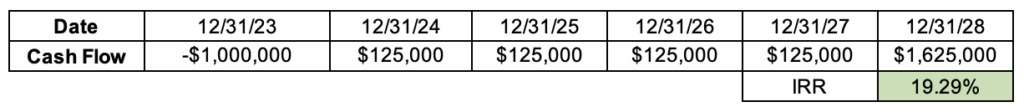

All of this may be flying over your head and that’s ok, the good news is that this metric can be easily calculated in Excel using the XIRR function. The XIRR function in Excel is the following: =XIRR(values, dates, [guess]). The required inputs are the “values” and “dates”, while the “guess” input is optional. What “values” refers to are the series of cash flows (negative and positive). The “dates” input is more intuitively understood and is is the time at which those cash flows (“values”) are received. The “guess” input is an estimate of what the IRR will be and if left blank Excel takes the default value of 10%. Let us use the example below to better understand the internal rate of return metric. Let’s say that you invest $1MM in a multifamily deal and for the next five years you get $125,000 in cash flow. In year 5, you get $125,000 in cash flow in addition to $1.5MM (the return of your initial investment plus appreciation of the asset) after selling the property. If you were to use the XIRR function in Excel, you see that the investment yields an IRR of 19.29%. Now if you were to change the $1.6MM in year 5 to $125,000, you would see that the IRR changes from 19.29% to -13.85%. The reason why that is so is because you never received your initial investment back and therefore you technically lost money. The XIRR function in a handy tool that is incorporated in nearly all financial real estate models.

There are multiple advantages of using this metric to calculate one’s return. For starters, IRR takes into account the time value of money as opposed to the COCR and equity multiple. Secondly, IRR is simple to calculate in Excel and makes it easy to compare multiple projects under consideration. Furthermore, as opposed to trying to guess the rate of return that you would require for a project, IRR is not dependent on knowing that rate of return and mitigates the risk of assuming what return is adequate for a project.

On the other hand, there are a number of disadvantages to this metric. Firstly, this metric ignores the economies of scale of a deal and what I mean by that is that the IRR does not take into account how big the project is. People prefer to invest different amounts of money and the IRR simply shows the return of the overall deal. More so, IRR ignores implicit risks associated with a deal, similar to COCR, such as the market the property is located in (to a certain extent), the condition of the property, etc. On top of those, the IRR formula can be manipulated based on the dates that are inputted into the formula. A sponsor team could change the dates of the cash flows by a few months and suddenly the investment could go from a 15% IRR to a 19%IRR at the simple touch of a few inputs. I could go all day further explaining the advantages and disadvantages of the IRR metric but to not bore you I went high level. I encourage you to look further into this metric if you’re interested in doing so.

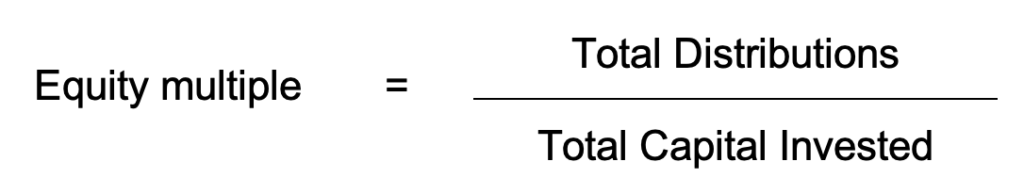

Equity Multiple

Thankfully, equity multiple is a lot easier to understand than the IRR metric. The metric is calculated by taking the sum of all positive cash flows and dividing it by the sum of all negative cash flows. In other words, the formula to calculate the equity multiple is the total distributions divided by the total capital invested. Let’s run through an example to better explain this metric. Let’s say that we invest $1MM into a deal and over the course of the investment we receive a total of $2MM from cash flow and the sale of the property. In this scenario, the equity multiple would be 2 ($1MM / $2MM). Similar to the COCR, equity multiple is an easy way to quickly analyze a real estate deal.

The advantages of this metric include simplicity and being able to convert it into an annualized rate of return (ARR). As stated previously, the equity multiple is simple and a quick way of analyzing the returns of a deal. It takes less than a minute to add up the distributions from a property and divide it by the capital invested. More so, you can effortlessly transform the equity multiple into an annualized rate of return via simple math. The formula to calculate the ARR is the following: (Equity Multiple – 1) / Years. Using the example from above and assuming the hold period of the investment was 5 years, you would end up with an ARR of 20% ((2-1) / 5 = 20%). If you have a number of deals to decide from but can only invest in one, you could quickly calculate the ARR of both deals to see which one offers the better return.

While this formula is simple, it does have one large drawback. Unlike IRR, this formula does not take into consideration the time value of money. One thing to remember is that the ARR of a deal will always be higher than the IRR because it does not take into consideration how money loses value over the course of time. This is why the IRR needs to be used in conjunction with the equity multiple in order to derive a realistic picture of the returns of a deal.

Conclusion

Having read this post I trust that you now have a better understanding of how to assess the returns of a multifamily project. Something that you may have realized while reading this post is that I purposefully left a certain drawback out in some sections that really apply to all of the metrics to see if you would catch on to the common theme. The reality is that while we all would love a high return on our investments, these metrics don’t accurately portray the risk associated with a deal. To a certain extent, the metrics account for risk because a higher return typically means more risk is associated but that’s not exactly accurate. A deal needs to be analyzed in all facets before coming to a conclusion as to if it’s worth investing in. Also, no single return metric should be used to come to a conclusion as to if a deal is worthy of putting your hard-earned capital into. The drawbacks of one metric are transformed into the advantages of another. With that being said, you’re now better equipped to analyze deals and this knowledge will help you on your journey to financial freedom.

If you have any questions regarding the terms and concepts in this post or previous ones, don’t hesitate to reach out to either me (tedi.nati@jpacq.com) or someone on our team so we can help explain what is causing the confusion. If you’re interested in investing with us at JP Acquisitions, you can contact us via email (contact@jpacq.com), LinkedIn, Instagram, or our investor portal to set up a meeting.

As always, I hope you enjoyed reading this post as much as I have writing it. Best of luck!

Connect with us!

About the Author

Tedi Nati is the Managing Partner of JP Acquisitions. In his role he is responsible for broker outreach, establishing deal flow, underwriting, marketing, and assisting in the closing process. In addition to his role at JP Acquisitions, he is an Assistant Equity Underwriter at Cinnaire, a non-profit Community Development Financial Institution (CFDI). In his role at Cinnaire, he is responsible for assisting the underwriting team in evaluating and structuring real estate equity investments and assessing the risks and mitigants associated with such. Tedi earned his Bachelor of Science in Finance from DePaul University, where he graduated Summa Cum Laude. In his free time he enjoys reading, writing for his blog (tedinvests.com), looking for multifamily deals, working out, and researching stocks.

Make sure to always do your own research before making any final decisions on buying/investing real estate, stocks, or other securities. I am not a CPA, attorney, insurance, or financial adviser and the information in this blog post shall not be construed as tax, legal, insurance, construction, engineering, health and safety, electrical or financial advice. If stocks or companies are mentioned, I sometimes have an ownership interest in them – DO NOT make buying or selling decisions based on my posts alone. If you need such advice, please contact a qualified CPA, attorney, insurance agent, contractor/electrician/engineer/etc. or financial adviser.

provigil 200mg tablet – provigil 100mg tablet lamivudine price

Your comment is awaiting moderation.