|

Getting your Trinity Audio player ready...

|

Getting started in the multifamily (MF) industry can be quite difficult and there are many barriers to getting your feet wet in this industry. Despite publishing over 25 articles, we’ve yet to clearly outline what factors are stopping newcomers from jumping into the multifamily industry in a concise article. In this post, I aim to outline the biggest barriers you may face when looking to purchase your first multifamily property. Whether you’re looking to start an investment company like JP Acquisitions or simply own a multifamily property, this post will provide you insights into what obstacles you may face on your path to financial freedom through apartment investing. Before diving into this post, I want to note that when I mention “multifamily”, I’m referring to a property that is 5+ units. Let’s dive in!

Financial Resources

The most obvious barrier that you may face on your journey is a lack of financial resources or in other words, money. Buying a multifamily property can be very expensive and while there are many so-called “gurus” or experienced investors who say that you can put no money down, the truth of the matter is finding a property that you can purchase with no money down is difficult.

With the recent turbulence in the banking system, this barrier is even more difficult to overcome as banks, in general, are tightening their lending requirements. Nevertheless, most banks are looking for anywhere between a 20-30% down payment on any given property. That down payment doesn’t even cover the closing costs or repairs. For example, let’s say that you want to purchase a $1.25M property and the bank you’re working with wants a 25% down payment. In this example, the down payment would run you $312,500, and while the closing costs can very, it’s safe to assume that those costs would be anywhere between $40K -50K. If we add up the down payment and the closing costs, that total is between $352,500 and $362,500. If the property in this example happens to need repairs, the total money down could be well above $400K. I’ll caveat this example, in addition to the others that I will cover, with the fact that they are simplified, although realistic, for educational purposes.

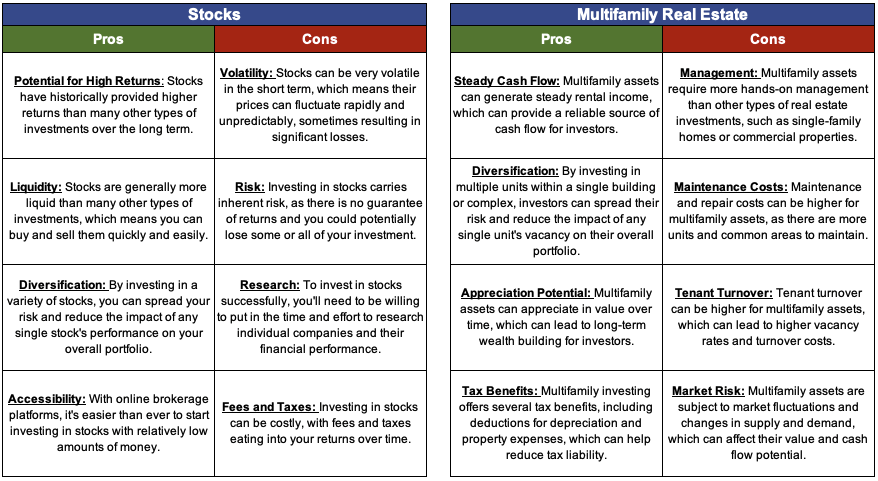

With the example I just provided, you may be thinking that you don’t have enough money to close a deal or that $400K is way too much money to spend on a multifamily property. However, before you stop reading the post here, think about whether or not spending that money is worth the investment and what other avenues you have to grow your money. Keep in mind that stocks, on average, provide an annual return between 6-8%, while investing in multifamily properties has historically provided a return anywhere between 10-20%. In addition, you don’t have to buy a multifamily property that is above a million dollars. There are many MF properties out there that cost far below $1M. For example, let’s say that there is a MF property that is $600,000 that you’re looking to purchase. The bank in this scenario may want a 20% down payment because they don’t see there being too much risk associated with the property. As a result, the down payment would cost you $120,000, and the closing costs would likely be anywhere between $12K and $35K. If we assume that there isn’t much repair needed on the property, then the total acquisition cost for the property would be anywhere between $132K – $155K. The range I just provided of slightly over $100K is still a lot, but the benefits of investing that money outweigh the cons, in my opinion. You may be asking “why so?” and the answer to that is because multifamily properties provide monthly cash flow, hedge through inflation through rent increases, appreciate in value over time, and provide tax benefits. These benefits are somewhat different compared to a portfolio of stocks which fluctuates in price drastically (as we have seen the past 12 months), although have a chance of providing high returns, are liquid, easily diversifiable, and easily accessed through a brokerage account.

Despite everything I have talked about in this section, the important thing to remember is that purchasing a multifamily asset can be very expensive. For this reason, amongst many others, it’s important to save your money and budget appropriately when you’re seeking to find the right property.

Note – I have provided a generalized list of the pros and cons of stocks and multifamily real estate at the bottom of this post.

Education

The next barrier I want to touch on has to do with education. When investing in any asset, be it multifamily, stocks, car washes, etc., you have to educate yourself so as to not put your money at risk and maximize the benefits of the investment. When it comes to multifamily, you have to educate yourself on several topics including the the acquisition process, underwriting, terminology, and communication.

Unlike more liquid assets, learning the acquisition process for a multifamily asset can be tricky as there aren’t many resources that spell it out in a clear, concise, and methodical way. Be that as it may, I recommend several books to learn the acquisition process which I’ve linked at the end of this blog post. In addition to the books that I provided the links for, I recommend using YouTube to your advantage to learn the process of acquiring a building. Beyond those suggestions, I’ve published a blog post regarding opening an LLC which I’ve linked here for you’re convenience. Realistically speaking, the best way to learn the buying process is to talk to others who own multifamily assets. Those individuals can answer the questions you have and get granular. While I would walk through the process of purchasing an apartment building in this post, that would take too long and I’ll be covering that topic in a separate post in the future.

In terms of learning the underwriting process, the good news is that real estate math is relatively simple and it’s just a matter of taking the time to practice to learn how to underwrite. For those who don’t know what underwriting is (see the “Glossary” page on our website for a detailed explanation), it can be defined as the process by which one analyzes a property’s past and present performance and forecasts future performance to determine the value of a property and understanding the associated risks. Thankfully and unlike the buying process, there are many resources out there including books, videos, and blog posts which you can use to help you to learn how to underwrite. To streamline your learning, I’ve linked a few books and blog posts which can be a starting point for you. I’ll note here that you’ll need an underwriting financial model in order to teach yourself and those can be found online. Some of those models can be purchased while others are free. I’ll note that while not all financial models are built the same, the fundamental mechanics are the same and it’s a matter of poking around in those models to understand the mechanics. While there is no need to build your own model, if you really want to prove to yourself and others that your an expert, I suggest taking the time to build an underwriting model in Excel.

With respect to learning multifamily terminology, the internet is your best friend. As a starting point to learn multifamily jargon, I recommend going through the “Glossary” page on our website. In that part of our website I’ve separated over 20 terms into various subsections including operations and underwriting, return metrics and deal structures, legal, and debt. The terms you’ll read about in the glossary come from a six part blog series that we published called “Terminology Multifamily Investors Should Know.” Furthermore, the books and blog posts that I’ve linked at the bottom of this post are very insightful and will help to guide you as you learn the common terms in the MF world. Being able to understand and communicate using MF terms used by professionals will help you come across as knowledgeable when talking to brokers and seasoned investors. In addition, you’ll be able to better explain your ideas which brings me to my final point regarding education, communication. Being able to explain your ideas will make a huge difference between whether you secure a deal or not. The last thing that brokers, limited partners, and other professionals want to hear is someone who doesn’t know what they are talking about in this market. This point I’m making on communication can be applied to any industry and is a critical skill not only in real estate but in life in general.

Relationships

Meaningful and substantive relationships are the backbone of any successful business and there is a reason I mention relationships as a final barrier. Prior to speaking and connecting with professionals you’ll want to get educated and have the financial resources necessary to close a deal so as to take advantage of opportunities that arise. This is not to say that you shouldn’t go out there and touch base with experienced investors right away, but rather be aware of who you talk to at the onset of your journey because you may have people brush you to the side or dare I say ignore you if you don’t know what you’re talking about. For example, lets say that you live in a small market controlled by a handful of brokers. If you start trying to establish relationships with those brokers right away without having a clue about real estate besides that you can make money investing in it, you may do more harm than good. While professionals and people in general usually assume that you mean well, the brokers in this scenario may assume that you still don’t know what you’re talking about down the road after you educate yourself. Nevertheless, continuously networking with people in real estate will help you tremendously. You’ll want to connect with brokers, lenders, investors, operators, and other professionals as you educate yourself. You never know where one of these relationships will take you and it’s important to keep an open mind with communicating with those people. Professionals are always talking to one another and if you’re able to build trust with them then they will be able to open doors for you. For example, Jaynish (President of JP Acquisitions) is constantly networking with people and those connections led us to finding the loan officer we used to close our first deal. That relationship with the loan officer has proven in be invaluable and led to our team connecting with others. All this is to say that starting off in this industry is tough because it requires you to put together a team. This team I refer to is comprised of lenders, lawyers, brokers, guarantors, and potentially partners. That said, if you seek to constantly grow your network and explain yourself as a competent investor you’ll succeed in this industry.

Conclusion

This brings us to the end of another post. To summarize, we covered the three main barriers to getting started in the multifamily industry: financial resources, education, and relationships. There is one more barrier which I’ll quickly make note of and that is the market you’re located in. The market you’re located in may be small, declining in economic activity, difficult to operate in, or a combination of the three. The reason why I didn’t mention the market you’re located in as a barrier is because regardless of where you’re located, there are opportunities all around you so long as you look, but I digress. I have confidence that the resources that I’ve outlined in this post and the topics we covered will be useful to you on your journey of achieving financial freedom through real estate investing.

If you have any questions regarding the terms and concepts in this post or previous ones, don’t hesitate to reach out to either me (tedi.nati@jpacq.com) or someone on our team so we can help explain what is causing the confusion. If you’re interested in investing with us at JP Acquisitions, you can contact us via email (contact@jpacq.com), LinkedIn, Instagram, or our investor portal to set up a meeting.

As always, I hope you enjoyed reading this post as much as I have writing it. Best of luck!

Connect with us!

About the Author

Tedi Nati is the Managing Partner of JP Acquisitions. In his role he is responsible for broker outreach, establishing deal flow, underwriting, marketing, and assisting in the closing process. In addition to his role at JP Acquisitions, he is an Assistant Equity Underwriter at Cinnaire, a non-profit Community Development Financial Institution (CFDI). In his role at Cinnaire, he is responsible for assisting the underwriting team in evaluating and structuring real estate equity investments and assessing the risks and mitigants associated with such. Tedi earned his Bachelor of Science in Finance from DePaul University, where he graduated Summa Cum Laude. In his free time he enjoys reading, writing for his blog (tedinvests.com), looking for multifamily deals, working out, and researching stocks.

The Pros and Cons of Stocks and Multifamily Real Estate

Multifamily Educational Resources

Books on the acquisition process and multifamily real estate:

- Financial Freedom with Real Estate Investing: The Blueprint To Quitting Your Job With Real Estate – Even Without Experience Or Cash Paperback

- Best Ever Apartment Syndication Book

- The Book on Rental Property Investing: How to Create Wealth With Intelligent Buy and Hold Real Estate Investing

Books on Underwriting

- The Definitive Guide to Underwriting Multifamily Acquisitions: Develop the skills to confidently analyze and invest in multifamily real estate

- Structuring and Raising Debt & Equity for Real Estate

Blog Posts on Underwriting

- Three Tips for Underwriting Multifamily Deals

- The Most Common Return Metrics in Multifamily Real Estate

- Common Deal Structures in Multifamily Syndications

Make sure to always do your own research before making any final decisions on buying/investing real estate, stocks, or other securities. I am not a CPA, attorney, insurance, or financial adviser and the information in this blog post shall not be construed as tax, legal, insurance, construction, engineering, health and safety, electrical or financial advice. If stocks or companies are mentioned, I sometimes have an ownership interest in them – DO NOT make buying or selling decisions based on my posts alone. If you need such advice, please contact a qualified CPA, attorney, insurance agent, contractor/electrician/engineer/etc. or financial adviser.

ivermectin for sale – carbamazepine price buy tegretol pills for sale

Your comment is awaiting moderation.