|

Getting your Trinity Audio player ready...

|

Risk profiles for multifamily syndication firms have been changing dramatically since the beginning of 2022. If you’ve been paying attention to the commercial real estate market, you’ve likely heard numerous headlines from popular business news publications reporting on various syndicators facing foreclosures and defaulting on their debt obligations. The events that these publications have reported on stem from the rapidly evolving economic environment. In many ways, we’re heading into uncharted territory and there is a hint of fear in the air. As the economy continues to slow, we’ve seen an increase in negative trends such as large layoffs, businesses closing, consumer confidence decreasing, tightening corporate budgets, and more. That being said, the focus of this blog post will not be so much a commentary on the financial system as a whole, but more so on the multifamily real estate market. Specifically, we will cover what has recently changed in the economy, why syndicators are shifting the way they see risk, and how it is that they’re pivoting as a result.

The Shifting Economic Environment

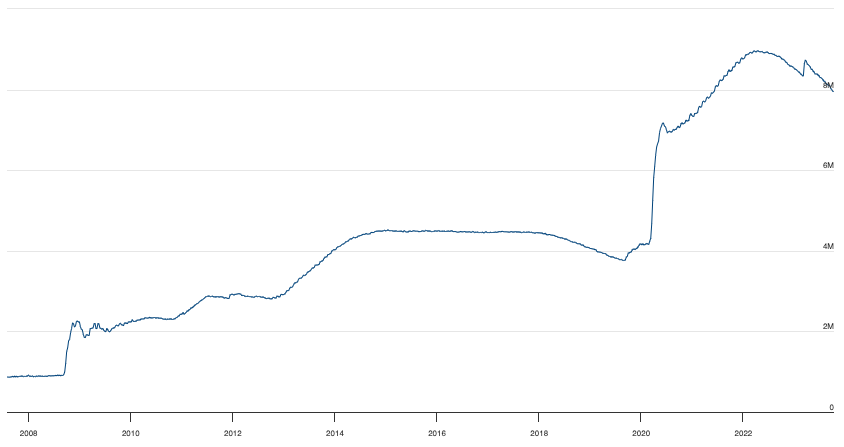

During the course of Covid, the Federal Reserve (the “Fed”) printed trillions of dollars (see Chart 1) which in turn drove the cost of goods (i.e., inflation) way up. To put things into context, the pandemic-era inflation reading peaked at 9.1% in June 2022. That reading was the highest since November 1981. Just recently, the U.S. Bureau of Labor Statistics reported that the consumer price index rose 3.7% in the 12 months through September 2023, and remained unchanged from August 2023.

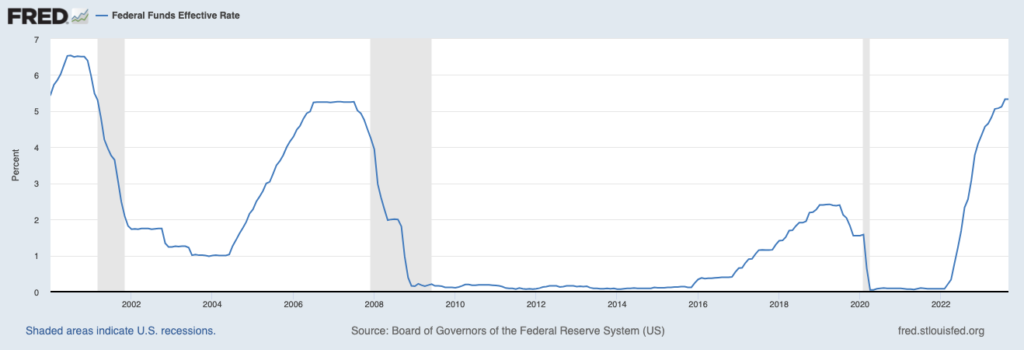

The Fed targets a 2% annual inflation rate over the long term and officials don’t expect us to reach the target until 2026. Nevertheless, in order to fight inflation, the Fed has a number of tools under its belt. However, to not make this post too complicated, we’ll talk about the one tool everyone has their eyes on, the federal funds rate (FFR). The FFR is what causes interest rates to change and as shown by the chart below, the FFR has increased significantly since the start of 2022. Increased interest rates discourage individuals and businesses from borrowing money which in turn slows down the economy.

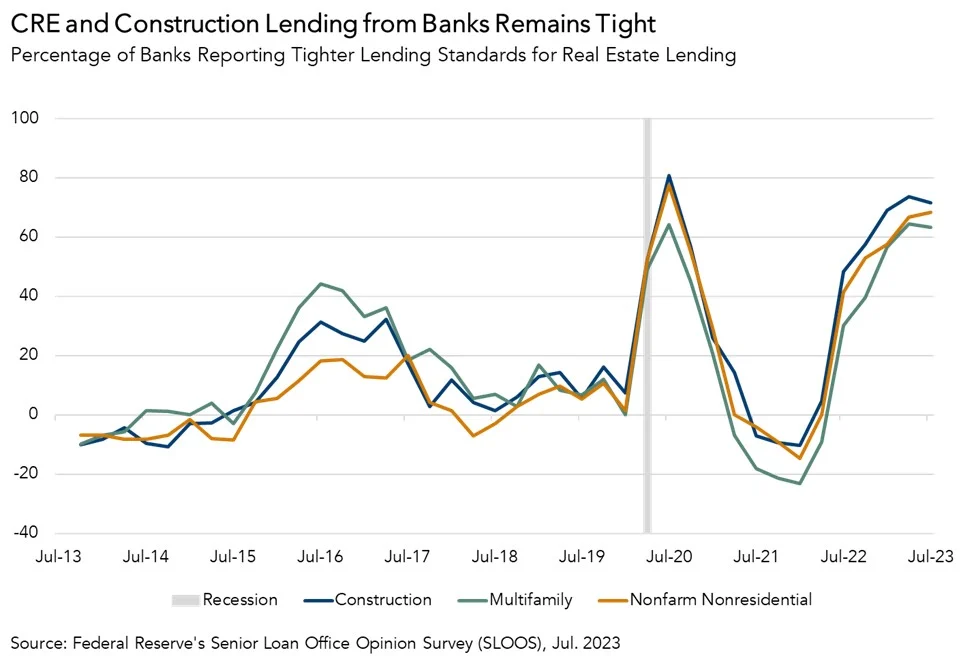

All this is to say that lending for commercial real estate, as well as other types of lending, has tightened. One of the ways the Fed measures how tight the lending environment has gotten is by asking lenders a set of questions through the Senior Loan Officer Opinion Survey (SLOOS). The SLOOS is a quarterly survey that asks bank loan officers if bank standards have loosened, remained unchanged over the quarter, or tightened. According to the most recent July 2023 survey, over 60% of banks reported tightening commercial real estate lending practices (refer to Chart 3). We can see that the trend has been upwards for some time now and it’s not surprising to see the positive correlation between increasing interest rates and tightening lending practices. This information begs two questions, how are syndicators perceiving risk and what are they doing to pivot during these unprecedented times?

Risk Perception and Altering Acquisition Strategies

In light of a tightening economy and lending practices, multifamily syndicators are thinking about risk differently. For now, gone are the days when interest rates were close to 0% and floating-rate construction loans were fueling heavy value-added projects with high returns. The following was the general business plan for many multifamily syndicators in those days:

- Find a multifamily property in need of heavy repairs in a growing market

- Analyze the quality of nearby comps and their rents to determine if the same rents could be achieved

- Underwrite the deal and map out a value-add plan to achieve the same rents as the comps

- Secure capital commitments from investors

- Have a lender provide a floating-rate bridge loan and proceed with the renovation plan

- Refinance once the renovation plan is complete and the property is stabalized

- Rinse and repeat steps 1-6

The problem that started occurring as interest rates started climbing is that the cost of the debt would increase and returns would be negatively impacted as a result. To add fuel to the fire, the prices that investors were willing to pay for the renovated properties decreased due to the cost of the debt negatively impacting returns. Thus, several things could’ve happened to these syndicators with the obvious outcomes being the following:

- The lucky syndicators were able to sell off their assets before rates got too high to not warrant the price they were asking for

- A refinance occurred at (likely) a higher interest rate than what they had underwritten to

- The floating rate got so high on the construction loan during the renovation process that the debt payments could no longer be made

Keep in mind that when interest rates were low, many operators and investors had no idea that the Fed would increase rates at the rate that they had. You’d think that syndicators would model what it would look like if rates increased drastically, but the allure of making a ton of money can be blinding to the risks that are inherent in the business plan I outlined above. I don’t mean to make it sound as if all syndicators experienced calamities and had their backs against the wall. In reality, the projected returns of these deals were likely missed, but many operators lived to see another day.

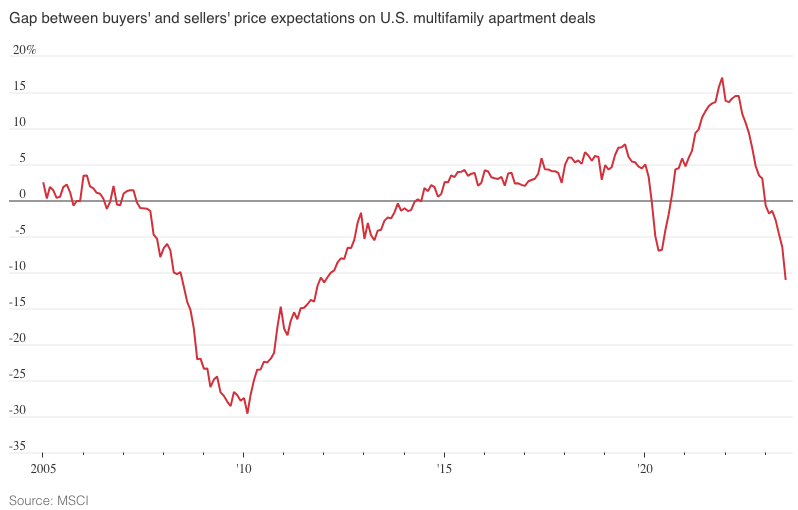

The chart below of the bid-ask spread for U.S. multifamily apartment deals outlines what a global pandemic resulting in 0% interest rates and a failure to conservatively underwrite deals can do to the perception of investors. The pandemic caused rates to drop to 0% which in turn spurred a ton of activity in the multifamily space. Many operators took advantage of the opportunity and implemented the value-add business plan I outlined. The low-interest rate environment caused cap rates to compress dramatically, and investors began expecting and actually selling at sky-high prices. Many operators made a ton of money, but once the interest rate party was over, many got caught holding the bag. We now find ourselves in an environment where sellers are trying to relive the glory days and asking too much for their properties, as evidenced by chart 4 (the latest reading is -10.9% as of July).

In terms of where interest rates will go next, your guess is as good as mine. However, deals are still getting done but they don’t resemble those during the pandemic. The combination of sellers asking too much for their properties and interest rates causing debt service to be high is causing operators to shift focus. Many syndicators are focusing on deals with the following characteristics:

- High in-place cash flow

- Less of a value-add component

- Lower leverage (i.e., lower LTV) at a fixed-rate

The deals I talked about earlier had lower in-place cash flow, a large value-add component, and higher leverage with a floating-rate component prior to conversion. The primary difference in the deals that are getting done today is that they’re more conservative (i.e., they’re less risky and provide lower returns). In terms of the value-add component, since these high interest rates in tandem with high asking prices don’t typically warrant obtaining a construction loan, some syndicators are raising large capital expenditure budgets via equity. Nevertheless, while these conservative deals can still provide great returns, many investors are anchored to the higher returns that they got hooked on when rates were low. These conversations with investors about lower returns can be difficult because the average investor looks primarily to returns to make their investment decisions. Slowly but surely investors will come around to this new reality, but it will be a difficult pill to swallow. The similar hard pill will have to be swallowed by sellers who are pricing their properties as if the FFR hadn’t jumped from the 0-.25% range to the 5-5.5% range. We’ll wait and see how operators, lenders, investors, and sellers will change their perceptions going forward, but one thing is for certain and that is that it will take time.

Conclusion

In this post, we’ve covered what has transpired in the economy in recent years, how syndicators are perceiving risk given the largely unforeseen events in the financial system, and what it is that they’re doing in order to get deals done in this new environment. Inflation is still running higher than the Fed’s target of 2% and expectations of it slowing down to the target are forecasted as far out as 2026. As a result, predicting interest rates will be extremely difficult, but that’s always been the case. On the one hand, the Fed can stay firm on their goal of 2% inflation and keep rates high or dare I say increase them. With this approach, they risk breaking more parts of the financial system. On the other hand, the Fed can lower rates but inflation may continue to persist at higher levels. All that can be said at the end of the day is that investors and syndicators alike should proceed with caution and decrease their risk tolerance for the time being.

If you have any questions regarding the terms and concepts in this post or previous ones, please reach out to either me (tedi.nati@jpacq.com) or someone on our team so we can help explain further. If you’re interested in investing with us at JP Acquisitions, you can contact us via email (contact@jpacq.com), LinkedIn, Instagram (jpacquisitions), or our investor portal to set up a meeting.

As always, I hope you enjoyed reading this post as much as I have writing it. Best of luck!

Connect with us!

About the Author

Tedi Nati is the Managing Partner of JP Acquisitions. In his role he is responsible for broker outreach, establishing deal flow, underwriting, marketing, investor relations, and assisting in the closing process. In addition to his role at JP Acquisitions, he is an Assistant Equity Underwriter at Cinnaire, a non-profit Community Development Financial Institution (CFDI). In his role at Cinnaire, he is responsible for assisting the underwriting team in evaluating and structuring real estate equity investments and assessing the risks and mitigants associated with such. Tedi earned his Bachelor of Science in Finance from DePaul University, where he graduated Summa Cum Laude. In his free time he enjoys reading, looking for multifamily deals, and working out.

Sources:

- https://www.cnbc.com/2023/10/12/heres-the-inflation-breakdown-for-september-2023-in-one-chart.html#:~:text=The%20consumer%20price%20index%20rose,rate%20over%20the%20long%20term.

- https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

- https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20230920.pdf

- https://www.federalreserve.gov/data/sloos/sloos-202307-chart-data.htm

- https://www.mansionglobal.com/articles/how-to-play-the-property-meltdown-in-five-charts-f8a0a4bf

Make sure to always do your own research before making any final decisions on buying/investing real estate, stocks, or other securities. I am not a CPA, attorney, insurance, or financial adviser and the information in this blog post shall not be construed as tax, legal, insurance, construction, engineering, health and safety, electrical or financial advice. If stocks or companies are mentioned, I sometimes have an ownership interest in them – DO NOT make buying or selling decisions based on my posts alone. If you need such advice, please contact a qualified CPA, attorney, insurance agent, contractor/electrician/engineer/etc. or financial adviser.

order promethazine 25mg generic – promethazine pills order lincocin generic

Your comment is awaiting moderation.