|

Getting your Trinity Audio player ready...

|

If you’ve been keeping up with the economy and the events that have occurred in the multifamily market since the beginning of Covid, you understand how much the market has changed. Even if you haven’t kept up with recent financial trends, it’s likely you or someone you know has felt the impact. That being said, some of the developments in the multifamily market that have happened and show little to no signs of improvement include the following:

- Increasing interest rates (Link to treasury rates) which in turn have led to tightening capital markets

- An increasing number of properties on the watch lists of financial institutions

- An Increasing number of foreclosures

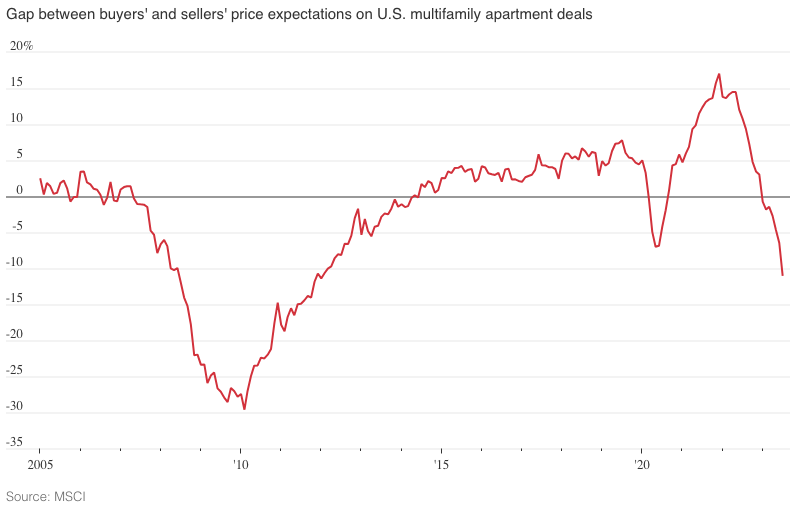

- A large gap between buyer and seller expectations

At first glance, the list above can seem daunting and discouraging for individual investors and syndicators who are looking to close deals. While many buyers are on the sidelines and waiting for the market to stabilize, playing the waiting game isn’t ideal when 2024 presents buyers with an opportunity to pivot strategies and profit if they haven’t already done so. In this post, I want to explain the strategy that we’ve successfully implemented at JP Acquisitions, as well as other operators, to close deals during these uncertain times.

Before diving into the substance of this post, I’ll note that I wrote about the trends I mentioned earlier and the ripple effect they’ve had on the commercial real estate market in a post published a few weeks ago titled, “Why and How Risk Profiles Have Been Changing in the Multifamily Real Estate Market.” I encourage you to read that post if you haven’t so as to be in a better position to understand what we will cover in this post.

The Strategy

For anyone who has been actively looking for multifamily properties to purchase, they know how irritating this market can be. The chart below explains why buyers are irritated and shows the gap between multifamily pricing expectations for buyers and sellers (the latest reading is -10.9% as of July). As highlighted by the chart, in general sellers are asking too much for their properties and not facing the reality that debt is not only harder to obtain, but also a lot more expensive. More so, plenty of sellers are still stuck in the past characterized by low-interest rates and think they can get top dollar for their property. In many cases, the difficult capital markets have led to deals being either retraded or falling apart as a result of lenders hiking rates during the closing process. The situation sellers and buyers find themselves in begs many questions. From a buyer’s perspective, one of the main questions they would love to know the answer to is, when will sellers come back to planet Earth and realize they can no longer command the same price they could when rates were low?

The reality is that many multifamily owners have fixed-rate debt and can ride out this turbulent market without a problem. Multifamily owners aren’t oblivious to what’s going on and understand that the cost of capital (i.e., interest rates) has increased and there is much market uncertainty. Put simply, now is not the time to sell if there is no good reason to do so. Thus, many buyers may continue to find themselves struggling to close deals. However, as time goes on, more and more owners may choose to sell or need to sell for varying reasons. Perhaps a seller is getting old and looking to retire, going through a divorce, etc. Despite what the seller’s situation is, smart buyers understand that there is no reason to overpay for a property and that having options is a form of leverage.

What we’ve done at JP Acquisitions to position ourselves for success is make very low offers and especially so when a seller’s situation calls for them to sell their property. This may seem like an obvious strategy to some, but many buyers think it’s disrespectful to make a very low offer or feel that the seller won’t acknowledge them if they do so. One of the important things to realize about investing and business in general is that it’s cutthroat. At the end of the day, buyers are in the business to make money and business shouldn’t be mixed with emotions. This is especially true when it comes to syndicators who are stewards of capital and need to act on behalf of their investors. In other words, making a low offer is a normal part of the game.

What we’ve noticed happening after we make a low offer is rejection, sellers getting upset, or both. This is to be expected, although what’s interesting is what happens as time goes on and sellers don’t get the price they ask for. As weeks or months pass from the initial low offer, we find that some brokers come back to us and say the seller has dropped the price. Usually, the price drop still doesn’t warrant purchasing the property and we stand our ground. This process of the seller dropping the price tends to occur a few times until the building is either bought or taken off the market.

The confidence we have in this strategy comes from having used it to purchase our most recent property. We had numerous deals slip our hands prior to having closed that deal. We didn’t let rejection leave us upset and simply moved on to the next. What’s important to realize is that finding a good deal is a matter of underwriting countless properties, making a few offers, and closing a small percentage of the deals we make offers on.

Conclusion

Especially in markets as turbulent as the one we currently find ourselves in, the good and great operators will be sorted out by how firm they can stand on their investment principles. With the gap between sellers and buyers being the largest it’s been since 2012, many firms have yet to experience the current situation and may choose to overpay. The strategy I laid out in this post is one that requires patience and relentless pursuit of new deals. This strategy is not new by any means and opportunities will arise for those that choose to implement it.

If you have any questions regarding the terms and concepts in this post or previous ones, please reach out to either me (tedi.nati@jpacq.com) or someone on our team so we can help explain further. If you’re interested in investing with us at JP Acquisitions, you can contact us via email (contact@jpacq.com), LinkedIn, Instagram (jpacquisitions), or our investor portal to set up a meeting.

As always, I hope you enjoyed reading this post as much as I have writing it. Best of luck!

Connect with us!

About the Author

Tedi Nati is the Managing Partner of JP Acquisitions. In his role he is responsible for broker outreach, establishing deal flow, underwriting, marketing, investor relations, and assisting in the closing process. In addition to his role at JP Acquisitions, he is an Assistant Equity Underwriter at Cinnaire, a non-profit Community Development Financial Institution (CFDI). In his role at Cinnaire, he is responsible for assisting the underwriting team in evaluating and structuring real estate equity investments and assessing the risks and mitigants associated with such. Tedi earned his Bachelor of Science in Finance from DePaul University, where he graduated Summa Cum Laude. In his free time he enjoys reading, looking for multifamily deals, and working out.

Sources:

- https://www.mansionglobal.com/articles/costa-ricas-inland-escazu-neighborhood-has-become-a-new-development-hot-spot-f37a0020

Make sure to always do your own research before making any final decisions on buying/investing real estate, stocks, or other securities. I am not a CPA, attorney, insurance, or financial adviser and the information in this blog post shall not be construed as tax, legal, insurance, construction, engineering, health and safety, electrical or financial advice. If stocks or companies are mentioned, I sometimes have an ownership interest in them – DO NOT make buying or selling decisions based on my posts alone. If you need such advice, please contact a qualified CPA, attorney, insurance agent, contractor/electrician/engineer/etc. or financial adviser.

order phenergan pill – phenergan price lincocin medication

Your comment is awaiting moderation.