|

Getting your Trinity Audio player ready...

|

While both “yield on cost” and “cash on cash return” are metrics used in real estate investment analysis, they have distinct differences in terms of what they measure and how they are calculated. Both metrics provide insights into the returns generated by a real estate investment and the key difference lies in what they consider as the base for calculation. It’s important to understand the similarities and differences of these metrics to be able to make informed investment decisions. As you’ll soon learn, the distinct differences between the metrics have a significant impact on the perception on the returns of any given project.

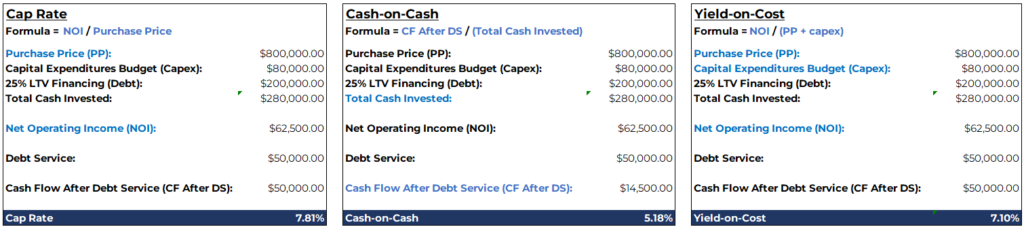

Below you will see an image that highlights how to calculate the cap rate, cash-on-cash (CoC), and yield-on-cost (YoC) metrics for the same deal. The numbers I used are arbitrary and uniform throughout to help understand the calculation. The words highlighted in blue express that they are used in the calculation to come up with the calculated percentage at the bottom of each term. As a side note, these metrics are always calculated as a percentage. The calculations/image below will continue to be referred to in the post for ease of understanding. I’ll note that my intention for including the cap rate calculation in the graphic below has to do with how similar it is to the CoC and YoC calculations. However, I want to make it clear that in this post we will mainly discuss the CoC and YoC metrics. Having said that, let’s jump into this post.

Note – The definitions of the technical terms in any of our posts can be found in the glossary section of our website.

Similarities

There are three main similarities between the CoC and YoC metrics beyond the ones we touched on in the introduction. To reiterate, the simple similarities I touched on in the intro are that they are used to calculate returns and expressed as percentages. Beyond those, the first similarity is the focus on cash flow. Both metrics prioritize the actual cash received from a property. Thus, these metrics are more important in projects in which the bulk of the projected return is derived from cash flows as opposed to at sale. The second similarity is they are both used to compare and rank different investment opportunities within a similar market or asset class. However, due to the difference in calculation, comparing two deals only makes sense if you use the same metric. Measuring the YoC of one project to the CoC of another isn’t useful. Finally, the third similarity is that these metrics are relatively easy to understand. Even beginners can take the numbers needed in each calculation and compute a percentage. The interpretation is a bit more challenging, but as we will learn in the differences section, it’s not rocket science.

Differences

There are two main differences between the CoC and YoC metrics. Firstly, the CoC metric takes into account the cash flow after debt service in the numerator. YoC on the other hand takes into consideration the net operating income (NOI) and thus does not take into account debt service. When investing in a deal with solely cash, both metrics essentially mean the same thing because there would be no debt payments. In other words, in a all cash purchase, the numerator would simply be the NOI and the denominator would be the capex plus the purchase price. However, most deals have a debt component and thus for properties that are purchased using debt, the CoC metric is superior in terms of portraying a more accurate representation of the project’s returns. Secondly, the denominator for the CoC metric takes into consideration the total cash invested (down payment for the loan + closing costs + capex), while the YoC metric takes into consideration the total purchase price and the capital expenditure budget. Once again, the biggest difference between the two metrics is the inclusion of the debt component or lack thereof.

I want to mention that the cap rate metric is what brokers use to market deals and rightfully so. Brokers do not know what debt terms or capital expenditure budget a buyer has in mind for a project. Since the cap rate metric does not include capex or debt in it’s calculation, it’s useful for comparing various assets in a similar market. In addition, it has a few other meaningful uses such as gauging how prices have changed in a market over time, roughly what CoC or YoC an investor can expect, and more.

It’s also worth noting that CoC and YoC are sometimes calculated differently. Typically they are calculated as shown above, but there may be slight nuances depending on the sponsor. For example, sometimes these metrics do not include closing costs. Nevertheless, it’s important to calculate these metrics for yourself when analyzing a deal a sponsor is presenting. At JP Acquisitions, we purchase our deals using debt and prefer using the CoC metric as a result of using debt.

Conclusion

In summary, yield on cost is more comprehensive in the sense that it includes all costs associated with an acquisition, whereas cash on cash return is more focused on the cash investment made by an investor. Additionally, the biggest difference between the two metrics will result when there is debt involved in a deal. Investors often use a combination of these metrics to gain a more comprehensive understanding of the financial performance of their real estate investments. I’ll reiterate it here that it’s important to know these metrics for any given deal that you invest in.

If you have any questions regarding the terms and concepts in this post or previous ones, please reach out to either me (tedi.nati@jpacq.com) or someone on our team so we can help explain further. If you’re interested in investing with us at JP Acquisitions, you can contact us via our contact form, by emailing a member of our team, messaging us on LinkedIn, or signing up for our investor portal to set up a meeting.

As always, I hope you enjoyed reading this post as much as I have writing it. Best of luck and happy holiday!

Connect With Us!

About the Author

Tedi Nati is the Managing Partner of JP Acquisitions. In his role he is responsible for broker outreach, establishing deal flow, underwriting, marketing, investor relations, and assisting in the closing process. In addition to his role at JP Acquisitions, he is an Assistant Equity Underwriter at Cinnaire, a non-profit Community Development Financial Institution (CFDI). In his role at Cinnaire, he is responsible for assisting the underwriting team in evaluating and structuring real estate equity investments and assessing the risks and mitigants associated with such. Tedi earned his Bachelor of Science in Finance from DePaul University, where he graduated Summa Cum Laude. In his free time he enjoys reading, looking for multifamily deals, and working out.

Make sure to always do your own research before making any final decisions on buying/investing real estate, stocks, or other securities. I am not a CPA, attorney, insurance, or financial adviser and the information in this blog post shall not be construed as tax, legal, insurance, construction, engineering, health and safety, electrical or financial advice. If stocks or companies are mentioned, I sometimes have an ownership interest in them – DO NOT make buying or selling decisions based on my posts alone. If you need such advice, please contact a qualified CPA, attorney, insurance agent, contractor/electrician/engineer/etc. or financial adviser.

ivermectin india – tegretol price purchase carbamazepine sale

Your comment is awaiting moderation.