|

Getting your Trinity Audio player ready...

|

This is the second post of the Basics of Commercial Real Estate Loans blog series. The goal of this series is to provide you with a basic understanding of commercial real estate (CRE) loans so you are better equipped to invest in commercial real estate. At JP Acquisitions, we invest solely in multifamily real estate (apartment buildings with 5+ units) and thus this blog series will primarily use examples from our experience in the multifamily industry.

In this post, we will be covering the similarities and differences between agency loans and bank loans. If you have not read the previous post, I encourage you to do so to better understand the content of this post. That said, It’s helpful if we review some basic definitions:

Agency Loan: Agency Lending refers to Government-Sponsored Enterprises such as Fannie Mae, Freddie Mac, and the Federal Housing Authority. For this article, we will be focusing on the two most active multifamily agencies: Freddie Mac and Fannie Mae

Banks Loans: What’s important to understand when it comes to banks is that there are a multitude of federally regulated bank institutions providing multifamily loans throughout the United States. Each bank has a lending program unique to it’s specific business plan and focus, however I will outline the general similarities of bank lending.

One final thing I want to note, an important detail to remember while reading this post is that agency loans are typically made to larger firms with more experience in strong financial positions. On the other hand, bank loans are usually made to individuals or small companies with limited experience and financial resources who are looking to gain experience in the multifamily space.

- Note 1 – The definitions of the technical terms in any of our posts can be found in the glossary section of our website.

- Note 2 – The examples in this blog post series are simplified for ease of understanding.

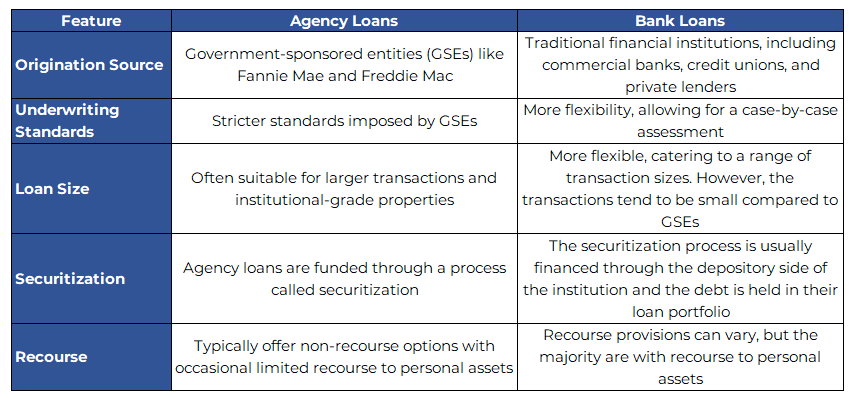

Overview Comparison Table

Recourse vs. Non-recourse

A significant distinction between agency and bank lending programs lies in the borrower’s liability, characterized as either recourse or non-recourse debt. Recourse debt implies that in the event of default, the lender can access the borrower’s personal assets, including checking and savings accounts, residence, and business assets, to settle the outstanding debt. Conversely, non-recourse loans only allow lenders to seek satisfaction through seizing the collateral, typically the multifamily property, without recourse to personal assets.

The majority of Fannie Mae and Freddie Mac loans fall into the non-recourse category, with rare instances requiring limited recourse. In contrast, most bank lending involves recourse transactions, which may be less appealing to sophisticated real estate investors. Despite the prevalence of recourse lending in the banking sector, a subset of banks in the multifamily loan market offers non-recourse loans, albeit with potential trade-offs. These non-recourse loans may come with higher interest rates, increased costs, reduced leverage, and lower loan proceeds.

Non-recourse lenders typically rely on the underlying asset for repayment, placing their primary focus on the historical, current, and projected operations of the multifamily property during underwriting. The borrower’s strength is also pivotal, with specific criteria for experience, net worth, and liquidity.

In contrast, bank lending involves a more thorough scrutiny of borrowers. For instance, banks often mandate the submission of individual tax returns for the past two years. Bank underwriters meticulously examine these tax returns to assess individual debt-to-income ratios, a requirement that may not be directly related to the multifamily property’s fundamentals. This form of underwriting can pose challenges for borrowers with complex tax situations. Bank underwriters also consider borrower credit card debt, car loans, personal loans, and various other debts, aligning with the individual underwriting norms akin to home loans. In contrast, agency lenders, operating in a non-recourse lending framework, do not demand individual tax returns and do not engage in the same level of borrower debt-to-income analysis.

Underwriting Requirements

While banks often delve deeply into the income analysis of borrower tax returns, their scrutiny of multifamily properties is typically less rigorous than that of agency lenders. This divergence is to be expected since non-recourse agency lenders primarily rely on the asset itself as the primary source of repayment.

The heightened due diligence undertaken by agency lenders primarily revolves around the operational and maintenance aspects of the property. In contrast to banks, which often rely on appraisals for most property-related information, agency lenders introduce additional layers of scrutiny. They may mandate a representative from an independent engineering company to accompany the appraiser during property visits. This secondary engineer or property inspector’s role is to furnish a comprehensive report on any maintenance deficiencies detected at the time of inspection. Identified deficiencies are documented as repair items that must be rectified either before closing, if deemed critical, or after closing for lower-priority issues.

Limitations

Agency debt: Due to the intricacies of their transactions, agency loans are typically less cost-effective for very small deals. Agency lenders prefer larger loan amounts, with most agency loans setting a minimum requirement of $1 million. The need for additional third-party vendors, such as inspectors and lawyers, in the agency loan process contributes to slightly higher due diligence fees compared to those required by banks. However, these added vendor costs are balanced by the potential for lower interest rates and higher loan proceeds available through agency loan programs.

While agencies may consider smaller loan amounts on a case-by-case basis, the transaction costs, when expressed as a percentage of the loan amount, often render agency loans less feasible for very small transactions. For loan amounts ranging from $100,000 to $1,000,000, bank debt is generally considered more suitable.

Additionally, due to the emphasis on thorough property inspections in agency loans, it’s advisable to avoid using them for properties with evident maintenance issues or a lack of proper on-site management.

Bank Debt: With the exception of a few large national institutions, most banks concentrate their lending efforts within specific geographic markets. Smaller banks may focus on particular submarkets or neighborhoods within larger metro regions, while others may steer clear of neighboring lending areas where they’ve encountered loan losses in the past. In contrast, Fannie Mae and Freddie Mac, as mandated by Congress, are tasked with facilitating affordable housing opportunities across all 50 states and in communities throughout the nation. Consequently, real estate investors aiming to own multiple multifamily properties across a diverse geographic spectrum typically favor agency loans over bank loans. These investors are often the same individuals who prefer non-recourse transactions and possess a wealth of experience in the ownership, operation, and maintenance of multifamily properties.

For investors aspiring to expand their wealth through the accumulation of multiple multifamily properties, agency loans become an attractive choice. Banks, being cautious lenders, prefer to mitigate risk by diversifying across a broad spectrum of borrowers. Most multifamily loans originated by banks remain in their own portfolios from origination to payoff. Therefore, banks seek to avoid “over-exposure” to any single borrower by imposing lending limits on individual investors. In contrast, agencies don’t face an over-exposure concern with individual borrowers because each loan is securitized and sold off in the secondary market. Essentially, multifamily property investors have unrestricted access to Fannie Mae and Freddie Mac multifamily loans, provided each transaction meets the agency’s underwriting requirements. These investors are the dreamers who aim high, looking to the stars, regardless of how many millions of miles away they may seem.

Multifamily Financing - Loan Options

The following table shows the general requirements and terms that can be expected in association with multifamily agencies and bank loans.

Conclusion

In the realm of commercial real estate financing, there is no one-size-fits-all solution. The choice between bank loans and agency loans hinges on the specific needs, preferences, and characteristics of each project and borrower. Ultimately, a thorough understanding of the nuances between bank loans and agency loans empowers borrowers to navigate the complex landscape of commercial real estate financing successfully. I trust this post has helped you gain insights into the differences between agency and bank loans!

If you have any questions regarding the terms and concepts in this post or previous ones, please reach out to either me (tedi.nati@jpacq.com) or someone on our team so we can help explain further. If you’re interested in investing with us at JP Acquisitions, you can contact us via our contact form, by emailing a member of our team, messaging us on LinkedIn, or signing up for our investor portal to set up a meeting.

As always, I hope you enjoyed reading this post as much as I have writing it. Best of luck!

Connect With Us!

About the Author

Tedi Nati is the Managing Partner of JP Acquisitions. In his role he is responsible for broker outreach, establishing deal flow, underwriting, marketing, investor relations, and assisting in the closing process. In addition to his role at JP Acquisitions, he is an Assistant Equity Underwriter at Cinnaire, a non-profit Community Development Financial Institution (CFDI). In his role at Cinnaire, he is responsible for assisting the underwriting team in evaluating and structuring real estate equity investments and assessing the risks and mitigants associated with such. Tedi earned his Bachelor of Science in Finance from DePaul University, where he graduated Summa Cum Laude. In his free time he enjoys reading, looking for multifamily deals, and working out.

Make sure to always do your own research before making any final decisions on buying/investing real estate, stocks, or other securities. I am not a CPA, attorney, insurance, or financial adviser and the information in this blog post shall not be construed as tax, legal, insurance, construction, engineering, health and safety, electrical or financial advice. If stocks or companies are mentioned, I sometimes have an ownership interest in them – DO NOT make buying or selling decisions based on my posts alone. If you need such advice, please contact a qualified CPA, attorney, insurance agent, contractor/electrician/engineer/etc. or financial adviser.

ivermectin 3 mg without prescription – tegretol 200mg us carbamazepine us

Your comment is awaiting moderation.