The Factors that are Hindering Awareness of Multifamily Syndications

May 30, 2023Why Multifamily is Recession-resistant

June 12, 2023The Chicago multifamily market is strong in 2023, with robust rent growth and rising occupancy. The market is expected to remain strong in the near term, but like any market, there are some potential headwinds on the horizon. In this post, I want to touch on what we can expect from the Chicago market in 2023 in terms of vacancy, rent growth, and the sub-markets in which we think present a strong opportunity to invest in. If you didn’t know, our team is located in the Chicagoland area and is invested in the multifamily market here. We’ve toured numerous properties, spoken and built relationships with brokers in the area, and talked to operators who invest in Chicago. Given all that we’ve done in the area, our ability to provide insights is strong and we want to share with you how our team thinks about the market. I’ll note that some of the data in the post will be slightly dated but nevertheless gives us an idea on the state of the market in Chicago. That being said, let’s jump into this post!

Vacancy

According to a Chicago market report by Marcus and Millichap, vacancy in the Chicagoland area hit a record low of 2.9% in the first quarter of 2022 and since then has climbed to 4.7% in March 2023. Despite that increase of 180 basis points (bps), the good news is that 4.7% is still below the five-year average. According to a report by the National Association of Realtors, the national multifamily vacancy rate moved up to 6.7% in the first quarter of 2023, which is a notable increase from the 5% in the first quarter of 2022. This data shows that the Chicago market is in a healthy place as the vacancy rate for the market is roughly 1.9% lower than the national average.

From the properties that we have toured and underwritten, the data from Marcus and Millichap appears to be accurate as we’ve regularly been seeing vacancy rates hovering around 5%. We recently spoke to an operator who was in the process of turning two units on the westside of Chicago and just as he was finishing one unit he managed to receive multiple applications and will be filling the unit with a tenant that will pay on the high end of what rents are going for in the market. In 2022 this same operator worked to turn roughly half of the building (8 units) and finding tenants hadn’t been a challenge.

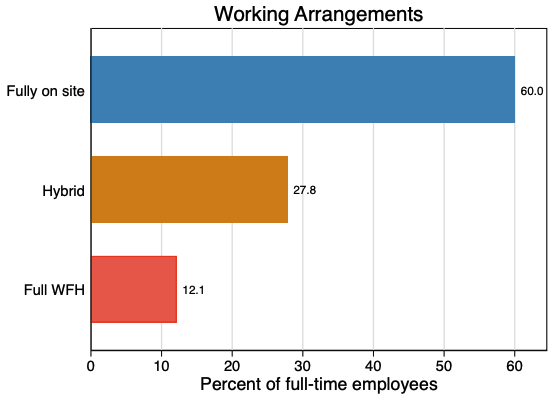

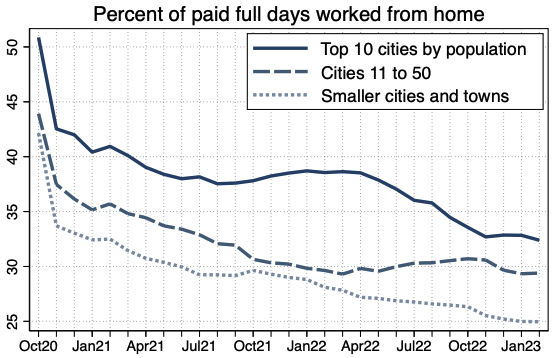

On a different note, one of the drivers to keep in mind that impacts vacancy rates in the Chicagoland area is the rise of remote work. Companies are increasingly offering the option for employees to work either a hybrid schedule or fully remote. According to a Stanford University study, as of February 2023, 12% of full-time employees were fully remote, 60% were full-time on-site, and 28% were in a hybrid arrangement. The pandemic is what accelerated the work-from-home (WFH) trend and based on professionals I’ve talked with, I don’t expect the trend to lose much steam before stabilizing. The reason for that is that people enjoy being able to spend more time with family, not having to commute, flexible schedules, and more. More so, the Stanford study found that WFH is more common in major cities than in smaller cities and towns (refer to the graph below). As a result of this trend, I suspect more people are moving into the Chicagoland area to enjoy all the city has to offer and thus keeping vacancy rates lower than the historical average. How deep the impact WFH has on vacancy rates is unknown, but regardless their seems to be at least some impact.

Rent Growth

According to the report by Marcus and Millichap, the average rent in Chicago rose 0.7% in the first quarter of 2023. This growth is a slowdown from what we experienced in the preceding 12 months where the average effective rate rose nearly 20%. According to a survey done by Essex Realty, Chicago apartment owners reported that there average rent increase was 3.4% on renewals and 6.4% on new leases so far in 2023.

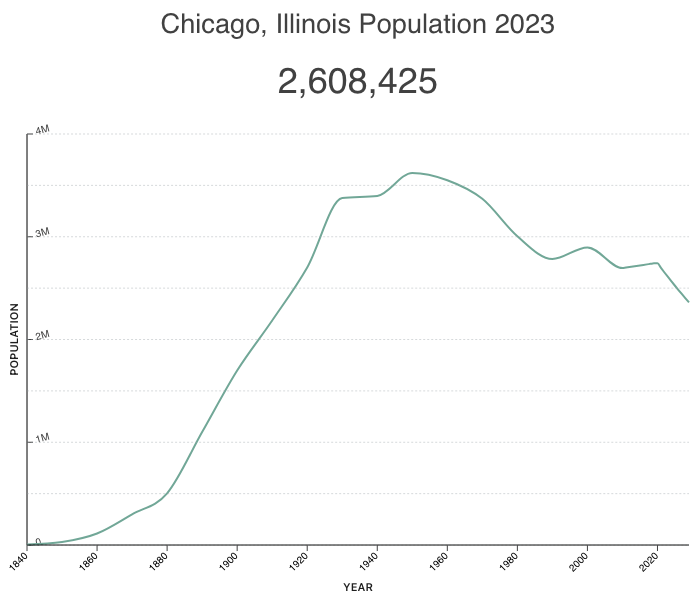

Our team at JP Acquisitions saw firsthand how fast rents grew as we achieved our year 5 rent projections at our property on the westside of Chicago after being in operation for 9 months. I’ll note that 88% of our tenants at that property are section-8 tenants and it was the Chicago Housing Authority that deemed that the rent increase was appropriate given the economic climate. For context, according to the study by the National Association of Realtors, rents at the national level rose 2.5% year-over-year (YoY) in the first quarter of 2023 compared to 5.6% and 3.8% in the third and fourth quarters of 2022. What’s interesting is that rents continue to climb in Chicago despite the population continuing to dwindle (refer to the chart below). Another interesting trend highlighted in a report done by Northmarq is that renter demand has been particularly strong in less expensive apartments (class B and C). The strongest rent growth has been occurring in more affordable class B and C properties as the combined average rent advanced by 11% to $1,390 through the middle of 2022. This is good news for our strategy at JP Acquisitions where we look to purchase more affordable properties in Chicago with the focus being on renovating units and providing a good experience for tenants through our property management team to increase the properties value.

Sub-markets

In terms of sub-markets, based on all the properties we’ve underwritten and toured, the west side of Chicago presents the best opportunity in terms of achieving high risk-adjusted cash-on-cash yields. More specifically, when referring to the west side of Chicago I’m primarily referring to areas such as Oak Park, Broadview, Forest Park, Humboldt Park, etc. We’ve also seen a fair bit of opportunities in South Shore near Jackson Park where the Obama Library is being built. The demand in South Shore is certainly there as trades along the lakefront near the South Shore continue to gain popularity, accounting for 10 percent of all transactions since the first quarter of 2022. We’ve found that the north side of Chicago (Bucktown, Wicker Park, Old Town, etc.) has compressed cap rates resulting in low cash-on-cash returns but the potential for increased valuations on the back end is higher than that of areas such as the west side. That is not to say that investing in those areas is bad, but there is an inherent risk when investing there because the return you can expect will be primarily driven by your exit cap rate assumption. Based on conversations we’ve had with brokers, the west side continues to pick up steam and we believe that cap rates will compress slowly in that area of the city. Something to keep in mind is that real estate is hyper-local and in any large city property prices and asking rents change drastically block by block. In Chicago, similar to other large cities, you could see nice class A or B apartment buildings on one block and it’s a matter of walking 10 min down the street and you could see boarded up houses and run down apartments, but I digress. All-in-all we’re bullish on Chicago and continue to look for new areas to invest in. We’ve found a small niche radius in the west side where we believe we can scale by buying properties in close proximity to one another and leveraging that proximity by making it easy for our property management team to handle the day-to-day operations.

Conclusion

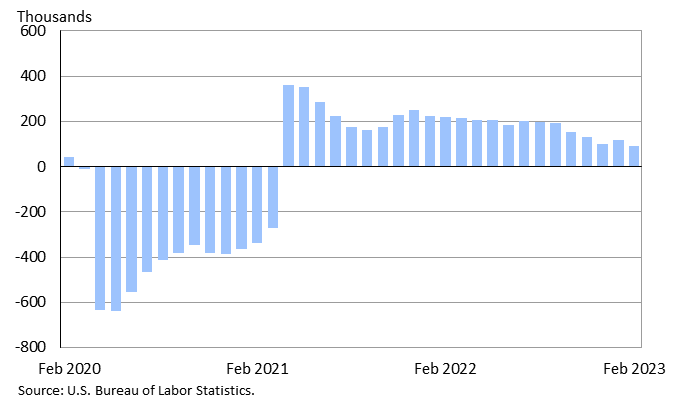

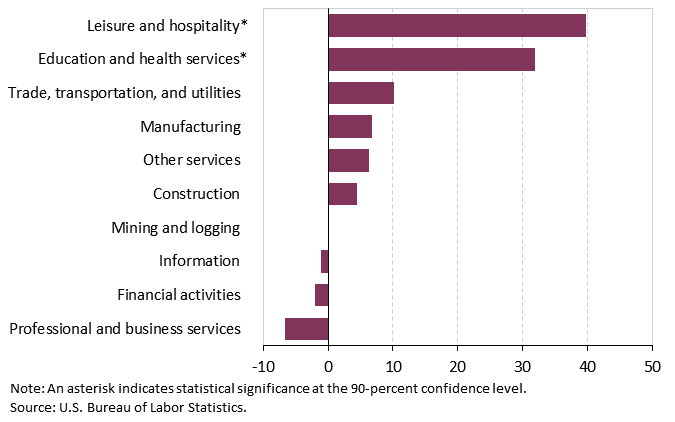

I want to conclude this post by providing some employment stats and recapping what was written in the above sections. The Chicago metro area is among the nation’s 12 largest metropolitan statistical areas reported by the Bureau of Labor Statistics. According to People Ready, in February 2023, 93,000 jobs were added in the Chicago metro area, with notable gains in leisure and hospitality, and education. Total nonfarm employment is up 2.0% YoY in the Chicago area, which compares to a 2.9% national increase. The unemployment rate in the U.S. is 3.9%, compared to 4.4% in the Chicago area.

So what can we take away from this post? The demand for multifamily in Chicago is undoubtably high and as a matter of fact Marcus and Millichap reported that more than 40% of purchasers last year were based out of state. Rents have gone up incredibly and vacancies have remained low which go to show the resilience of the multifamily market in Chicago. Even while job growth in the Chicagoland area has been slower than that of the national average and the unemployment rate is slightly higher than that of the national average, the market is still robust. That claim is supported by the fact that Chicago’s average multifamily cap rate registered 100 basis points higher than any other U.S. gateway over the 12-month period ending in March 2023 which speaks to the level of demand in the market.

At JP Acquisitions we continue to focus our efforts on more affordable apartment buildings in Chicago which we can achieve high cash-on-cash returns for our investors all the while reducing risk through keeping our property management efforts in house to maintain a high level of control. While we have looked in neighboring states for investment opportunities, as long as Chicago continues to trend low in vacancies and exhibit strong rent growth, we’ll continue to invest in the market.

Note* – Gateway cities are urban metro areas that act as the foundation and hub for the economic industry for the state, region, or country. Classic gateway cities include San Francisco, Los Angeles, Chicago, Miami, Boston, and New York.

If you have any questions regarding the terms and concepts in this post or previous ones, don’t hesitate to reach out to either me (tedi.nati@jpacq.com) or someone on our team so we can help explain what is causing the confusion. If you’re interested in investing with us at JP Acquisitions, you can contact us via email (contact@jpacq.com), LinkedIn, Instagram, or our investor portal to set up a meeting.

As always, I hope you enjoyed reading this post as much as I have writing it. Best of luck!