2 Business Habits to Win the Best & Final Process for a CRE Deal

June 18, 2024

The Importance of Marketing and Branding Your Syndication Firm in the Commercial Real Estate Industry

June 28, 2024Understanding your multifamily real estate investment strategy is critical to maximizing profit. Whether you’re a syndication shop raising capital from investors to acquire multifamily properties or you’re an individual looking to start or grow your portfolio, this post will help you hone your acquisition strategy. We’ll specifically cover the importance of matching your strategy to your character and work balance, understanding the different types of multifamily asset classes, and mapping your end goal(s). What we won’t cover in this post is investing in real estate equities such as REITs, ETFs, etc., but rather physical properties.

Our company, JP Acquisitions, created our investment strategy partly through a combination of trial and error, understanding our strengths and weaknesses, and continuously educating ourselves about the multifamily market we operate in. At the moment, we specifically target value-add C-class multifamily properties in the $1M to $3M range in a specific pocket of the west side of Chicago. We utilize the Section 8 program (Sec 8) to maximize our rental income and decrease expenses (Sec 8 allows to bill back electricity and gas).

Our strategy is likely to change in the future because when you scale up to larger properties (something we’re looking to do) in the multifamily game, the owners of those properties are more sophisticated and likely to have maximized efficiencies of the properties. I’d argue that the best opportunities lie in the middle-market properties (20 – 100 units) as those properties have a higher likelihood of being operated by less sophisticated owners that are not driven to maximize value by the target returns promised to investors. Those are the assets that can generate 15 to 30% internal rates of return (IRRs) and 2.5x+ equity multiples in shorter time frames. The larger multifamily assets (100+ units) are usually owned and operated by sophisticated and/or institutional investors that syndicate their deals and know the ins and outs of how to squeeze value. As such, their is less room to increase value for the next investor which results in lower returns. I bring up this correlation between the size of an asset and the expected returns because it plays a role in helping you build out your strategy. I’d also argue that this relationship between the size of an asset and the expected returns applies to all asset classes (real estate, equities, etc.), but I digress.

Note – The definitions of the technical terms in any of our posts can be found in the glossary section of our website.

Match Your Character and Work Balance

Your character, including your risk tolerance, patience, and interpersonal skills, influences your satisfaction with different types of multifamily investments. For example, if you enjoy hands-on work and engaging with people, a strategy involving active property management (PM) may be fulfilling. Operations of course get more complicated as you scale because their will reach a point where you will need to either build a team to vertically integrate PM or hire a third-party team. On the other hand of the character spectrum, if you prefer a more passive or reserved role, hiring a third-party PM company and managing them may be more your style. What’s important is understanding the implications of hiring a third-party PM (i.e., fees, control of an asset, etc.). Regardless of what your style is, you should play into your personality strengths and know the advantages and drawbacks of your choices.

Different strategies require varying levels of time and effort. For instance, value-add strategies that involve significant renovations and repositioning of properties demand more hands-on involvement compared to buy-and-hold strategies with stable, fully occupied properties. If maintaining a balanced lifestyle is important to you, selecting a strategy that fits within your desired work hours and personal life is essential. A strategy that demands extensive travel, long hours, or high stress may not be suitable if you value leisure time and/or family commitments.

Knowing Your Multifamily Asset Class

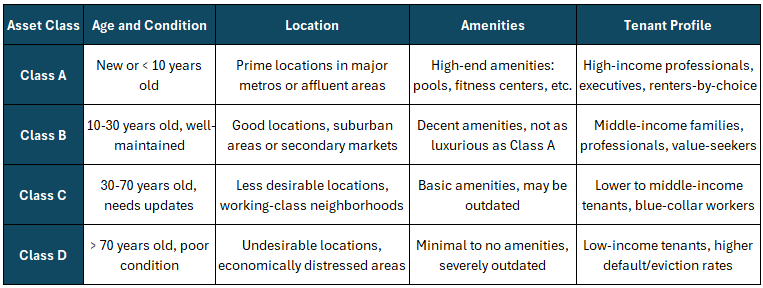

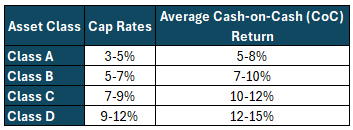

Multifamily real estate is often classified into different asset classes (A, B, C, and D) based on various factors such as age, location, amenities, and tenant profile. Each class comes with different levels of risk, return potential, and management intensity. Understanding the multifamily asset class that you are targeting is absolutely key to a focused investment strategy. If you choose to focus on multiple asset classes then you run the risk of mismatching your target returns, work balance, and overcomplicating your operations. For example, if you own and operate multiple Class A properties and choose to invest in a class C property, you may be shocked to find the amount work required to maintain the property and communicate with the tenants. In order to not make this section too long, I’ve provided two tables below that highlight the characteristics of multifamily asset classes, their cap rates, and targeted CoC returns. I’ve left the potential IRRs and equity multiples the asset classes could generate because they can vary largely based on the business plan.

Knowing Your End Goal

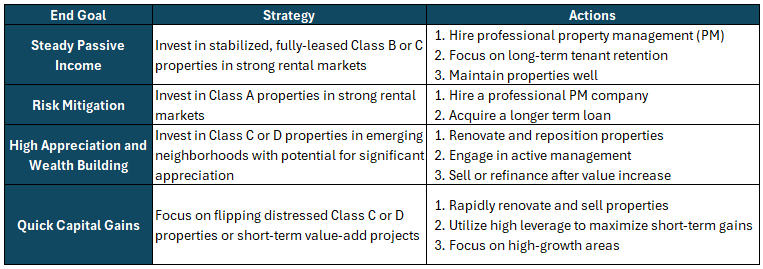

Understanding your end goal is foundational in crafting a multifamily real estate investment strategy. It guides every aspect of your investment process, from property selection and financing to risk management and exit strategies. This alignment not only enhances the likelihood of achieving your financial objectives but also helps in maintaining focus and making informed decisions throughout the investment lifecycle. For example, if your end goal is to create as much cash flow as possible to pay for your lifestyle with a lesser amount of hand-on work, then investing in class B or C properties and hiring a third-party PM could match your objectives. If you’re more risk averse and/or looking to simply park your money, then investing in class A properties may be more your style. The below table outlines a few end goals and their accompanying strategy and actions to highlight a few ways of how your strategy can match your goals.

At JP Acquisitions, our current goal is to scale on the west side of Chicago and provide investors with outsized returns (8-10% avg CoC and 2x+ equity multiple) when compared to stabilized institutional grade assets. We started our company by buying properties with a 5 year term and repositioning the tenant base to Section 8. This strategy has proven to generate great returns, but we’re seeing a better opportunity to operate in the same market but add a construction component. This week we’ll be closing on our largest project (38 units) with a construction loan and being more aggressive with forcing appreciation through unit renovations while still focusing on turning the tenant base over to full Section 8. I describe our goal in relation to our strategy here to highlight how we’ve aligned our strategy with our goals.

Conclusion

Finding the right multifamily real estate investment strategy is essential for achieving your financial goals and ensuring a sustainable, satisfying investment journey. By understanding your character, desired work/life balance, and knowing what multifamily asset class you want to invest in you can make informed decisions that lead to long-term success. Additionally, whether your goal is steady passive income, high appreciation, or quick capital gains, having a clear end goal helps you craft a strategy that guides your property selection, financing, management, and exit planning.

If you have any questions regarding the terms and concepts in this post or previous ones, please reach out to either me (tedi.nati@jpacq.com) or someone on our team so we can help explain further. If you’re interested in investing with us at JP Acquisitions, you can contact us via our contact form, by emailing a member of our team, messaging us on LinkedIn, or signing up for our investor portal to set up a meeting.

As always, I hope you enjoyed reading this post as much as I have writing it. Best of luck!