Best Practices for Raising Capital for a Real Estate Deal

April 8, 2024

3 Common Questions Investors Ask Our Team at JP Acquisitions Prior to Investing

April 22, 2024Commercial real estate financing is a complex landscape, where lenders are looking to meet the needs of a borrower all the while managing their own risk. Among these considerations, determining the size of the loan is a pivotal step. It’s a process that involves thorough analysis and evaluation to mitigate risks while ensuring the borrower’s needs are met. In this blog post, we’ll delve into the key factors that commercial real estate lenders consider when determining the size of a loan.

Note – The definitions of the technical terms in any of our posts can be found in the glossary section of our website.

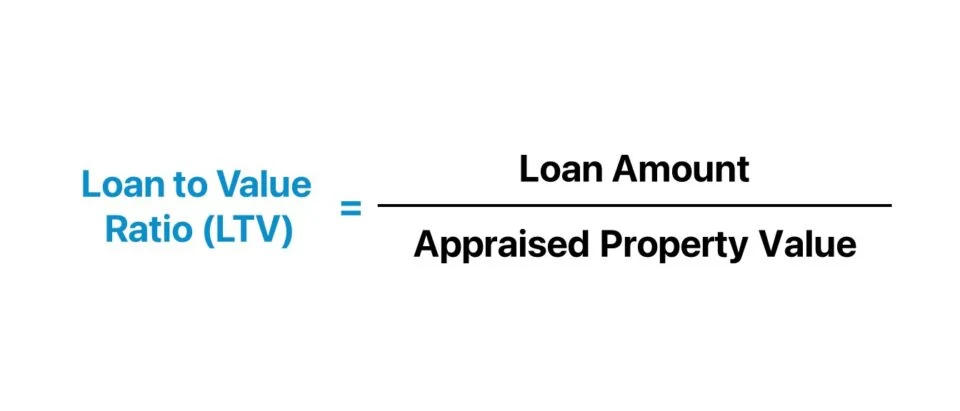

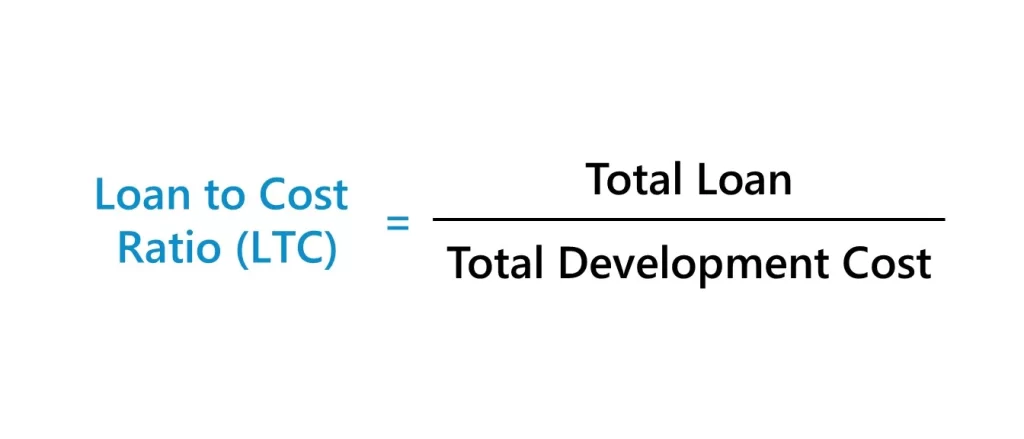

Loan-to-Value (LTV) & Loan-to-Cost (LTC)

The Loan-to-value ratio (LTV) is a key metric that compares the loan amount to the appraised value of the property and it’s expressed as a percentage. Lenders usually have maximum LTV limits based on the property type and market conditions. The lower the loan amount (i.e., the lower the LTV), the less risk their is for the lender and vice versa. The reason for that is because if a borrower were to foreclose, it’s easier for a lender to be repaid if the loan size is small.

The Loan-to-cost ratio (LTC) on the other hand compares the loan amount to the total development/construction costs. The key difference between LTV and LTC is that the LTV ratio measures the total loan amount for a project relative to its post-completion value, rather than its construction cost. Similar to LTV, a higher Loan-to-Cost (LTC) ratio indicates increased risk for lenders, with many lenders typically only willing to finance projects with an LTC of no more than 80%.

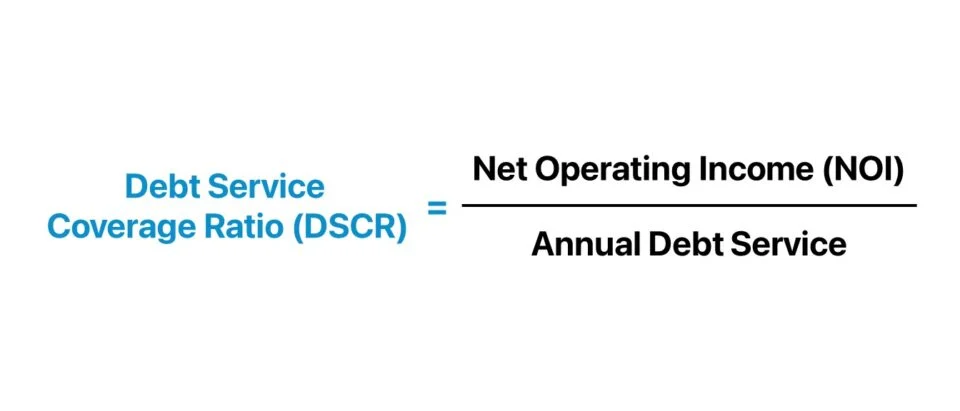

Debt Service Coverage Ratio (DSCR)

The debt-service coverage ratio assesses a property’s ability to generate sufficient income to cover the loan payments. The DSCR is calculated by taking the net operating income (NOI) of a property and dividing it by the total debt service (inclusive of principal and interest on a loan). As a reminder, NOI is calculated by taking the rental income and subtracting the expenses from that figure. Lenders typically prefer a DSCR above a certain threshold (often 1.25 to 1.50) to ensure a property’s income stability. A higher DSCR indicates lower default risk, potentially allowing for a larger loan size.

Other Considerations

Up until this point we have primarily talked about mathematical formulas that lenders use in order to size a loan for a commercial real estate deal. There are several other factors that lenders consider and those include the following:

- Market Analysis: One of the primary aspects lenders assess is the market conditions. They scrutinize the demand and supply dynamics, vacancy rates, rental trends, and overall economic indicators of a specific real estate market where a property is located. A robust market indicates lower risk for lenders, potentially allowing for larger loan sizes.

- Property Condition: The condition of a property plays a significant role in determining its value and risk. Well kept buildings with minimal deferred maintenance typically command higher LTVs, while properties that are older and in need of renovations may warrant lower LTVs.

- Income Stability and Cash Flow: Lenders assess a property’s ability to generate consistent income to support debt service payments. Properties with stable and predictable cash flows, such as long-term leased office buildings or fully occupied multifamily properties, may qualify for higher LTVs compared to properties with fluctuating or uncertain income streams.

- Borrower’s financial strength: Lenders evaluate the financial strength and creditworthiness of a borrower or borrowing entity. Factors such as credit history, cash reserves, liquidity, and experience in managing similar properties are taken into account. A financially stable borrower with a strong track record may qualify for a larger loan size compared to a borrower with less favorable financial credentials.

- Property Type and Use: The type of property and its intended use significantly influence the loan size. Lenders assess the risk associated with different property types such as office buildings, retail spaces, multifamily residences, industrial properties, and hospitality establishments.

Conclusion

Determining the size of a commercial real estate loan is a multifaceted process that requires careful consideration of various factors. From market analysis and property valuation to borrower’s financial strength, lenders undertake a strict assessment to mitigate risks. By understanding the key factors that influence loan sizing, you can better navigate the commercial real estate financing landscape and secure financing tailored to their needs.

If you have any questions regarding the terms and concepts in this post or previous ones, please reach out to either me (tedi.nati@jpacq.com) or someone on our team so we can help explain further. If you’re interested in investing with us at JP Acquisitions, you can contact us via our contact form, by emailing a member of our team, messaging us on LinkedIn, or signing up for our investor portal to set up a meeting.

As always, I hope you enjoyed reading this post as much as I have writing it. Best of luck!