The Differences Between Active and Passive Investing in Multifamily Properties

October 24, 2023

How You can Profit in 2024 from the Rapidly Changing Multifamily Market

November 6, 2023When investing with a real estate general partner (the expert(s) who manages the investment), it’s important to understand what fees are being charged. There are a multitude of fees that the general partner can charge and many of those fees are explained at length in the glossary section of our website under the section titled “Sponsor Fees.” Before I proceed, I’ll note that I will use the terms sponsor, general partner (GP), management team, and syndicator interchangeably.

The trouble with these fees is that many investors either quickly gloss over them or simply compare the fees of various sponsors without digging deeper. The question that investors must ask themselves is, “What’s the sponsor’s incentive?” In a perfect world, the sponsor’s fees are aligned with the incentives of the investors. The investors want the deal to succeed and that requires that the management team stays focused and maximizes efficiencies on all fronts (i.e., generate the most amount of revenue while keeping the expenses as low as possible). You might be thinking, “Why wouldn’t the sponsor focus on making the property run as efficiently as possible?” The answer to that question partly lies in the fees that the sponsor charges.

There are sponsors in the multifamily private equity space who make large amounts of money regardless of performance. As to how they do that isn’t terribly difficult to understand and will be covered in this post. More so, sponsors have ongoing costs for things such as employee overhead (i.e., salaries, rent for office space, etc.). In order to pay for those costs, sponsors will charge certain fees, and rightfully so. How else would those sponsors be able to keep the lights on? All this is to say that in this post, we will be covering how the acquisition fee and asset management (AM) fee affect the economics/returns of a deal. In addition to talking high level about these fees and their impacts on returns, I’ll be using a deal that is currently on the market to explain the impact that the two fees have on returns. It’s important not to pay attention to what the return (i.e., internal rate of return or cash-on-cash) is itself, but rather the impact that a change in fees has on the return. I’ll be writing this post with the thought in mind that a multifamily investor (limited partner) is reading it, however, sponsors too will be able to glean insights from this post.

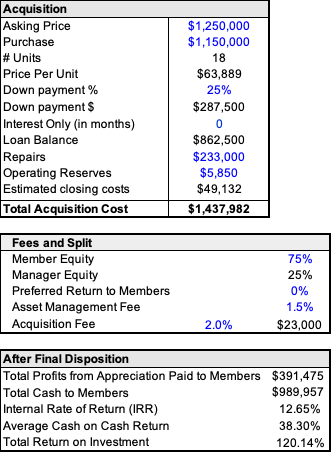

Below I’ve provided a screenshot of the base case scenario for the example property that we’ll be working with. This specific property is one that needs a fair bit of work (roughly $13k/unit). This deal requires the sponsor to renovate the units to increase rent in addition to billing back utilities to reduce expenses in order to achieve the IRR that is projected below.

You’ll notice that we can adjust other fees and splits besides the acquisition and AM fees, but we won’t be covering those in this post. Keep in mind that the following numbers are factoring a refinance in year 5 and a sale in year 10 and that is why the average cash-on-cash is so high.

Acquisition Fee

The acquisition fee in a multifamily syndication can have a significant impact on the returns of the deal. An acquisition fee is a one-time fee paid to the syndicator (the party or company responsible for organizing and managing the investment) when the multifamily property is acquired. It is typically calculated as a percentage of the total purchase price or the equity invested in the property and is often used to compensate the syndicator for their work in finding, evaluating, and closing the deal.

When it comes to this fee, be cautious of syndicators that charge a high percentage. By charging a high acquisition fee, the managing team receives a large amount of money upfront, which can discourage them from working diligently toward stabilizing the property. It’s like when a teenager wants something (e.g., a car, vacation, etc.) really bad. They could have their parents help purchase whatever it is they want, but the teenager still needs to put in the work. The alternative is to have their parents buy that thing right away. In this example, the parent’s help (i.e., money) is similar to the acquisition fee in a multifamily syndication. If the parents were to buy the teenager what they wanted, the chances that the teen would work hard in the future to buy or achieve something is less. More so, the teenager is likely to associate less value with what their parents bought because the teen didn’t have to put in much work.

Relating the example of the teen to a multifamily syndication, the teen is the sponsor group, the parent’s money is the acquisition fee (and also the equity of the investors), the thing is the property, and the value of the thing is the deal’s returns/profitability. The lower the acquisition fee, the more the sponsor will have to work to get compensated which means they will have to focus on executing the business plan quicker, and that will lead to higher returns.

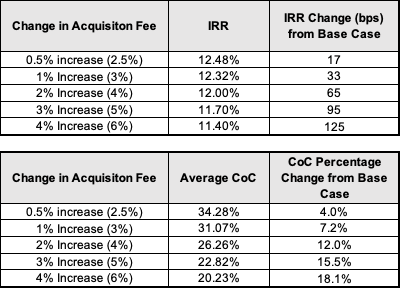

Below I have provided a table showing what happens to the IRR (i.e., the overall return) of the deal as the acquisition fee increases and all else stays constant. You can see that with every 1% increase in the acquisition fee, there is a roughly 30 basis point (bps) decrease. In other deals, there will likely not be the same decrease due to the business plan, although you can certainly expect the IRR to drop. Remember, the acquisition fee increases the overall equity in the deal and thus dilutes the percentage ownership of each party. In terms of the CoC of the deal, the effect of increasing the acquisition fee is drastic and especially pronounced when the acquisition fee is lower.

Asset Management Fee

The asset management fee in a multifamily syndication can have a notable impact on the returns of the deal. As stated earlier, this fee is an ongoing management fee paid to the syndicator (or their management company) for overseeing and managing the property’s operations. The asset management fee is considered an operating expense for the property and is a percentage paid from the property’s revenue (rental income and other income sources). Similar to the acquisition fee, the AM fee can be defined in a few different ways and maybe a per-unit AM cost such as $200-300 per unit. This fee directly affects the property’s cash flow and, subsequently, the returns distributed to investors. I’ll want to make it clear and reiterate that the AM fee is typically paid irrespective of whether the property or portfolio cash flows or not, hence why it is considered an operating expense.

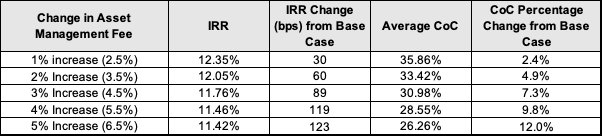

Below you will a similar table to the one that I created for the acquisition fee. You can see that the AM fee has a large effect on returns and especially so for this deal which relies heavily on cash flow to support the returns. The IRR is less impacted as the AM fee increases, while the average CoC decreases at a fairly steady rate as the AM fee increases.

I want to take a moment to talk about how the AM fee should be taken into consideration relative to the size of a firm. Smaller firms rely more on the AM fee to pay for salaries and other overhead costs compared to larger firms. There comes an inflection point where the AM can cover all of the overhead costs along with a slight cushion. Once that point is reached, everything else is additional income. The AM fee can be thought of as a person’s salary. Let’s say the person needs to make $100k a year to cover a modest lifestyle. After $100k, the additional income can be used for whatever they please. Similarly, a small firm (such as JP Acquisitions) is hungry and striving to reach that inflection point. While small firms are eager and have a strong incentive to work harder to maximize profits for investors and themselves, the downside is that they need to be scrappy and can’t afford to pay themselves much while growing the firm. I state this not to say a smaller firm is better then a larger one, but rather to provide some context on what it means to grow a syndication firm from the ground up.

Conclusion

To recap, the acquisition and asset management fees in a multifamily syndication can have a significant impact on the returns of a deal and the operations of a firm. Investors need to critically analyze the two fees we talked about in this post and ask themselves if the syndicator is incentivized properly and on even footing with their investors. I’ve seen acquisition fees reach as high as 5-6% and asset management fees reach 3%+. The following questions can help you dive deeper to see if the sponsor’s fees are justifiable:

- How much does the GP make if I lose everything?

- Is the game executing on a business plan based on a competitive advantage, or to raise as much $ as possible

- Are their deals large or small, and is the fact they’re doing small deals an advantage?

I trust that this post has helped you understand how sensitive the economics of a deal are to the returns of investors. If you have any questions regarding the terms and concepts in this post or previous ones, please reach out to either me (tedi.nati@jpacq.com) or someone on our team so we can help explain further. If you’re interested in investing with us at JP Acquisitions, you can contact us via email (contact@jpacq.com), LinkedIn, Instagram (jpacquisitions), or our investor portal to set up a meeting.

As always, I hope you enjoyed reading this post as much as I have writing it. Best of luck!