What are the Day-to-Day Tasks of Multifamily Operators?

April 10, 2023The Biggest Impediments to Getting Started in Multifamily Real Estate

April 24, 2023In today’s world, investors have a multitude of avenues they could take to grow their wealth. The traditional route is investing a part of your paycheck into a 401K and waiting till you’re 59.5 years old to withdraw without penalty. However, what if I told you there was a way to get $50K+ in yearly cash flow by investing $25K a year? In this post, I want to outline a plan in which by saving and investing in apartment buildings as a limited partner (see our glossary page for the definition or the “definitions” section at the end of this post) you could cover your expenses and achieve financial freedom. I am not saying this plan will be easy, but it’s certainly achievable. With that being said, let’s dive into this post.

The Plan

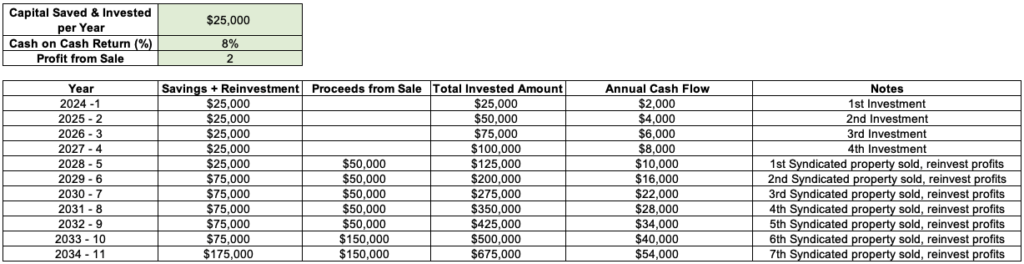

Below I have outlined the plan by which you can take to achieve over $50K a year in cash flow. This plan will take 11 years to achieve and I make several realistic assumptions which include the following:

- You invest $25K a year into a real estate syndication as a passive investor (i.e. limited partner).

- Every 5 years the property you had invested in 5 years ago gets sold and you achieve a 2x multiple (i.e. you double the investment you had made 5 years ago).

- You reinvest all of the proceeds from the sale of the properties.

- You achieve an 8% cash-on-cash return. You can also assume that you achieve an 8% preferred return, both will lead you to the same conclusion.

Now that you know the assumptions, I’ll explain the plan which is outlined below. In year 1 you invest $25K and you get an 8% return ($2K in cash flow). That may not be much, but it’s a start. In years 2 – 5, you do the same thing (invest $25K a year). What you’ll notice in year 5 is that the first property you invested in gets sold and you get $50K in profit. This is great news, you doubled your money! However, you don’t do anything with that money but continue to reinvest it. By the end of year 5, you’re now making $10K in cash flow. $10K is not a small amount, but in the grand scheme of things, it’s not a life-changing amount of money. Starting in year 6 and until the end of the period, you are now investing $75K because you’re still investing the $25K every year but you now have the sale proceeds to reinvest. By years 10 and 11 because you had invested $75K five years previously, at the sale you’ll have gotten a total of $150K from the sale of those assets. By year 11 you’ll have invested a total of $675K and that results in $54K in passive income!

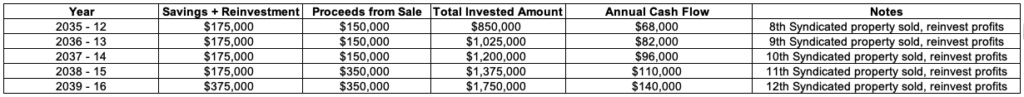

Now what happens if we extend this game plan (outlined below) for another 5 years? The amount of cash flow you generate starts to exponentially grow. You can see below that by year 16 you are cash-flowing a whopping $140,000. At that point in time, you could quit your job and you’ll have enough or more than enough money to cover your expenses. Unless your expenses happen to be more than $140K a year, at which point you’re probably making a lot of money a year, you’ll have to keep working at this plan. Nevertheless, I think I’ve gotten my point across.

The Truth about Investing

The truth is that investing is a long-term game, hence why the plan I outlined above takes a little over a decade to complete. As the clique saying goes, “Rome wasn’t built in a day.” As the saying implies, important things or great achievements take time and effort to accomplish. If your goal is to become rich tomorrow, good luck. On the other hand, if your goal is something along the lines of slowly replacing your W2 income or simply generating cash flow to cover your expenses, apartment building investing is a great avenue to do so. By no means is investing as a limited partner in syndications the only way to generate cash flow, but it happens to be a better way (in my opinion) to achieve financial freedom passively than most other avenues. Keep in mind that when someone passively invests in a multifamily deal through a syndication, they’re looking for a sponsor team to manage their money and send them a check either monthly or quarterly along with regularly scheduled updates on the performance of the investment property.

While all of what I’ve said in this post in theory sounds great, there are a few caveats I want to mention. Firstly, before you invest in a syndication, you must educate yourself on the asset class. If you’ve read our previous posts, you’re probably tired of me emphasizing education but it’s critical that you understand the significance of education. Furthermore, life is rarely as straight forward as the plan I outlined above. Things can always go wrong resulting in less cash flow or dare I say losing money. Be that as it may, things can also go better resulting in you achieving financial freedom quicker. The better that you are at analyzing investment opportunities that sponsors present you, the higher the chances are that you will be over-achieve the plan I laid out in this post.

Conclusion

I trust that reading this post has opened your eyes to the realm of possibilities when it comes to investing in multifamily syndications. As I stated previously, by no means is the plan that I laid out in this post easy to accomplish, but it is realistic. You have the power to change yourself and those around you by educating yourself and leading through your actions. While the process to financial freedom is a slow one, great things can come out of sticking to a financial plan and knowing what you’re investing in.

If you have any questions regarding the terms and concepts in this post or previous ones, don’t hesitate to reach out to either me (tedi.nati@jpacq.com) or someone on our team so we can help explain what is causing the confusion. If you’re interested in investing with us at JP Acquisitions, you can contact us via email (contact@jpacq.com), LinkedIn, Instagram, or our investor portal to set up a meeting.

As always, I hope you enjoyed reading this post as much as I have writing it. Best of luck!