Tax Basics Part 1 – Tax Forms Every Real Estate Investor Should Understand (Form 1040, 1065, K-1, Schedule C & E, 8582)

February 12, 2024

Tax Basics Part 3 – 1031 Exchanges

February 27, 2024This blog post is part 2 of our Tax Basics blog series. In the last post, we covered tax forms that real estate investors should know about. The goal of the last post was to provide context regarding where the deductions and tax concepts covered in later posts (including this one) show up. As a reminder, this blog series isn’t meant to go too in-depth as those topics and conversations are best reserved for experienced CPAs. That said, in this post we will cover several topics as they relate to investment property taxes. Before reading further, I encourage you to read the last post and specifically pay attention to the real estate professional IRS designation section as that classifies how your income and losses are treated.

It’s important to note that all syndicators are property owners but not all property owners are syndicators. Nevertheless, everything that is mentioned in this post can apply to property owners. In most cases, I will use the terms “property owner” and “syndicator” interchangeably. Let’s jump into the post!

Note – The definitions of the technical terms in any of our posts can be found in the glossary section of our website.

Rental Income Tax and Property Taxes

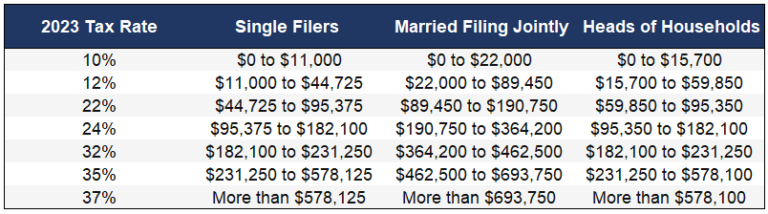

Whether you’re investing in a multifamily syndication as a passive investor (i.e., limited partner) or investing in your own rental properties, there are two sets of taxes that you need to be aware of: those relating to rental income and those that relate to the eventual sale the property. Firstly, rental income is taxed as ordinary income according to the Internal Revenue Service (IRS). The following is a look at the 2023 tax brackets for various filers:

As an example, if you have $10k in rental income and you’re in the 22% tax bracket, you’ll owe $2.2K in taxes on the rental income. When it comes to calculating rental income, the IRS describes rental income as “any payment you receive for the use or occupation of the property” and in addition to the income that includes some the following:

- Security deposits (if you don’t plan on returning all or a portion of the amount)

- Tenant-paid owner expenses (e.g., utility bills)

- Partial Interest (if you own part of a rental property, you must report your fair share)

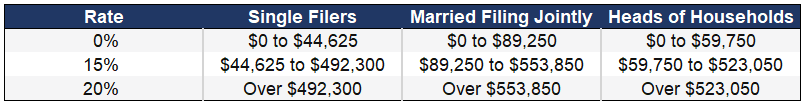

When you go to sell a property, there are two types of taxes that you may be liable for: capital gains and depreciation recapture (this will be talked about in the depreciation section). If you hold a property for more than a year, any profits from the sale are taxed at the long-term capital gains rate. The following are the capital gains tax brackets for 2023:

On the other hand, if you sell the property after owning it for less than a year, the profits will be taxed at the short-term capital gains rate which is equal to how your ordinary income at your marginal tax rate. Thus, property owners are encouraged to hold their assets for longer than a year by the IRS. In a future post, you will see how you can avoid capital gains tax altogether.

Property Tax Deductions

The good news is that you can reduce the tax bill that you incur by deducting allowable expenses. For this reason, you should always keep good track of your expenses or ensure the syndicator you are investing with keeps track of their expenses. Accounting software such as QuickBooks or Wave Financial can help with this. Property owners can generally deduct the expenses for managing and maintaining a property. These deductions are generally taken in the same year that you spend the money. That includes payments such as:

- Advertising

- Auto and travel expenses

- Cleaning and maintenance

- Homeowners Association (HOA) dues

- Insurance

- Legal and professional fees

- Mortgage interest

- Property management

- Property taxes

- Utilities and other services

When it comes to capital expenditures (capex), the tax rules change a bit. As a reminder, capital expenditures refer to expenses that go toward adding to or improving a property beyond the common and routine repairs. Think of these expenses as the ones that add significant value to your property such as a unit renovation project. These expenses need to be capitalized as opposed to expensed in the year they incur. When an expense is capitalized, it is depreciated and thus a portion is expensed annually over its useful life as defined by the IRS. This gets more complicated and when it’s wise to consult with a tax professional for guidance.

Depreciation & Recapture

Depreciation is one of the biggest tax perks when it comes to owning real estate. It allows you to deduct the costs of buying and improving a rental over its useful life which in turn lowers your taxable income in the process. The IRS says that properties have a “useful life” which can be thought of as the number of years a property can remain in service for the purpose of revenue generation. For residential and commercial properties the number of years each can be depreciated in 27.5 and 39 years respectively. However, a property owner can only depreciate an asset if all the following is true:

- You own the property. As far as the IRS is concerned, you are the owner even if the property is subject to a debt.

- You use the property in your business or as an income-producing activity (e.g., as a rental).

- The property has a determinable useful life, meaning it’s something that wears out, decays, gets used up, becomes obsolete, or loses its value from natural causes.

- The property is expected to last at least one year.

What’s important to note is that you cannot depreciate land because it never gets “used up.” Similarly, you cannot depreciate clearing, planting, and landscaping costs. Nevertheless, the process of calculating depreciation on a property involves:

- Determining the basis of the property (the amount you paid to acquire the property including settlement fees and closing costs)

- Separating the cost of land and buildings (this is determined using the fair market value or the assessed real estate tax value, not the amount you paid)

- Determining your basis in the home (i.e., the amount of what you paid that is attributable to land and building)

While depreciation is a thing of beauty, the IRS will remember the depreciation you took and tax you on it. This is known as depreciation recapture tax. Depreciation recapture applies to the depreciation deduction that you took. For example, if you took $10K a year for 10 years, you would owe depreciation recapture tax on $100,000. Even if you choose to not depreciate your property, the IRS will calculate the depreciation tax amount by calculating the depreciation that you should have taken. The tax is equal to your ordinary income tax rate and capped at 25%. This is reported on Form 4797 (Sales of Business Property).

Key Takeaways

- Rental income is taxed as ordinary income according to the Internal Revenue Service (IRS).

- If you hold a property for more than a year, any profits from the sale are taxed at the long-term capital gains rate (see table above for rates).

- If you sell the property after owning it for less than a year, the profits will be taxed at the short-term capital gains rate which is equal to how your ordinary income at your marginal tax rate.

- You can reduce the tax bill that you incur by deducting allowable expenses. For this reason, you should always keep good track of your expenses or ensure the syndicator you are investing with keeps track of their expenses.

- Depreciation is one of the biggest tax perks when it comes to owning real estate. It allows you to deduct the costs of buying and improving a rental over its useful life which in turn lowers your taxable income in the process.

- Depreciation recapture applies to the depreciation deduction that you took. The tax is equal to your ordinary income tax rate and capped at 25%. This is reported on Form 4797 (Sales of Business Property).

Conclusion

In conclusion, understanding the nuances of rental income tax, rental property tax deductions, and depreciation is crucial for property owners seeking to maximize their financial returns and stay compliant with tax regulations. By taking advantage of available deductions such as mortgage interest, property taxes, and maintenance expenses, investors can significantly reduce their taxable income. Additionally, leveraging depreciation allowances provides a powerful tool for spreading the cost of an asset over its useful life, resulting in substantial tax benefits. However, it’s essential to stay informed about tax laws and consult with a tax professional to navigate the complexities of rental property taxation. With careful planning and adherence to tax guidelines, property owners can not only optimize their finances, but also foster a more sustainable and profitable real estate investment portfolio.

If you have any questions regarding the terms and concepts in this post or previous ones, please reach out to either me (tedi.nati@jpacq.com) or someone on our team so we can help explain further. If you’re interested in investing with us at JP Acquisitions, you can contact us via our contact form, by emailing a member of our team, messaging us on LinkedIn, or signing up for our investor portal to set up a meeting.

As always, I hope you enjoyed reading this post as much as I have writing it. Best of luck!