Terminology Multifamily Investors Should Know (Part 2)

November 13, 2022Terminology Multifamily Investors Should Know (Part 4)

November 28, 2022This is part three of the Terminology Multifamily Investors Should Know Blog Series (part one can be found here and part two here). In the last post, we got more into the weeds than we did in part one as we covered equity, debt, appreciation, internal rate of return (IRR), and multifamily building classifications. In this post, we’ll be building upon the last and covering the following terms: underwriting, sponsor fees, cash flow waterfall, re-finance, & preferred return. As previously mentioned, while the blog posts build upon one another, the terms are not laid out in a specific way. Thus, I leave it up to you to build a cohesive picture of the multifamily world. When this blog series is concluded, I will build an organized glossary of all the terms covered for a better understanding of everything we’ve covered. As always, the goal of this blog series is to educate the reader with the goal in mind of being able to confidently speak on and underwrite multifamily real estate. With that being said, let’s dive into this post.

Underwriting

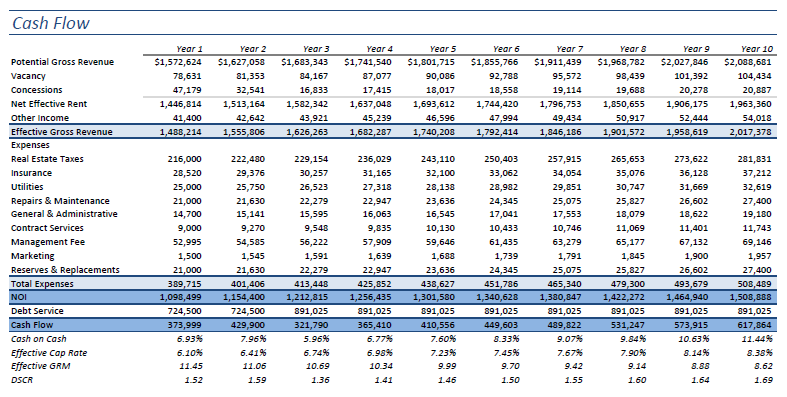

Underwriting refers to analyzing a property’s past and present performance and forecasting future performance to determine the value of that property and understand the associated risks. In other words, underwriting is analyzing, collecting, and organizing a property’s financials to build a projection of income, expenses, and investment returns (a pro forma). As a side note, if you’ve read our earlier post titled “Is a Recession Bullish for Stocks and Real Estate” you’ve actually seen part of our underwriting/financial model. The projections are what guide investment decisions, the business plan, and financing options. Below I’ve provided a picture of a cash flow tab (by “tab” I’m referring to an Excel worksheet) of a financial model to better illustrate what a real estate underwriting model looks like. By projecting out the income and expenses, we can get an idea of what the property in question will be worth in the future by dividing the future net operating income by the cap rate. In addition, financial models will calculate return metrics such as cash on cash (CoC), IRR, equity multiple, and more depending on the model. In the illustration below, you’ll notice the model calculates cash on cash on the fourth to last line. While you only see one worksheet of the model below, there are many more sheets which allow you to input critical factors such as debt terms (down payment, loan amount, interest rate, etc.), expenses, unit mix, etc. I should note that it’s not only real estate investors that underwrite, but also lenders, brokers, developers, and others to various levels of sophistication. There have been many books written on real estate underwriting and what I write here is simply meant to serve as a starting point for understanding what underwriting a deal means. I encourage you to look online and download one of the many free underwriting models syndicators put out in order to get a better idea of what it means to underwrite a deal. One of the books I, as well as many other multifamily professionals, found helpful is Rob Beardsley’s book “The Definitive Guide to Underwriting Multifamily Acquisitions“. That book goes deep into underwriting and I trust that it will help you in understanding how to run projections on a multifamily deal.

Sponsor Fees

As a result of a syndicator putting together a transaction and executing the business plan, the sponsor (synonymous with syndicator) is compensated via a set of fees. Not all syndicators structure their deals the same and depending on the structure, the interests of investors and syndicators could be in conflict. Below I’ve outlined the standard fee structure and benchmark rates that syndicators typically charge.

Acquisition Fee (1-2%): This fee is a percentage of the purchase price and is paid out via the capital raised for a deal. For example, if I’m the syndicator and charge a 1% acquisition fee for a $1M deal, I’ll take home $10,000 (1% * $1,000,000 = $10,000) at closing.

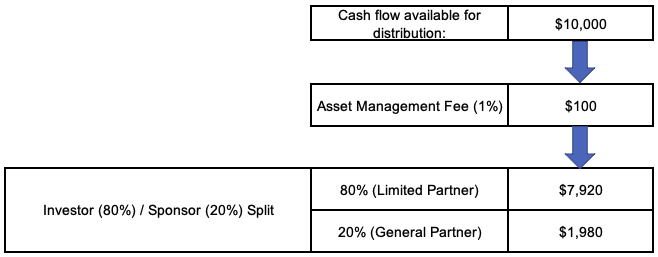

Asset Management Fee (1-2%): The asset management fee is a percent of the cash flow available for distribution that is given to the sponsor. Normally this fee sits at the top of the cash flow waterfall which means that the sponsor collects this fee before the investors get paid.

Refinance Fee (0.5 – 2%): This fee is calculated by taking a percentage of the refinanced loan amount as a result of the syndicators going through the refinance process.

Disposition Fee (1-2%): This fee is associated with the sale of a property and can be calculated by multiplying the sale price by the percentage charged by the sponsor.

What’s important to remember is that these fees can be structured in any number of ways. Investors should look into the fee structure of a deal they’re considering investing in so as to make sure their interests are aligned with the sponsor. I’ve seen an acquisition fee be as high as 5% and keep in mind that the acquisition fee comes out of money that is raised which means your equity in the deal is diluted or in other words you own less of the deal. On a related note, the best way to know if the sponsor’s interests are aligned with that of investors is to see if they have skin in the game. By “skin in the game” I mean that the sponsor group has contributed a fair amount of capital alongside investors (relative to their net worth) into the deal. When sponsors invest their capital alongside investors, you can rest assured that they want to see the deal succeed as much as you do. At JP Acquisitions our team always invests alongside our investors not only because we believe in the strength of our deals, but because we want to align our interests with our investors.

Cash Flow Waterfall

In a real estate syndication structure, cash distributions are calculated and made via what is known as a ‘ cash flow waterfall’. A cash flow waterfall can be thought of as a series of pools in which cash flows to one entity or individual to fill a single pool before spilling over to the next one. In the example below, there is $10,000 in cash flow after expenses and debt are paid for. Of that $10,000, $100 must go to the sponsor in the form of an asset management fee (assuming the deal was structured that way). The remaining $9,900 is then split among investors (limited partners) and the sponsor group (general partners) with the cash flowing 80% to the LPs and 20% to the GPs. This example is quite simplified as often the structure of syndications is more complicated. Nevertheless, this gives a general idea of what a cash flow waterfall is. Something that I want to mention is that the sponsor group will almost always take a percentage of the cash flow via a GP/LP split. The split shown in the illustration below is a common 80/20 split and you can see that after the asset management fee is paid, $7,920 (80%) of the cash flow goes to investors and $1,980 (20%) goes to the sponsor group. When I explain preferred return we will revisit this concept of a cash flow waterfall, but add a level of complexity.

Preferred Return

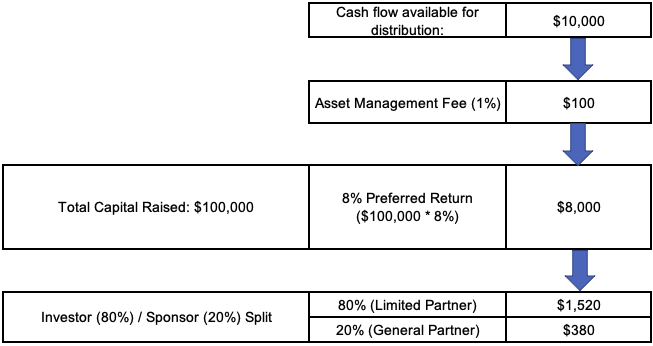

In real estate, a preferred return (also known as a ‘pref’ or preferred equity) is a percentage of profits that an investor is entitled to before the sponsor can receive profit. A typical preferred return ranges between 6% and 9% depending on the investment’s risk. A pref essentially puts the investors first in line to receive returns when it comes time to make distributions. To calculate a preferred return, you multiply whatever the pref is by the total capital raised. For example, if $1M is raised and the preferred return is 6%, then the annual preferred return would be $60,000.

Investors like preferred returns because they know they can assume a certain percentage return as opposed to a regular 80/20 split in which returns vary. With this structure, the syndicator is incentivized to make the property produce as high of a return as possible since they know they will not get paid if they don’t meet the preferred return hurdle. In the event that the preferred return cannot be payed, most syndicators structure the deal so that the pref accrues. For example, If a syndicator structures a deal with an 8% preferred return and cannot pay the full amount, then the remainder that was not paid is carried over into the next year. If upon sale there is any outstanding balance that is owed to investors as a result of the preferred return, that must be paid before the syndicator can receive their share of profit. Many syndicators structure their deals with a compounding factor on top of the preferred return in the event that it cannot be paid. What that means is that if the preferred return was not totally paid in that year, the syndicator will pay back the pref in addition to a percentage they promise. For example, If a syndicator cannot pay a preferred return of 8%, the residual of what they did not pay will carry over to the next year in addition to 3% of the balance that was carried over. The compounding preferred return is a favorable syndication structure because it incentivizes syndicators even further then the standard preferred return.

Below I have provided an illustration of how the previous cash flow waterfall would change with a preferred return structure. Notice how the total return to investors changed from $7,920 in the last waterfall to $9,520 ($8,000 + $1,520) in this example. As I stated before, since the preferred return acts as a hurdle before the syndicator can get paid, the syndicator is incentivized to make the project perform better so they can receive a higher return. Assuming the pref accrues, this pref structure is a win-win scenario for the investor since no matter what they get their return. Nevertheless, just because a syndicator provides investors with a pref that doesn’t necessarily mean the deal is a strong investment. The deal still stands to face the risks associated with multifamily real estate such as the inability to make debt payments, an increase in interest rates resulting in a lower valuation, and more. It’s critical that as an investor you conduct your own due diligence on the deal to access the viability of the returns promised by the syndication group. While there is a myriad of ways to structure a deal with a preferred return, you now understand how a basic pref structure works.

Cash-out Refinance

In part two of this blog series on multifamily terminology, I touched on debt which refers to money that is lent with the obligation of the borrower to repay the full amount plus interest on a regular basis. With that understanding, I want to now take it a step further and explain what a cash-out refinance is. In simple terms, a refinance is essentially trading in your current mortgage for a newer one often with a new principal balance and interest rate. The lender then uses the new mortgage to pay off the old one so you’re left with one loan with a new monthly payment. The beauty of a refinance is that if there is equity built up in your property, you can take the difference between the old balance and the new one which leaves you with money in your pocket (hence why it’s called a “cash-out refinance”). In addition, depending on where interest rates are, you may be able to get a lower rate. For example, let’s say an investor buys a multifamily property and gets a loan with a fixed 5% interest rate. Three years later let’s suppose interest rates have lowered and the investor refinances their property and gets a loan at a 4% rate. In this example, due to interest rates dropping the owner now pays less in interest and more in principal which allows that individual to build up equity in their property faster. In addition, since the investor had equity built up in their property when they refinanced, they were able to pocket the difference between the old loan and the new one. What’s important to note is that if interest rates are higher when an investor goes to refinance, that individual may be stuck with a higher interest rate. Nevertheless, an investor can continuously keep refinancing their property over the course of time and keep pulling cash out. If an investor chooses to renovate his or her property, once the renovations are done they can refinance that property and reap the benefits of the refinance. Often times you’ll see syndicators buy a property and take a loan out on it, renovate the property, and refinance which results in money being distributed back to investors as a result of the difference between the old loan and the new one. This renovate and refinance strategy is what we seek to do at JP Acquisitions.

As of the time I’m writing this post (11/20/22), the Federal Reserve (the ‘Fed’) has raised the federal funds rate significantly which has caused interest rates to increase. The federal funds rate is the rate at which commercial banks borrow and lend their excess reserves to each other overnight and is set by the FOMC (Federal Open Market Committee). That rate influences the interest rate that banks charge to borrowers. While the change in the federal funds rate has caused many syndicators and investors to take on higher rate debt, the good news is that property values adjust downwards as a result of the higher interest rate payments investors must pay. The change in property values doesn’t happen immediately and after talks with various lenders, it’s likely we’ll see the shift in property values start to dramatically play out in Q2/Q3 of 2023. What’s nice is that investors can buy properties at a lower price and simply refinance in the future when interest rates go lower. I doubt that rates will go back down to nearly 0% as they had been during the past two years, however that is left to be seen.

Conclusion

I trust that the information I explained here will do you good on your journey of investing in multifamily real estate. We’ve covered a total of fifteen terms throughout this blog series and there will be more to come in the near future. If something I wrote here or in the past posts doesn’t make sense, don’t hesitate to reach out to me or someone on our team so we can better help navigate through these terms. If you’re interested in investing with us at JP Acquisitions, reach out to us and we can set up a meeting to go over your investment goals. You can contact us in numerous ways including LinkedIn, email, our investor portal, and Instagram. We love meeting with new investors and providing value to people eager to learn and build their wealth.

As always, I hope you’ve enjoyed reading this post as much as I have writing it. With the holiday season upon us, I hope you and your family enjoy a quality time together. Best of luck!