Five Questions to Ask a Broker Before or While Touring a Property

January 3, 2023The Role of a Sponsor in Multifamily Syndications

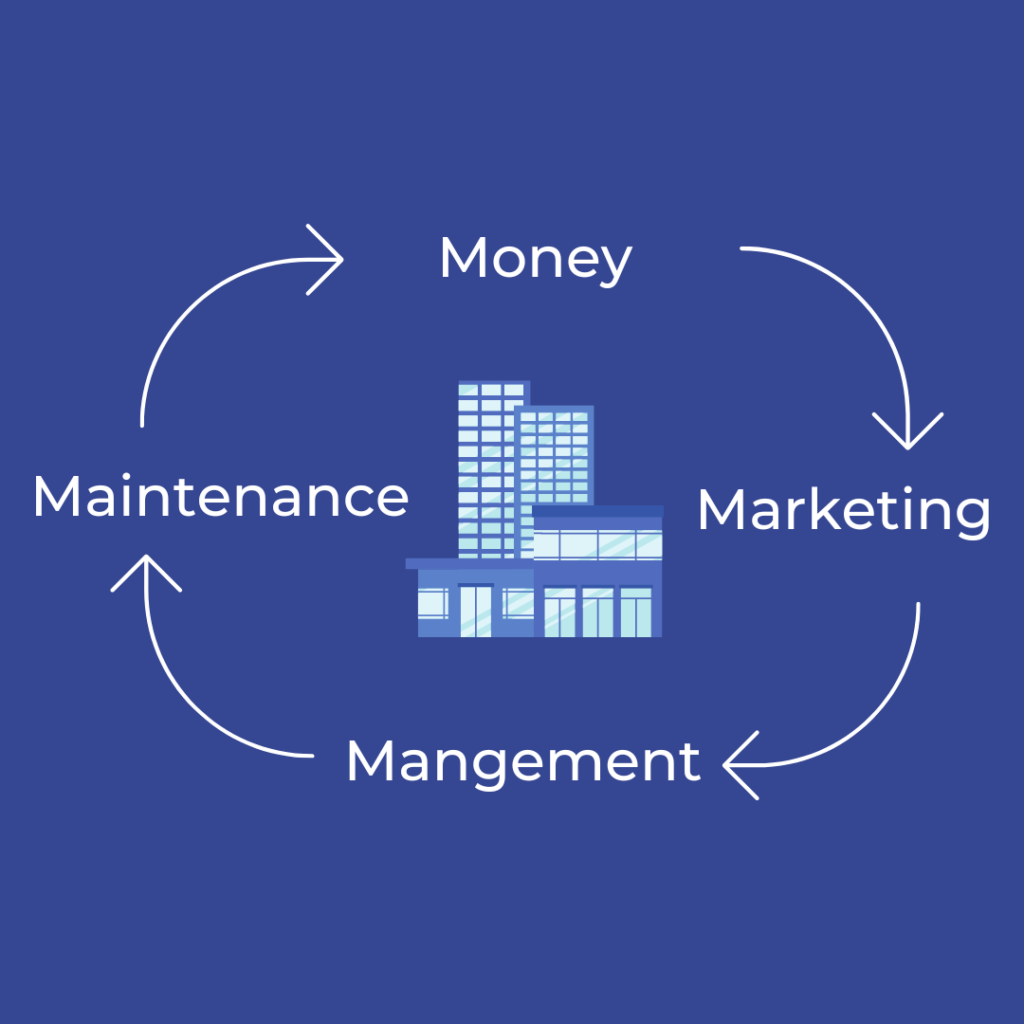

January 16, 2023There are four aspects/characteristics to multifamily syndication businesses, and really any income-producing real estate business, which I want to outline in this blog post. These four aspects all feed on one another and can be thought of as a loop (or cycle) in which if one aspect of the chain is broken, something will inevitably go wrong. The four characteristics can also be thought of as steps that need to be repeated or a framework to run any successful syndication business. While what I’m about to explain can be applied to any real estate acquisitions business, at our company we work in the multifamily space, and thus this post will refer to multifamily real estate primarily. Quite honestly, if you generalize what you’re about to read, you’ll see this framework can be applied to any industry.

The four aspects I’ve been alluding to and that make up the framework are money, marketing, management, and maintenance (“The Four Ms”). It may be obvious how all these four characteristics of a real estate business feed on one another if you own a real estate business or a property, but the connection between them may be more difficult to understand if you are new to the multifamily world. With that being said, it’s important to understand that when buying an income-producing property you are buying a business. With this in mind, let’s jump into the first M, Money.

Money

How money applies to the world of real estate and the syndication process is obvious, you need money to buy an apartment building. In a syndication business, the team has an individual or a group looking to raise money from investors so as to purchase a property. By definition, a syndication is a term describing an organization or group of investors pooling capital (money) to invest in real estate. Without money there is no chance of purchasing any asset, let alone an apartment building. If you’re purchasing an apartment building with your own money then this step in the chain is relatively simple to fulfill, however raising capital is a different story. Jaynish (Jay), President and Founder of JP Acquisitions, recently went on Michael Blank’s podcast and there he described the process of raising capital. In that podcast, he said that the capital raiser needs to be focused on the goals of the potential investor and describe to them how one’s real estate business can provide value to them and how their goals align with the syndicator’s. He goes on to say that undoubtedly in the process of capital raising you will face resistance, but it’s a matter of talking about what is impeding the potential investor from trusting the syndicator that leads to successfully being able to build the trust needed for someone to feel confident enough to invest their money.

Having described the capital raising process, chances are that you’ll want to take on debt so as to be able to purchase deals as opposed to buying a deal outright in cash. The process of taking on debt fits in this step of the four Ms. Finding a lender that can provide you with the best terms means shopping around the deal (i.e. showing the deal to multiple lenders) and understanding the debt options that you have available to you. For syndicators that have built relationships with various lenders, this process is easier because there will have been trust already built. For people new to the world of commercial real estate, the goal is to build relationships with multiple lenders and be able to call on those lenders when there is a deal on the table.

Marketing

The marketing characteristic of a syndication business is multifaceted. On the one hand, the syndicator needs to market their services to the world. Thankfully, if you have a syndication business or are looking to start one then this step can be accomplished/fulfilled through social media. Out of all the syndicators and real estate professionals that I’ve spoken to, there is one social media platform that best markets a syndication business. LinkedIn is by far the most recommended social media platform to market your syndication business and show others the value that you can provide them. LinkedIn is geared toward professionals and as a result, it’s great for syndicators looking for people making serious money with the ability to invest. That’s not to say that Instagram, Facebook, or one of the other social media platforms are not right for marketing a syndication business. Rather, those social media platforms are more geared toward a different audience that is looking for fun/recreational content. Simply scroll through LinkedIn and one of the other social media platforms and you’ll see what I mean. However, the best way to market a syndication business is to be on as many platforms as possible so long as you have the time and ability to produce content on all the platforms. At JP Acquisitions, we primarily use LinkedIn and Instagram and have found that to be successful to spread the word of the services we provide.

Furthermore, marketing refers to letting potential renters know about your property. If you own an apartment building and have vacancies, you’ll want to fill those units so you can increase your income. There are a number of websites in which you can spread the word on units you’re looking to fill. Some of the top websites you’ll want to market your apartment building are Apartments.com, Rent.com, ForRent.com, and Craigslist. In addition to using the internet to market your business, it’s a good idea to have physical forms of marketing such as a sign in front of or close to your property in addition to flyers at businesses near your apartment building. While a sign can cost money if your apartment building doesn’t have one already, it costs zero dollars to put up flyers at local businesses. The goal is to fill those vacancies and put as much money in your pocket as possible.

Management

Similar to marketing, managing a syndication business is multifaceted. For a syndication business looking to scale, it’s critical to have systems and processes in place to make sure your business doesn’t fall apart. When I say “systems and processes” what I’m referring to is setting up a systematic way of raising capital, securing soft commits, communicating with investors, establishing deal flow, etc. In addition, if you’re just starting your syndication business then being a one-person army can suffice. However, as your syndication business grows you’ll want to partner up with other knowledgeable individuals and allow them to dominate the aspects of the business that best align with their strengths.

In the podcast I mentioned earlier, Jay spoke about how and why he and I chose to partner up to grow JP acquisitions. Simply put, Jay is fantastic at raising capital and communicating. I always tell him about his natural ability to speak passionately and have people listen to him. I think of him as a natural-born leader who is business savvy and has more or less an A-type personality. What I bring to the table is an eye for setting up systems and processes as well as having strong excel modeling/math skills and being creative. When you watch the podcast you’ll also notice that Jay says, “he (me) cares about the company as much as I do.” Having partners that truly care about the trajectory of your business is extremely important. If you look inside how large businesses operate you’ll notice that the people who are performing at a high level are given equity in the company as an incentive. Keep that in mind when choosing your partner(s).

The other component of management is teaming up with property management companies (PM) to run the day-to-day operations of your properties. Notice how I mention teaming up with property management companies and not just hiring them. Property managers are not simply people that you hire to run your properties, they’re a vital component of your team similar to how lenders and lawyers are part of your syndication team. Property managers may not have equity in your company, but without them, you’d be running around like a headless chicken taking care of all the little problems that arise at your properties. In addition, property managers help make apartment building investing more of a passive investment. When teaming up with property management companies you’ll want to make sure they have experience operating the same class of apartment buildings that you own. For example, you won’t want to hire a PM company that specializes in operating class-A apartment buildings for your class-C property. Understand that the various apartment building types have different tenant bases and as a result different needs. Finding the PM company that is the right fit to manage your apartment building is one of the keys to success in the syndication business.

While I won’t touch on this much, perhaps you may want to self-manage or vertically integrate PM into your operations. Self-managing a property only really makes sense if you have the time and skill to do so. More likely than not, given that your property is large enough, you’ll want to hire a property manager to run the operations. Vertically integrating a PM company in your syndication business typically only makes sense once you reach a certain scale so that you can take advantage of the synergies between the number of units you have in a given area and your company’s operating cash flow. If you haven’t reached sufficient scale to vertically integrate PM into your company, you’ll likely want to hire a property manager.

Maintenance

The last part of the four Ms is maintenance. What comes to mind when you think of maintenance may be fixing a toilet, patching a roof, and other general tasks you have to do in order to keep an apartment building in good standing. In the most simple way of thinking of maintenance, the general upkeep of a property would suffice this part of the four Ms. However, I challenge you to expand your horizon beyond simple maintenance items. Think of this part of the cycle as also identifying and implementing efficiencies within your company’s systems and processes in addition to keeping an eye out for creative ways to generate what is referred to as “other income” in the multifamily world.

Certainly, a syndicator has to keep in good communication with the property manager(s) on their team and vice versa. The property manager is responsible for maintaining the syndicator’s property and taking care of any maintenance work that needs to be done so as to maximize the income the property generates. The syndicator on the other hand is responsible for paying the PM company in a timely manner. If a syndicator or PM ignores those maintenance requests then things can get ugly resulting in tenants leaving the property (i.e. higher vacancy). If we take this a step further, I’ll argue that maintaining a property also means finding creative (or traditional) ways to increase the income of a property. For example, let’s say that your property doesn’t have a laundry room equipped with washers and dryers. Finding a way to install washers and dryers is not only a great way to increase the income of your property, but it also increases tenant satisfaction. The best property managers will help you identify ways of increasing your properties income by communicating new ways of generating income. Those property managers that can help you make more money but are far and few between. If you happen to be lucky enough to find solutions oriented PMs, compensate them well and let them know their worth.

The other half of the maintenance equation is being on the lookout for ways you can make your syndication business run more smoothly. This may mean investing in new software such as a better CRM (customer relationship management) system. Perhaps you find yourself too busy to reach out to brokers and establish relationships and you need to hire someone to do that. Whatever the solution is to streamline your business, you’ll thank yourself in the future. At JP Acquisitions we’re always looking for new ways to make our business run more smoothly. Most recently we ran a cost/benefit analysis of a customizable fund and what that would do for us during the capital raising process and how it would make our investors’ lives more simple. Nevertheless, the point is to stay hungry and keep an eye out for opportunities.

Conclusion

I trust that by describing the four Ms of commercial real estate, specifically multifamily, you better understand what it means to be responsible for a syndication business. If one of the four Ms is out of alignment, you put your business at risk. After spending so much time building up your income-producing business, do you really want to see it crumble?

To reiterate, the first M stands for money and includes a combination of raising capital and leveraging debt. Marketing is the second M and has to do with letting the world know about your syndication business and the units you have waiting to be rented. The third M stands for management and is the process by which you manage your properties along with the systems, processes, and partners of your business. The final M stands for maintenance and is a combination of keeping your property in good condition, looking for creative ways to increase the income of your properties, and finding new ways of efficiently managing your syndication business.

If you have any questions regarding the terms and concepts in this post or previous ones, don’t hesitate to reach out to either me (tedi.nati@jpacq.com) or someone on our team so we can help explain what is causing the confusion. If you’re interested in investing with us at JP Acquisitions, you can contact us via email, LinkedIn, Instagram, or our investor portal to set up a meeting.

As always, I hope you enjoyed reading this post as much as I have writing it. Best of luck!