What are the Differences and Similarities of a Deed and a Title?

July 10, 2023

The Benefits of Having a Vertically Integrated Property Management Team in a Multifamily Syndication Firm

July 25, 2023Raising capital is a crucial aspect of establishing and growing a successful multifamily syndication firm. Whether you’re a seasoned real estate professional or a novice entrepreneur, securing adequate funding is essential for acquiring, managing, and scaling multifamily properties. In this blog post, I’ll delve into the process of raising capital for a multifamily syndication firm, covering key strategies, considerations, and best practices to help you navigate the capital-raising process. In addition, I’ll touch on what we’ve learned about raising capital while scaling our business.

1. Define Your Investment Strategy: Before embarking on a capital-raising journey, it’s crucial to define your investment strategy. Outline your firm’s investment criteria, target markets, property types, and expected returns. A well-defined strategy not only helps attract potential investors but also instills confidence in your ability to generate profitable opportunities. At JP Acquisitions, we took the time to explore different strategies but ultimately concluded that we would target class B- and C value-add multifamily in our ‘backyard’ (i.e., the Chicagoland area). We certainly expect our criteria to change as we scale and learn and that is natural for any growing business.

2. Develop a Compelling Business Plan: A well-crafted business plan is essential for conveying your firm’s vision, market analysis, investment strategy, and projected financials to potential investors. Include detailed information on your team’s experience, track record, and their roles within the syndication firm. Highlight the potential benefits and risks associated with investing in multifamily properties, demonstrating a thorough understanding of the market and showcasing your expertise. Gaining expertise of a market takes time and we were able to learn about the niche aspects of our target market by constantly underwriting properties and talking to real estate professionals (brokers, property managers, etc.) in our market.

3. Identify Your Target Investors: To raise capital successfully, you need to identify and understand your target investor base. Consider both individual and institutional investors who have an interest in real estate, particularly multifamily properties. Create an ideal investor profile, considering factors such as investment goals, risk tolerance, liquidity needs, and investment size. This will help you tailor your approach and messaging accordingly. When you’re first starting out, chances are that you’ll simply be talking to friends and family. Institutional investors normally come into play once you’ve developed a strong track record and have scaled your company. Similar to how your investment strategy can change over time, so too will your target investor. The difference between raising let’s say $300K and $1M is night and day. I say the difference is so big because when you’re raising $300K it’s ok to have investors investing smaller amounts (e.g., between $20 – 40K). As you scale, however, the last thing you want to do is have to manage many investors with smaller amounts of capital in your deal. Ask yourself, “Do I want to be responsible for 10 investors or 30?” Investors with more capital have a different profile and level of sophistication which will you will need to be keen to when pitching them an opportunity. In addition, due to securities laws, you may not be able to have so many investors, and thus your hand will be forced and you will need to constrict your target investor.

4. Build Relationships and Networks: Building relationships and networks within the real estate industry is instrumental in raising capital. Attend conferences, join real estate organizations, and engage with local investors and professionals. Establishing credibility, trust, and rapport will increase your chances of finding potential investors and referral sources. Leverage platforms like LinkedIn and other social media channels to expand your network and engage with a wider audience. Here I’ll note that not everyone has the personality that makes raising capital come easy. That being said, there are two ways you can go about raising capital if that is not something you prefer to do. The first option is finding a partner who prefers or is at least competent when it comes to raising capital. The second option is simply adapting and practicing talking to individuals and pitching them your opportunity. Either way, at the end of the day you will need to raise capital unless you happen to have access to a lot of capital.

5. Create a Strong Online Presence: I consider creating a strong online presence somewhat of an optional step in the capital raising process. I know firms that have a very small online presence and have scaled just fine. Nevertheless, in today’s digital age being active on various social media platforms can be very helpful. Utilizing the power of LinkedIn (primarily) and Instagram can lead to opportunities and helps spread the word of your company. The one thing that seems almost necessary nowadays is having a professional website that showcases your firm’s expertise, track record, and investment opportunities. If you provide valuable content through blogs, webinars, and educational resources to establish yourself as a thought leader in multifamily syndication, you will have an easier time raising capital. Active engagement on social media platforms can further enhance your visibility and attract potential investors. If you’re publishing content on your website, you might as well post it on social media otherwise your audience will likely not be very big.

6. Develop a Marketing Strategy: It seems odd to say that having a strong social media presence is optional yet I say you should develop a marketing strategy. The nuance here is that a marketing strategy doesn’t necessarily have to involve you being active on social media, but it certainly helps to provide value on social platforms. Nonetheless, crafting a comprehensive marketing strategy to effectively reach and engage with potential investors is highly recommended by successful business leaders. your marketing strategy should utilize various channels such as email marketing campaigns, webinars, podcasts, and direct mail to create awareness about your firm and investment opportunities. A robust marketing strategy takes up a lot of time and to the extent that you can at least utilize one channel, I recommend being active on LinkedIn because of its business focus. If you’re able to, leverage the power of storytelling to highlight successful projects and testimonials from satisfied investors. Consistent and targeted communication is key to building trust and generating interest.

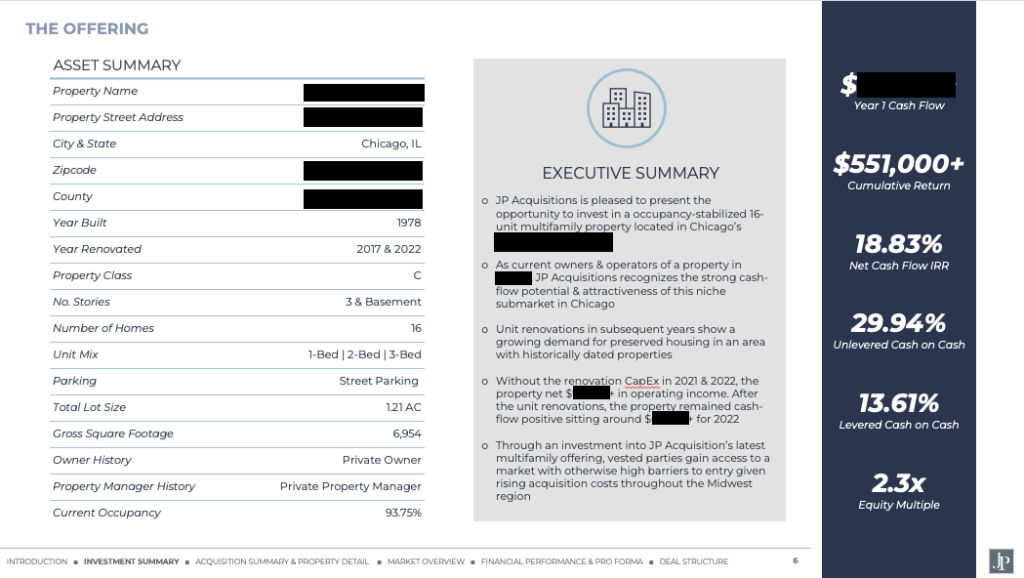

7. Offer Compelling Investment Opportunities: The majority of what I’ve touched on up until this point has been preliminary. The real action takes place when you present a well-structured and attractive investment pitch deck (or some other material) to potential investors. What’s important is that you highlight the benefits of multifamily properties in general, such as stable cash flow, long-term appreciation potential, and tax advantages. From there, diving into the details of the property is necessary and you should showcase your business plan, your underwriting/financial projections, market demographics, and other supporting information for why you believe the investment will succeed. Furthermore, you should clearly articulate the expected returns, exit strategy, and investor rights to instill confidence and transparency. The following graphic of the summary slide from one of our pitch decks and helps to get a sense of what sort of content needs to go into a pitch deck:

8. Comply with Regulatory Requirements: When raising capital for your syndication firm, you need to ensure compliance with all applicable securities laws and regulations. You need to engage legal counsel and professionals with expertise in securities laws to navigate through the complex regulatory landscape. Make sure to familiarize yourself with rules such as the Securities Act of 1933, Regulation D, and other relevant state and federal regulations to protect your firm and investors. In addition, you should have your SEC lawyer put together the private placement memorandum unless you happen to be syndicating the deal in a way that does not require one.

Conclusion

Raising capital for a multifamily syndication firm requires a well-executed strategy, effective networking, and a thorough understanding of the real estate market. By defining your investment strategy, developing a compelling business plan, and building strong relationships, you can attract potential investors and position your firm for success. With careful planning, diligent execution, and a commitment to compliance, you can establish a reputable multifamily syndication firm that offers attractive investment opportunities to interested investors. Once you have a strong track record and therefore have shown your commitment to executing your business plan, investors will start coming to you and the process of capital raising will be on autopilot so to speak.

If you have any questions regarding the terms and concepts in this post or previous ones, don’t hesitate to reach out to either me (tedi.nati@jpacq.com) or someone on our team so we can help explain what is causing the confusion. If you’re interested in investing with us at JP Acquisitions, you can contact us via email (contact@jpacq.com), LinkedIn, Instagram, or our investor portal to set up a meeting.

As always, I hope you enjoyed reading this post as much as I have writing it. Best of luck!