|

Getting your Trinity Audio player ready...

|

In multifamily real estate, both a deed and a title are important legal documents that are involved in the transfer and ownership of a property. While they are closely related, there are distinct differences between the two. In this short post, we will cover what a deed and a title are and how they are similar and different. Once this post is published, you will be able to find both definitions in the glossary section of our website to reference as needed. That being said, let’s jump into this post!

Deed

A deed is a written legal document that transfers ownership of a property from one party to another. It serves as evidence of the transfer of ownership rights. When a property is sold or transferred, the seller or grantor prepares a deed, which is then signed and delivered to the buyer or grantee. The deed typically includes information such as the names of the parties involved, a legal description of the property, and any relevant conditions or restrictions. Deeds need to be signed, notarized, and recorded with the appropriate government office, usually the county recorder’s office, to be legally valid. There are different types of deeds, such as warranty deeds, quitclaim deeds, and special warranty deeds, each providing different levels of protection to the buyer.

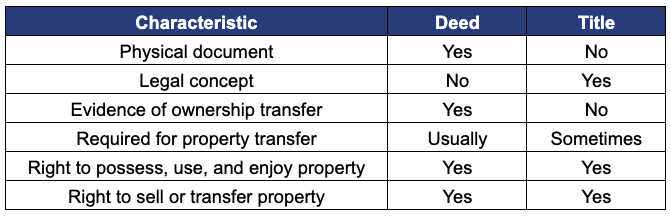

There are some exceptions to the rule that a deed is required to transfer a property (hence why it states “usually” in the table below). One example is if a property is inherited, the title may be transferred without a deed. However, in most cases, a deed is the best way to ensure that the transfer of ownership is legally valid.

Title

The title refers to the legal right to ownership and possession of a property. It represents a bundle of rights associated with the property, including the right to use, occupy, transfer, or sell it. A title is not a physical document but rather a concept of ownership. When a property is purchased, a title search is conducted by a title company or an attorney to ensure that the title is clear and free from any liens, encumbrances, or other claims. The title search examines public records to verify the ownership history and determine if there are any issues that could affect the buyer’s rights to the property. Once the title is deemed clear, the title company or attorney may issue a title insurance policy, which protects the buyer against any future claims or defects in the title.

In some jurisdictions, a title may be required to transfer a property even if there are no title defects (hence why it states “sometimes” in the table below). This is because the title is a legal document that is recognized by the government.

Conclusion

In summary, a deed is a written legal document that transfers ownership of a property, while a title refers to the legal right of ownership and possession. The deed is the physical document that evidences the transfer, while the title is the concept of ownership and can be insured through a title insurance policy. The table below outlines the differences between a deed and a title in an easily digestible way. You can expect the glossary section of our website to be updated within a couple days of publishing this post.

If you have any questions regarding the terms and concepts in this post or previous ones, don’t hesitate to reach out to either me (tedi.nati@jpacq.com) or someone on our team so we can help explain what is causing the confusion. If you’re interested in investing with us at JP Acquisitions, you can contact us via email (contact@jpacq.com), LinkedIn, Instagram, or our investor portal to set up a meeting.

As always, I hope you enjoyed reading this post as much as I have writing it. Best of luck!

Connect with us!

About the Author

Tedi Nati is the Managing Partner of JP Acquisitions. In his role he is responsible for broker outreach, establishing deal flow, underwriting, marketing, and assisting in the closing process. In addition to his role at JP Acquisitions, he is an Assistant Equity Underwriter at Cinnaire, a non-profit Community Development Financial Institution (CFDI). In his role at Cinnaire, he is responsible for assisting the underwriting team in evaluating and structuring real estate equity investments and assessing the risks and mitigants associated with such. Tedi earned his Bachelor of Science in Finance from DePaul University, where he graduated Summa Cum Laude. In his free time he enjoys reading, looking for multifamily deals, and working out.

Make sure to always do your own research before making any final decisions on buying/investing real estate, stocks, or other securities. I am not a CPA, attorney, insurance, or financial adviser and the information in this blog post shall not be construed as tax, legal, insurance, construction, engineering, health and safety, electrical or financial advice. If stocks or companies are mentioned, I sometimes have an ownership interest in them – DO NOT make buying or selling decisions based on my posts alone. If you need such advice, please contact a qualified CPA, attorney, insurance agent, contractor/electrician/engineer/etc. or financial adviser.

buy promethazine paypal – ciprofloxacin for sale buy cheap generic lincocin

Your comment is awaiting moderation.