3 Common Questions Investors Ask Our Team at JP Acquisitions Prior to Investing

April 22, 2024

2 Different Approaches to Underwriting Exit Cap Rates

May 6, 2024The topic of interest rates and it’s impact to various debt products constantly comes up when talking about commercial real estate and rightfully so. Debt terms can completely change the course of a deal and a drastic enough change can suddenly make a homerun deal turn sour. That said, not all investors see interest rates the same. In this post we will cover how it is that we look at interest rates at JP acquisitions and how our investment strategy is uniquely positioned to ride interest rate volatility. More so, we will take a look at the multifamily market in general and how it will be impacted if rates are to stay constant or move up.

Note – The definitions of the technical terms in any of our posts can be found in the glossary section of our website.

Note – I (Tedi) will use “we” when referring to the JP team and myself as well as speak in the first person throughout this blog post.

Market Impact from Interest Rates

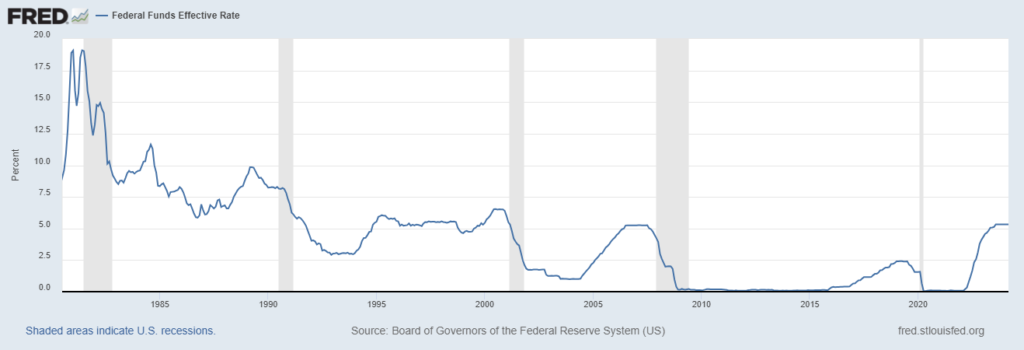

In must admit, I think that the Fed keeping interest rates in the 5% range is good for the economy in the long term and likely what is best. When rates were near 0%, inflation began to run red hot as there was so much money moving around in the economy (i.e., the velocity of money). Demand was going through the roof and companies knew that they could feed the demand through borrowing at low rates which allowed them to keep margins high. More so, people felt rich as they saw their investments in real estate, stocks, etc. sky rocket. However, all good things must come to an end. To fight the inflation, the Fed jacked up interest rates and brought the party to a halt. That brings us to today which has been colored by 11 interest rate hikes from the Federal Reserve from 2022 to 2023 and the current rate being the highest we’ve seen in over 20 years (see chart below).

I would be lying if I thought that rates will continue to remain elevated. For that to be the case, that would mean inflation will have persisted above the Fed’s target of 2% (last March reading was 3.48%) and the economy would have remained strong (wage growth, GDP growth, etc.). The truth of the matter is that know one really knows what will happen and as legendary investor Warren Buffet said, “There’s nobody whose predictions on interest rates I would pay attention to, even myself, even Charlie.”

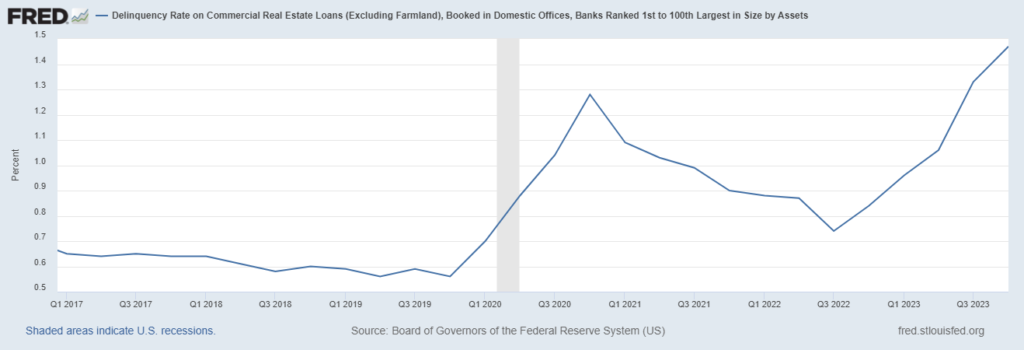

All this is to say that there are somewhat drastic negative short-term effects from interest rates being at this level and the impact will only worsen if rates increase. Firstly, we will likely continue to see a heightened delinquency rate in commercial real estate loans (see Chart 2). The delinquency rate will increase if interest rates increase because as debt payments increase, the likelihood of property owners being able to make those payments decreases. Owners with fixed rate debt will be fine, but those with floating rate debt will feel the pain if rates are to move up. Secondly, the owners that are coming to the end of their loan terms will have two options both of which aren’t ideal compared to the previous lower interest rate climate. Those folks will either have to refinance for a higher interest rate or they will have to sell at what is a lower valuation to what they would’ve gotten in the past. Remember, debt isn’t the only expense that has gotten more expensive. Insurance, taxes, the cost of maintenance materials, and just about everything else are more expensive which in turn lowers cap rates and compresses valuations. Thirdly, I’m not sure when sellers will finely come to their senses and realize that they can no longer obtain the valuations they could a couple years ago. The prices that sellers are asking compared to what buyers are willing to put up is still very wide and multiple brokers we work with have confirmed that to be the case. Since most sellers are not forced to sell and can afford to ride out the interest rate market, the number of deals on the market has fallen and many sellers are opting to simply wait for better selling conditions. These effects of the heightened interest rate environment are certainly not ideal, but rather sobering and perhaps good in the long-term as I stated previously.

Our Position at JP Acquisitions

The stance that our company takes toward relatively high and increasing interest rates is one grounded in conservatism and in line with Warren Buffet’s belief that predicting interest rates isn’t a smart way of doing business. We try to avoid floating rate debt as much as possible and will only choose to take that option if we’ve exhausted all other options and the cash flow from a given deal in combination with the potential rent increases from the business plan provide a significant margin of safety as expressed by the deal’s DSCR. Even with the high margin of safety, we will raise a significant amount of additional funds for unforeseen circumstances. The last thing we want to do especially as a young firm is overpromise and underdeliver. More so, we underwrite our exit cap rates to anywhere between 75bps to 1.5bps above the cap rate of the market. By doing so, we know that if interest rates are to rise significantly, we’ve already modeled that scenario and can still meet our targeted returns. If rates fall or stay the same, the high exit cap rate assumption is closer to a downside scenario, understates the profitability of the deal, and in turn is extra gravy for our investors. Thirdly, we never model a refinance in our underwriting because doing so skews the returns. By modeling a refinance, the IRR jumps due to the capital event and thus doesn’t show the true returns of the deal. Additionally, modeling a refinance requires debt assumptions which as I said earlier we don’t have a crystal ball to get those terms right. Lastly, we only invest in strong cash flowing deals that significantly surpass the typical 1.25x DSCR requirements that lenders have. By doing this, we can avoid borrowing with floating rate debt and keep our operating expense margins low which in turn positions us for success when combined with the other practices mentioned in this section. Overall, we make sure to cover all bases and want to deliver on our promise of providing investors with strong risk adjusted returns.

Conclusion

The party that was fueled by low-interest rates and high levels of borrowing was halted by the Fed last year and caused a vibration of negative effects in the economy which we have yet to see the end of. Real estate asset classes such as multifamily continue to experience a triple-threat increase in delinquency rates, cap rates, and bid-to-ask spreads. The multifamily market isn’t the only asset class in commercial real estate to feel the pain, the Fed’s decisions are hitting every asset class hard. Nevertheless, our team at JP Acquisitions is positioned to take on the broad market pain through conservative underwriting and by targeting high cash-flowing multifamily. As to how the future will pan out, our team is not counting on lowered rates and will continue to build a strong margin of safety in our projections to avoid our investors being hurt.

If you have any questions regarding the terms and concepts in this post or previous ones, please reach out to either me (tedi.nati@jpacq.com) or someone on our team so we can help explain further. If you’re interested in investing with us at JP Acquisitions, you can contact us via our contact form, by emailing a member of our team, messaging us on LinkedIn, or signing up for our investor portal to set up a meeting.

As always, I hope you enjoyed reading this post as much as I have writing it. Best of luck!