An Overview of the Chicago Multifamily Market (Q2 2023)

June 5, 20235 Questions to Ask a Syndicator before Investing with Them

June 20, 2023Multifamily (MF) real estate is often considered a recession-resistant asset class because the demand for rental housing tends to remain strong even during economic downturns. This is because people still need a place to live, especially if they are unable to afford to buy a home. Additionally, multifamily properties can provide investors with a steady stream of income and tax benfits which can be helpful during times of economic uncertainty. Of course, no investment is completely recession-proof. However, multifamily real estate is a relatively safe investment and in this post, I will explain why MF is recession-resistant. In addition, I will get a bit more nuanced and explain how multifamily can be negatively impacted during recessionary periods. That being said, lets jump into this post.

Demand

The demand for housing is relatively inelastic, meaning that it does not change much in response to changes in economic conditions. This is because people need a place to live, even if they are unemployed or have lost their job. For example, during the Great Recession of 2008, when the unemployment rate reached 10%, the demand for rental housing remained relatively strong. This is because people who lost their jobs still needed a place to live, and they were unable to afford to buy a home.

I want to note that while in general demand for multifamily is strong in the majority of markets, the various types of multifamily are affected differently in recessionary times. There are 3 types of multifamily asset classes (A, B, and C) with A being the best and C being the worse. According to a study by CBRE, Class A apartments had the largest drop in revenue at -13.4% during the Covid recession while Class B and C assets fell 9.1% and 11.4% respectively. Class A assets had the largest drop off due to deep job losses in the tenant pool that those assets attracted. In addition, some Class A tenants chose to downgrade their lifestyle by moving to Class B apartments. The study goes on to point out that Class C tenants experienced more credit loss which means more tenants were not paying rent and breaking lease contracts due to job losses. What’s important to note is that Class A MF assets represent the top 20% of properties based on rent while Classes B and C represent the next 60% and 20% respectively. The fact there are different apartment classes varying in rent in combination with the need for people to have a place to live is perhaps the primary reason apartment building investing is recession-resistant.

Stocks Versus Real Estate in Recessions

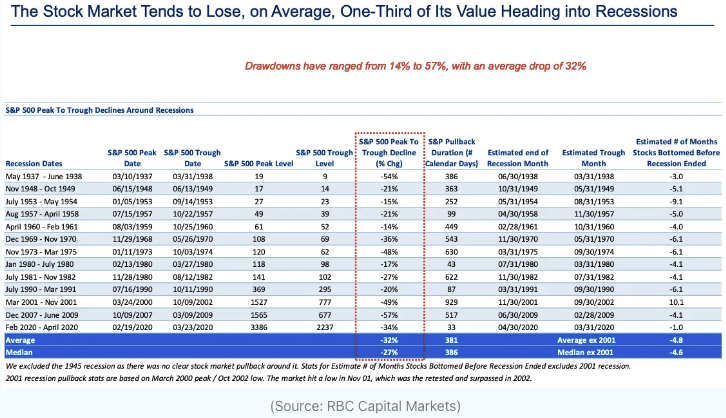

For a moment let’s compare MF real estate to stocks during a recession. I want to make this comparison between stocks and real estate because when talking about how an asset class performs during tough economic conditions, it’s important to have context. Needless to say, different asset classes perform in different ways during recessions and I wouldn’t be able to make the claim that MF real estate is recession-resistant without this context. That being said, while MF assets do experience negative effects in rents and rent collection during recessions, the negative effects in rent do not compare to the drawdowns that stocks experience in their prices. The table below shows us that on average the S&P 500 experiences a drop of 32% peak to trough during recessions. Keep in mind that after a large decline in the value of a stock, the percentage gain that is needed to get to prior levels is high. For example, if a stock drops 50%, to get back to prior levels the stock needs to achieve a 100% gain. In contrast, a MF investor will likely experience some decline in rents as shown in the previous section but still hold the asset to collect cash flow. To best illustrate the effects of a recession on the two assets, I want to highlight two scenarios. The first scenario is one in which someone has $100,000 invested solely in stocks. If we assume the average drop of 32% during recessions that the chart shows below, that individual will experience a $32,000 drop in their investment portfolio which leaves them with $68,000 at the bottom of the trough. To get back to the $100,000 they had before, their account would need to grow by roughly 48%. Scenario 2 on the other hand is one in which an investor owns a Class A 10 unit apartment building that is fully occupied and does $60,000 after all operating expenses and debt is paid. That $60,000 represents the cash flow that is going straight into the investors pocket in a year. If the rents drop by 14% and the building is 90% occupied for the year, that person would still be collecting $45,360 that year. More so, let’s say the apartment building dropped in value and the end of the term of their loan was still 5 years away. That investor wouldn’t have a need to sell and would still be collecting rental income and seeing their net worth increase as a result of the cash flow. While I did not factor in taxes in either scenario, the scenarios still highlight the fact that the MF investor generates income while the stock investor sees their investment value decline. The beauty of being a MF investor during a recession is that they collect cash flow while stock investors see their stocks decline in value. I’ll admit that comparing the two asset classes isn’t exactly apples-to-apples. Real estate is a physical asset with inherent value and stocks are based off of somewhat subjective valuations. However, of the four major asset classes – cash, fixed income, equities, and real estate – these two asset classes best compare to one another.

Tax Benefits

Multifamily properties can offer a number of tax benefits which help lessen the negative effects of recessions to MF investors. Investors can depreciate the cost of a property over time, which can reduce their taxable income. Depreciation is a tax deduction that allows you to deduct the cost of an asset over its useful life. In the case of apartment buildings, the useful life is typically 27.5 years. This means that you can deduct 1/27.5th of the cost of the building each year. For example, If you are a limited partner (passive investor) in a syndication multifamily property investment that is valued at $500,000, this property shows a depreciation expense equaling $18,182 annually ($500,000 divided by 27.5). If this multi-unit property generates an income of $80,000 each year, your tax payment owed will equal the following:

Taxes Owed Before Depreciation: $80,000 x 25 percent (federal income tax) = $20,000

Taxes Owed After Depreciation: ($80,000 – $18,182) x 25% = $15,455

These calculations enable you, as a passive investor, to save $4,545 every tax year before further benefits from adding other allowed deductions. More so, there is something called bonus depreciation which was first introduced in the Tax Cuts and Jobs Act of 2017 (TCJA) and allows investors to accelerate depreciation using a cost segregation study. The IRS permits real estate investors in multifamily properties to write off depreciation expenses for items within properties, such as cabinets, appliances and fixtures during a 7-year period. As an example, if you are a passive investor in a syndication property investment that is valued at $500,000 and has cabinetry, appliances and fixtures that have a total value of $100,000, your depreciation expense will be calculated in the following manner:

Property Value = $500,000 – $400,000

Property Depreciation Expense = $400,000 / 27.5 = $14,545

Cabinetry, Appliance and Fixture Depreciation Expense = $100,000 / 7 = $14,286

Depreciation Expense Total = $14,545 + $14,286 = $28,831

While these examples are simplified, they make it clear that MF investors can take advantage of tax benefits which result in tax savings. Most experienced passive investors (limited partners) in MF syndications consider depreciation as one of the most valuable tax shelters. Savings from depreciation can account for a sizable portion of a successful real estate investor’s after-tax profits.

Conclusion

In summary, multifamily real estate is a recession-resistant asset class for a few reasons. Investing in apartment buildings provides investors with consistent cash flow due to rental demand as well as tax benefits which investors can use to reduce their taxable income. The combination of cash flow and tax benefits safeguards MF investors from experiencing large losses. Furthermore, during recessionary times stocks decline on average by 32% whereas MF investors enjoy cash flow even after accounting for drops in rental revenue. I trust that this post has helped better explain how as an investor in apartment buildings you can protect yourself from losses during times of economic turbulence.

If you have any questions regarding the terms and concepts in this post or previous ones, don’t hesitate to reach out to either me (tedi.nati@jpacq.com) or someone on our team so we can help explain what is causing the confusion. If you’re interested in investing with us at JP Acquisitions, you can contact us via email (contact@jpacq.com), LinkedIn, Instagram, or our investor portal to set up a meeting.

As always, I hope you enjoyed reading this post as much as I have writing it. Best of luck!